Dow gains 10,000th point since Trump's election

Market surge heightens stakes in 2020

The stock market has been unstoppable under the influence of President Trump.

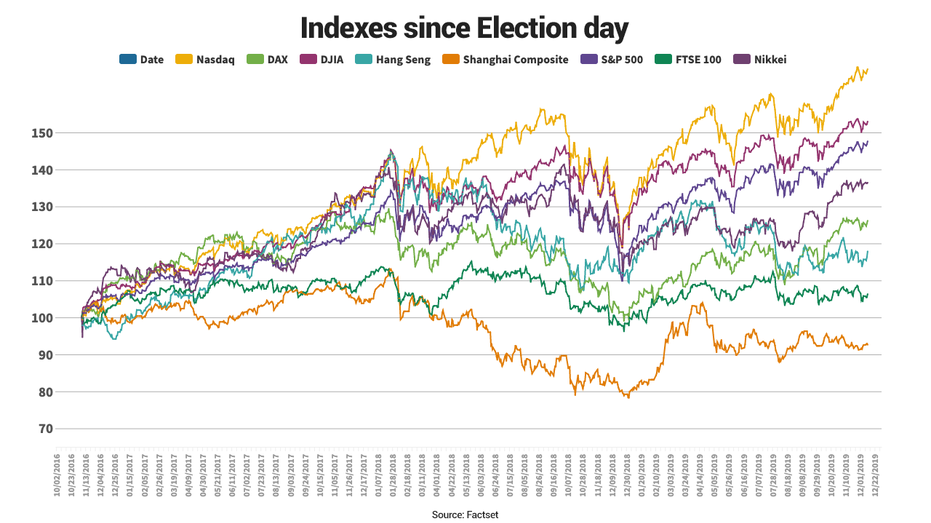

The Dow Jones Industrial Average crossed 28,332.74 on Monday, meaning it has rallied 10,000 points, or more than 54 percent, since Trump’s election victory on November 8, 2016. The benchmark S&P 500 has gained more than 46 percent.

“The rally has been driven by pro-growth measures, de-escalation of trade tensions, huge liquidity injections by central banks and a FOMO approach by investors worried about missing out on a remarkable U.S. market outperformance that has set one record high after the other.” Mohamed El-Arian, chief economic adviser at Allianz, told FOX Business.

STOCK MARKET 'MELT-UP' COMING SOON: BANK OF AMERICA

The gains show why U.S. markets have become the envy of the world under Trump, who has followed through on his promises of cutting taxes and regulations and rewriting global trade deals in America's favor.

By comparison, global exchanges such as Hong Kong’s Hang Seng and Britain’s FTSE have gained 20.4 percent and 6.4 percent, respectively, since Trump’s election win, while China’s Shanghai Composite has lost 7.2 percent, according to Dow Jones Market Data Group. Of the major global averages, only Japan’s Nikkei, up 44.1 percent, has come close to the gains of the U.S. markets.

U.S. investors' holdings have benefited from Trump’s pro-business agenda. He has lowered income tax rates for individuals, cut corporate taxes and rolled back a number of regulations, including restrictions on the country’s biggest banks.

Trump also negotiated the United States-Mexico-Canada Agreement, which overhauls the Clinton-era North American Free Trade Agreement, commonly known as NAFTA, and has embarked on a nearly 21-month-long trade war against China, which he says has “been taking advantage” of the U.S. for years.

This week, Democrats in the House backed the USMCA after months of negotiation, and an initial trade deal with China was reached. Both deals are expected to provide a tailwind for a stock market, and an economy, that have been on fire in the past four months.

The Dow Jones index, for instance, has gained 11.2 percent since bottoming out on Aug. 14.

David Kostin, chief US equity strategist at Goldman Sachs, thinks the stock market’s recent success suggests “the pace of U.S. economic growth will improve in the near future.”

TRUMP'S HOME-RUN WEEK DELIVERS EDGE IN 2020 RACE

His team points to Fed rate cuts along with the bottoming of the inventory cycle as reasons, in addition to the easing of trade tensions with China.

Morgan Stanley Equity Strategist Michael Wilson, who recently released his year-end 2020 S&P 500 outlook, has a base-case target of 3,000 – almost 5 percent below current levels.

He expects the US economy to “muddle through in 2020,” but is concerned that earnings growth will disappoint.

Bob Doll, chief economist at Nuveen Investments, partly agrees. He told FOX Business’s Maria Bartiromo that the recession fears from December 2018 and August are “dissipating,” leading to the stock market’s rally.

CLICK HERE TO READ MORE ON FOX BUSINESS

However, Doll says the economy has to deliver, or it will be a sluggish year because “valuations are not cheap” and expectations for next year’s earnings are “a little on the high side.”