Commercial Drones Are Revolutionizing Business Operations

When most hear “drone,” they think expensive military aircrafts or small consumer toys. However, the future of drones will actually be shaped by practical commercial applications, due to their ability to drive efficiency and data analytics.

This article defines drones and their total addressable market and highlights how their capabilities can be leveraged in commercial business operations. It also includes investment trends and predictions for the future of the industry.

When most hear “drone,” they think expensive military aircrafts or small consumer toys. However, the future of drones will actually be shaped by practical commercial applications, due to their ability to drive efficiency and data analytics.

This article defines drones and their total addressable market and highlights how their capabilities can be leveraged in commercial business operations. It also includes investment trends and predictions for the future of the industry.

Francesco has over a decade of experience in finance, consulting, and management, at prestigious companies such as Bain and Uber.

Expertise

PREVIOUSLY AT

Executive Summary

Commercial Is the Future of the Industry

- In a 2016 report, Goldman Sachs estimated that drone technologies will reach a total market size of $100 billion between 2016 and 2020.

- The commercial business represents the fastest growth opportunity, projected to reach $13 billion between 2016 and 2020.

- Drones are expected to become part of daily operations across industries as varied as insurance, agriculture, and journalism. BCG estimates the industrial drone fleet in Europe and the US to be $50 billion by 2050 and more than 1 million units.

- Commercial drones currently only represent 6% of the market in term of units, but their price tags of around $100,000 are projected to represent 60% of the industry’s revenue.

- Commercial use cases include: 3D mapping, delivery, inspections, data transmissions, and video collection.

Hardware Will Become Commoditized; Value Will Derive from Services

- Drone hardware has become more affordable to produce and purchase; manufacturing and hardware itself will not drive industry growth going forward.

- Instead, services that operate and manage drones for companies will generate most of the value. End-user companies will turn over services that operate drones, manage drone data, and manage maintenance to third parties.

- Indeed, value-added services will represent $23 million of the $50 million total market.

Most Investments in the Space Are Early, with Few Exits

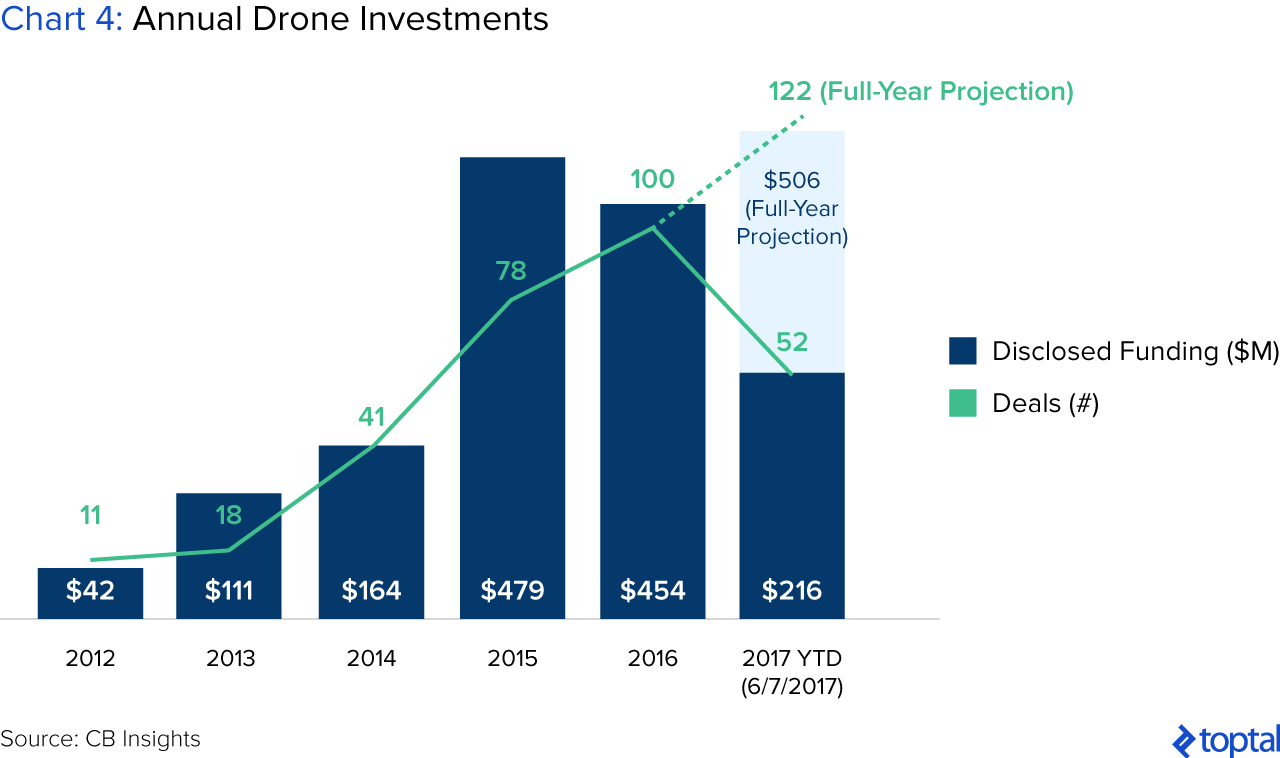

- Investments have grown steadily. 2017 year-to-date (through June 2017) has seen 52 deals worth $216 million, already surpassing 2014′s annual total by 11 deals and $52 million.

- Drone investments typically skew early; seed and Series A investments represent 62% of 2017 investments, though down from a high of 73% in 2014.

- As a relatively young industry, most investments have yet to produce the expected exits or IPOs. Since 2012, there have been 34 exits and IPOs.

Predictions for the Future

- Consolidation will increase. With the consumer business already dominated by a few major players, there will be consolidation in the commercial space via M&As. Consolidation will likely result in a few companies fighting for market share while the rest fall to the wayside.

- Insurance will rise to the forefront for commercial operators. The growth of commercial use cases has led to greater awareness of risk factors. It’ll become standard practice for high-end commercial operators to have significant limits of insurance to fulfill contracts.

- Algorithm-driven autonomous drones will be game changers. Autonomous flight via predictive or prescriptive analytics would render drone pilots unnecessary, making drones even more economical in commercial operations. According to an Interact Analysis report, more than 12,000 fully autonomous drones will be shipped by 2022.

- Swarm intelligence will allow multiple drones to collaborate. Currently, collaborative robots are trained by humans; however, we are nearing a time when robots can "think" and train each other without humans. Groups of drones can cover sprawling geographic locations and carry out specialized tasks at the same time.

Drones get a bad reputation. Most people associate them with expensive military aircrafts or small consumer toys. However, recent data shows that the future of drones will actually be shaped by practical commercial applications. The usage of drones in business operations has broadened in different industries in the last few years due to their ability to drive efficiency and data analytics. VCs have invested a total of $1.5 billion since 2012 in drone commercial startups that are shaping the industry.

In this article, I will define drones and their addressable market as well as highlight how their capabilities can be leveraged in commercial business operations. I will also include investment trends and explain their appeal to investors. I’ll then conclude with my predictions for the future of the industry. In general, I will provide not only third-party analysis, but also my personal insight after learning about the industry in the course of developing a drone company myself (Archon).

What Is a Drone?

Put simply, a flying drone is an aircraft without a human pilot aboard, earning their alternate name as unmanned aerial vehicles (UAV). Drones are robots typically remotely controlled by a pilot, though fully autonomous drones are in the late stages of development. Drones were originally created as safer, cheaper alternatives to manned military aircraft. Today they are still used for military purposes, but are now also consumer toys and purveyors of commercial operational efficiency.

Drones can vary in shape and size, but the main core elements (battery, microcontroller, motor, sensors) are essentially the same. Since drones are made with smartphone parts, investments over the last 10 years in these parts have driven drone prices down, increasing accessibility to consumers and businesses.

Drones can be viewed as smartphones with the ability to fly or move. Unlike most fintech developments such as big data and payment innovation, drones are valuable for their combination of mobile hardware and internet connectedness. Drones are distributed sensors that make the internet smarter. They can serve as a platform on which different applications, software, and business models can be built. Indeed, everything from drone mapping software to flight planning software, drone insurance, and marketplaces for people to find drone pilots has emerged.

Drone Market Size

The drone market will grow steadily in the consumer, commercial, and military sectors. In a 2016 report, Goldman Sachs estimated that drone technologies will reach a total market size of $100 billion between 2016 and 2020. Though 70% of this figure would be linked to military activities, the commercial business represents the fastest growth opportunity, projected to reach $13 billion between 2016 and 2020.

The Commercial Market—Not Consumer or Military—Will Drive the Industry Forward

In many business activities, drones can substitute traditional methods of operation. This development comes after the Federal Aviation Administration expanded permissions for commercial, non-hobbyist usage of drones. With less human operation and no safety infrastructure, drones can reduce time and costs. They can also enhance data analytics, which allow companies to better comprehend and predict operating performance. In some industries, drones will even enable new business models and opportunities.

PWC estimates that commercial applications have a total addressable market of $127 billion globally. Drones are expected to become part of daily operations across industries as varied as insurance, agriculture, and journalism. Consulting firm BCG estimates the industrial drone fleet in Europe and the US will be $50 billion by 2050 and more than 1 million units, with most of the value linked to drone services and data collection.

According to market research from Gartner, the market size for commercial drones in 2016 was $2.8 billion with only 110,000 million units sold. In 2017, commercial drones sales are estimated to grow about 60% and reach 170,000. While personal drones dominate unit sales at 94% of the market, they only comprise 40% of the market’s revenue share. Commercial drones only represent 6% of the market, but their price tags of around $100,000 are projected to represent 60% of the industry’s revenue.

According to PWC, the most promising industry seems to be infrastructure, with a global potential value of $45 billion, followed by agriculture and transportation.

Drone Hardware Will Be Commoditized; Value Will Derive from Services

Since drone hardware has become more affordable to produce and purchase, manufacturing and the hardware itself will not drive industry growth going forward. Instead, services that operate and manage drones for companies will generate most of the value. End-user companies will turn over services that operate drones, manage drone data, and manage maintenance to third parties. For example, telecommunications companies may end up selling drone data communications services for guiding drones and relaying the data they collect. Indeed, value-added services will represent $23 billion of the $50 billion total market.

Commercial Use Cases for Drones

Drones can be used in a wide range of applications, but some of the most valuable ones are detailed below.

3D Mapping

Drones can execute 3D mapping, surveying sites, and taking photos to create maps. Drones offer bird’s-eye views that map out areas more efficiently than a surveyor would be able to on foot.

With this capability, drones are already shaping the operations of construction, agricultural, and mining companies. In agriculture, farmers can get a clearer idea of what crops look like, which can help them make data-driven decisions to increase yield. Drones can feed data into a farmer’s tractor, more easily identifying which areas of corn require more nitrogen and allowing the farmer to act on the issue quickly. According to Forrest Meyen, COO of startup Raptor Maps, “Farmers are not what you view as the traditional guy in the field with a pitchfork and a hoe…they’re business managers of complex operations. Everything that they do has to increase their return on investment.”

It’s not hard to imagine the value that drones also offer for construction and mining, where drones can generate accurate contour maps, monitor change over time, and share insights via the cloud. Data gathering is more accurate, occurs at a fraction of the normal time and the budget, and drives an unprecedented level of analytics.

Delivery

Range delivery by drones can serve medical purposes in hard-to-reach areas of the world. Zipline, a Silicon Valley startup, delivers blood and vaccine supplies to African countries lacking infrastructure. In these areas, flying is more efficient than driving and can be an effective substitute for more expensive solutions like helicopters.

Drones are also considered the future of last-mile delivery for consumer goods since it would reduce cost per delivery and delivery time. According to a McKinsey report, a 40% savings in delivery costs could translate into a 15-20% increase in profit margin and a resulting 15-20% price decrease. Since wages are likely to continue rising, autonomous delivery will become increasingly advantageous, especially in developed nations.

Amazon Prime Air: Imaginative Drone Patents

eCommerce giant Amazon has long been publicizing its grand plans of delivery under 30 minutes by utilizing drones for delivery, under a project called Amazon Prime Air. Amazon’s autonomous drones, which are guided by GPS, can fly at heights of up to 400 feet and carry packages of up to 5 pounds at speeds of up to 50 MPH.

In June 2017, Amazon filed a patent for a beehive-like depot used for dispatching drones. This patent portrays a multi-level fulfillment center accommodating both inbound and outbound delivery drones. The facility has multiple levels, with multiple landing and takeoff locations.

That’s not all. Amazon’s other drone and logistics patents have been the stuff of imagination: airborne drone warehouses 45,000 feet in the air, underwater drone warehouses, and drone recharging stations attached to telephone poles, buildings, and lampposts. Though Amazon’s Whole Foods acquisition is likely its highest-profile move for distribution footprint expansion, Amazon’s many logistics patents demonstrate the company’s emphasis on fulfillment and delivery. However, Gartner’s predictions around drone delivery are pessimistic, estimating delivery to comprise only 1% of all commercial operations by 2020.

Inspections

Drones are particularly valuable for inspecting difficult-to-reach areas at certain altitudes or in contaminated environments. For example, the use of drones is already revolutionizing telecommunication tower inspection, where a drone can implement monitoring activities at a fraction of traditional costs and time.

Drones can also be used for aerial analysis of buildings and other infrastructure, such as pipelines, solar panels, electric grids, and offshore platforms. Drones can employ thermal imaging cameras to identify “hotspots” on solar panels—spots where energy is not transmitting properly. This can increase plant productivity by quickly identifying potentially damaged areas.

Drones have also proved to be useful for insurance companies after events like natural disasters, becoming insurance for insurers by providing an accurate and efficient method of determining cause, liability, responsibility, and total damage.

Data Transmission

Drones can amplify internet network signals and access remote locations such as deserts or sprawling areas of Africa or Asia. An all-wireless network in the sky would be less expensive, less disruptive, and would take less time to build than land-based infrastructure. Google acquired Titan Aerospace, a startup that makes high-altitude drones, and has been testing solar-powered broadband drones to support the implementation of Project Loon, which aims to provide internet for all global citizens.

Data transmission using drones can also be utilized during large-scale events such as sports matches or concerts when the coverage is inadequate for everyone in a stadium. In addition, drones can utilize radio signals to collect measurements of specific activities (e.g., gas consumption) when it is not otherwise possible to connect smart meters to the internet.

Video Collection

With video collection, drones can be used for security and for patrolling remote areas. With drones, it’s easier to react more quickly in a critical situation and eliminate the risk of human exposure in dangerous situations. Separately, drones are also often used in cinematic production thanks to their ability to produce high quality aerial views at lower costs than helicopters.

Investment Trends

Investments Are Concentrated in China, Israel, and the US, with Each Country Serving a Different Market Segment

The majority of investments and well-funded startups are concentrated in China, Israel, and the US. However, each country has a different focus within the market: On one hand, China has dominated the consumer market and hardware solutions with Dajiang Innovations (DJI), which accounted for 36% of North American consumer drone sales last year. On the other hand, US companies are focused on developing specific commercial hardware solutions or end-to-end software for commercial applications, and Israel has been at the forefront of military application development. Israeli drone companies are also now leading the way for autonomous solutions for enterprises with Tel Aviv-based Airobotics.

To date, the race for advanced commercial solution development has been led by US companies and startups, furthered by the mature local market and demand for analytical solutions for businesses. With that said, I expect that Chinese companies will acquire a stronger foothold in the commercial market, leveraging their competencies in manufacturing, hardware solutions, and the development of their internal market. In fact, China’s giant DJI started producing commercial drones and developing software applications a year ago.

Investments Remain High: AI, Decreasing Production Costs, and Commercial Opportunities

Investments in the space have totaled close to $1.5 billion since 2012. The main drivers for these investments include decreasing prices of drone components (e.g., sensors, batteries), the massive commercial market potential, and technological developments in artificial intelligence (AI) and analytics.

For these reasons, investments in drones have grown steadily. Through June of 2017, we have seen 52 deals worth $216 million, already surpassing 2014′s annual total by 11 deals and $52 million. At the current run-rate, deals are projected to hit a new record of 122, worth $506 million in funding.

Mostly Early Stage Investments and Few Exits

It’s important to note that drone investments typically skew early; seed and series A investments represent 62% of 2017 investments, though down from a high of 73% in 2014. This indicates that different areas of the drone industry are still in development and will produce impact in the next 5 to 10 years.

Some of the areas attracting most of the investments include autonomous solutions as well as business intelligence or analytics software.

In 2017, the top deals to date include:

-

$53 million series D to 3D Robotics, which markets itself as “the complete commercial drone platform”

-

$34 million series B to Swift Navigation, which is driving the future of autonomous vehicles

-

$32 million series C to Airobotics, a startup building autonomous drones for the enterprise sector

-

$29 million series B to Echodyne, a company developing a radar vision platform

As a relatively young industry, most investments have yet to produce the expected exits or IPOs. Since 2012, there have been 34 exits and IPOs, with more expected in the next five to ten years.

Investments Are Driven by Smart VCs and Main Corporate Ventures

Venture Capital Funds

In 2017, venture capitalists have already bet more than $200 million on the global drone phenomenon. One of the most active VC investors is Lux Capital, which has covered a variety of startups from drone sailing to drone racing and drone automation, viewing the drone industry as one of the most lucrative. Andreessen Horowitz has also been an active VC in the space, investing in areas varying from long-range delivery to automation or drone defense. According to partner Chris Dixon, “There are tens of millions of dangerous jobs that involve climbing buildings, towers, and other structures that can be performed much more safely and effectively using drones.” Since 2012, “smart money” VCs have participated in approximately 46 deals, accounting for $681 million in disclosed equity funding. Some of these VCs include Felicis Ventures, NEA, Social Capital, Accel, First Round, and Bessemer Venture Partners.

Corporate Ventures

On the corporate side, the venture arms of many companies have made significant investments. It’s clear these companies have prioritized robotics as part of their long-term strategy and are interested in a multitude of drone capabilities. The financings have also skewed towards early-stage companies, with more than two-thirds of corporate deals over the past five quarters at the seed or series A stages. Corporate ventures are looking to enter specific segments or to acquire specific knowledge, such as “sense-and-avoid” capabilities, which would equip drones with the “sense” to think and avoid collisions and to safely achieve their purposes.

The most active corporate venture investors include:

-

Qualcomm Ventures, the most active venture investor, making six investments to date in companies focused on mapping, pipe inspection, delivery, 3D mapping, autonomous solutions, and commercial solutions. Qualcomm also acquired Kmel Robotics to expand their cellular technologies inside drone operations, launching their own robotics commercial solutions.

-

Google Ventures, which has also been actively investing in long range delivery, end-to-end commercial solutions, and 3D mapping. Google Ventures has developed 63 drone-related patents across varying drone capabilities.

-

Intel Capital, which has invested in a complete end-to-end commercial solution, an analytics solution, and a hardware company. They have also acquired two companies, including Ascending Technologies, which is developing “sense and avoid” algorithms, and MaVinci, which is developing flight planning software. These acquisitions and investments have supported Intel in developing its own solutions for commercial drone applications.

Predictions for Future Trends

I believe the following developments will be significant for the future of drones:

Increased M&A and Consolidation

With the consumer business already dominated by a few major players, I expect more consolidation in the commercial space via significant M&As. According to Chris Korody, Principal at DroneBusiness.center, a likely scenario is that a company for whom drones are an adjunct rather than a core business will “buy a particular [drone] technology and the team behind it to round out an offering or reduce time to market.” This could bring about the development of a more “complete drone solution,” where the outputs are simple and offer actionable information rather than raw data. Consolidation will also result in some companies getting squeezed out: A few companies fighting for market share will become de facto standards while the rest fall to the wayside.

Insurance Will Rise to the Forefront for Commercial Operators

To date, the needs and requirements related to insurance haven’t been as much of a priority. According to Chris Proudlove, Senior Vice President with Global Aerospace, “The growth and scope of commercial use cases has led to greater awareness around risk factors and this, coupled with companies’ general risk management procedures, means that any commercial operator who wants to be able to fulfill a variety of commercial contracts needs proper insurance.” It’ll become standard practice for high-end commercial operators to have significant limits of insurance to fulfill contracts.

Algorithm-Driven Autonomous Drones Will Be Game Changers

Today, drones are controlled by human operators. However, autonomous flight via predictive or prescriptive analytics would render drone pilots unnecessary, making drones even more economical in commercial operations. To date, only Tel Aviv-based Airobotics has been granted permission to fly truly autonomous drones in Israel. According to an Interact Analysis report, though nonexistent today, more than 12,000 fully autonomous drones will be shipped by 2022.

“Autonomous” drones’ capabilities will extend beyond autonomous flight—it will also span autonomous ongoing operation, which will solve the current issue of limited battery life for drones and void the need for skilled operators to swap batteries or recharge the drones. Drone batteries typically limit their flight to around 15-30 minutes in the air, but could eventually offer 24/7, continuous operations for inspection, surveillance, and delivery. At an even more sophisticated level, drones will develop autonomous task performance. With this, drones will create insights based on harvested data and automatically translate them into decisions and actions. Imagine a drone continuously monitoring volumes of construction materials and ordering supplies on a real-time basis as necessary. “The next generation of drones will not need pilots at all—just orders.”

Swarm Intelligence Will Allow Multiple Drones to Collaborate

Imitating the way certain groups of animals work together, swarm intelligence leverages AI to plan the activities of hundreds if not thousands of robots, allowing drones to collectively achieve larger, more complex tasks. Currently, collaborative robots are trained by humans; however, we are nearing a time when robots can “think” and train each other without humans. Groups of drones can cover sprawling geographic locations and carry out specialized tasks at the same time. They can also form a network—that is, if drone B is too far away from the control center to communicate with it, but is close enough to drone A, it can effectively pass a message down the line.

Parting Thoughts

Drones are not just a fad—they are here to stay and will soon become mainstream. The same cost and efficiency benefits that have historically made drones attractive to the military are now applicable for a broad spectrum of business and civil government functions. We are just now touching the tip of the iceberg in terms of harnessing the true power of drones for business operations, and new ways of conducting business.

Still, according to a recent Economist report, “Trying to imagine how drones will evolve, and the uses to which they will be put, is a bit like trying to forecast the evolution of computing in the 1960s or mobile phones in the 1980s. Their potential as business tools was clear at the time, but the technology developed in unexpected ways. The same will surely be true of drones.”

Further Reading on the Toptal Blog:

Understanding the basics

How much is the value of the drones market?

The total drones market, including the consumer, military, and commercial sectors, is estimated to reach $100 billion between 2016 and 2020. Though 70% of this figure is linked to military activities, the commercial business is the fastest growth opportunity, projected to reach $13 billion between 2016 and 2020.

What is a UAV?

UAV is an acronym for “unmanned aerial vehicle,” which is an aircraft that doesn’t have a human pilot. Instead, it is remotely flown by a skilled operator or by autonomous flight technology.

What are drones and what are they used for?

Put simply, a flying drone is an aircraft without a human pilot aboard. Drones were originally created as safer, cheaper alternatives to manned military aircraft. Today they are still used for military purposes, but are also consumer toys and purveyors of commercial operational efficiency.

Francesco Castellano

Milan, Italy

Member since January 4, 2017

About the author

Francesco has over a decade of experience in finance, consulting, and management, at prestigious companies such as Bain and Uber.

Expertise

PREVIOUSLY AT