There’s renewed interest in climate change on Capitol Hill. The 116th Congress (2019–2020) has seen a flurry of climate-related hearings, introduction of climate principles, and there’s even growing bipartisan interest in establishing market-based approaches to address climate change. Approaches proposed to date include carbon tax, cap and trade, and a clean energy standard.

Within the first eight months of this Congress, we’ve seen the introduction of six carbon tax and cap-and-dividend proposals, and we are likely to see more proposals introduced later. The growing attention is only partly a result of the change in control of the House of Representatives. It also reflects encouraging news, as nearly half of these proposals have been introduced or are cosponsored by Republicans. Bipartisan cooperation will be crucial for lasting progress. The six proposals are:

- The Energy Innovation and Carbon Dividend Act of 2019 (H.R.763) introduced by Reps. Ted Deutch (D-Fla.) and Francis Rooney (R-Fla.) on Jan. 24, 2019;

- The Healthy Climate and Family Security Act of 2019 (S.940 and H.R.1960) introduced by Sen. Chris Van Hollen (D-Md.) and Rep. Don Beyer (D-Va.) on March 28, 2019;

- The American Opportunity Carbon Fee Act of 2019 (S.1128) reintroduced by Sens. Sheldon Whitehouse (D-R.I.), Brian Schatz (D-Hawaii), Martin Heinrich (D-N.M.), and Kirsten Gillibrand (D-N.Y.) on April 10, 2019;

- The Climate Action Rebate Act of 2019 (S.2284 and H.R.4051) introduced by Sens. Chris Coons (D-Del.) and Dianne Feinstein (D-Calif.), and Rep. Jimmy Panetta (D-Calif.) on July 25, 2019;

- The Stemming Warming and Augmenting Pay Act of 2019 (H.R. 4058) introduced by Reps. Francis Rooney (R-Fla.) and Dan Lipinski (D-Ill.) on July 25, 2019; and

- The Raise Wages, Cut Carbon Act of 2019 Act of 2019 (H.R.3966) introduced by Reps. Dan Lipinski (D-Ill.) and Francis Rooney (R-Fla.) on July 25, 2019.

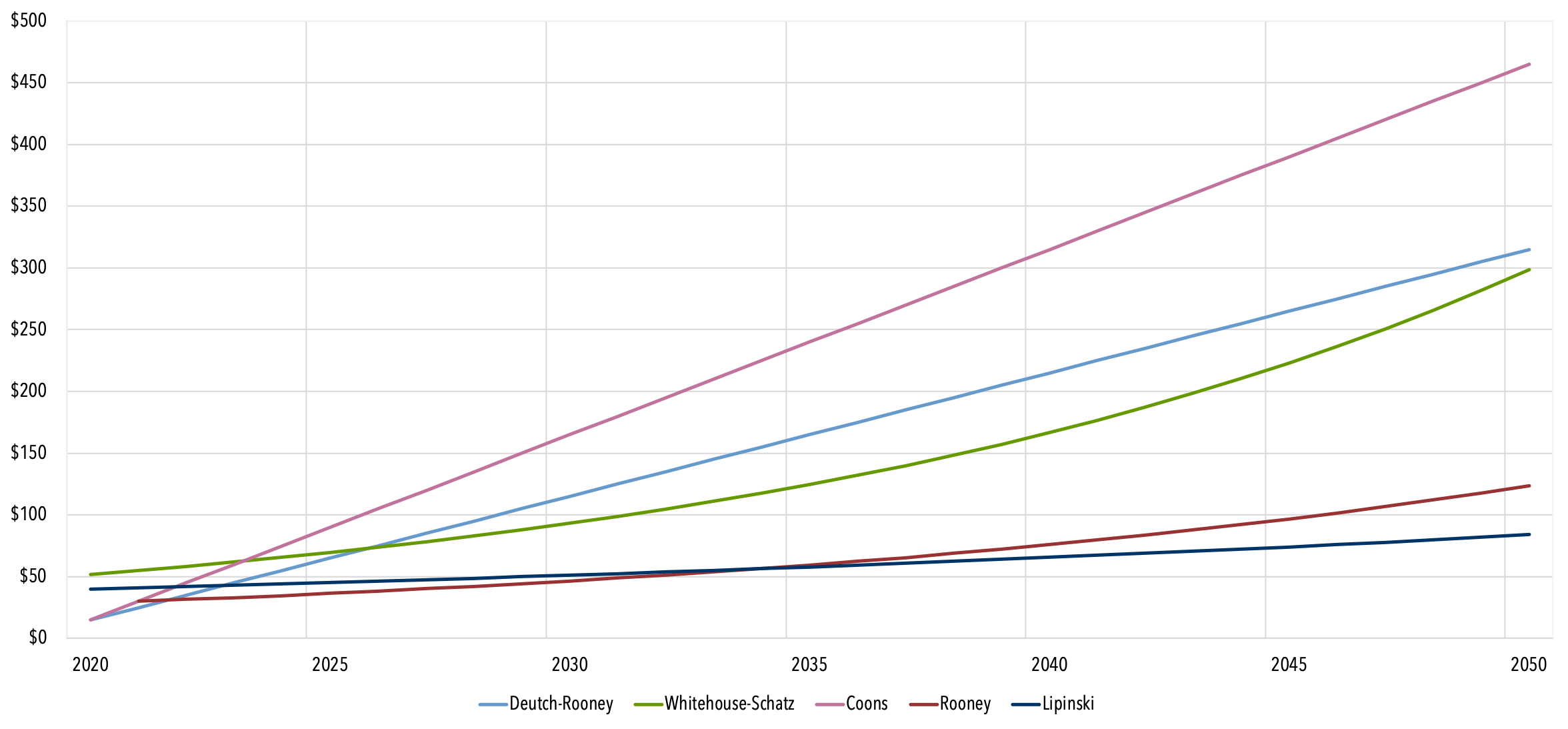

Five of these proposals would establish a carbon tax (or “carbon fee”) and one would establish a cap-and-dividend program (a cap-and-trade program that rebates program revenues to consumers). The proposals differ on many elements including their targets, starting price level (see Figure 1) and how to use the revenues. For a detailed comparison, see our new fact sheet.