The State of US Broadband in 2022: Reassessing the Whole Picture

In absolute terms, the United States is among the world’s leaders in deploying fast broadband, and it does so at competitive prices. But there is room for improvement on broadband adoption.

KEY TAKEAWAYS

Key Takeaways

Contents

Introduction

The U.S. broadband marketplace is large, complex, and dynamic. While policymakers all must make decisions on a micro level, those decisions will go awry if they do not account for the whole picture of broadband in the United States and around the world. This report presents the state of U.S. broadband deployment, adoption, and price in that larger context. It interprets empirical data to assess broadband progress both in absolute terms and compared with the rest of the world.

The Information Technology and Innovation Foundation (ITIF) published the first iteration of this report in 2013.[1] The broadband landscape was very different then, as many now-common technologies were in their infancy, and a broadband connection was more of a nice-to-have than a necessity.

Today, broadband technology has matured and secured its place as the infrastructure of the present—and the near future. Internet service in a post-COVID-19 world is critical to full participation in society, and both broadband statistics and the policies and conversations guiding them reflect this.

Claims that the United States stacks up generally poorly against other economies in its broadband performance are far off the mark, but there are still areas ripe for improvement. Despite populist rhetoric to the contrary, the U.S. broadband market is competitive, and private Internet service providers (ISPs)—fueled by their own investments and recent government funding for deployment to high-cost unserved areas—are continually improving the reach and quality of broadband service. The central remaining challenge for U.S. broadband policy is adoption, wherein the United States has a middling performance compared with international peers, but the United States also has a host of demographic factors that play into lower adoption rates. The goal of this report is to sift out the facts from the falsehoods and draw a clear picture of how the United States is actually doing in an Internet-reliant world.

Deployment

Deployment is a measure of the number of households that have access to broadband to which they could subscribe. In theory, with the emergence of LEO satellites, broadband has been deployed to virtually all Americans. But for most, deployment refers to terrestrial broadband, either cellular or fixed.

Ubiquitous deployment is a baseline requirement for universal connectivity, but data on deployment is sparse. For example, the Organization for Economic Cooperation and Development (OECD) collects data on different types of Internet “access” across a wide range of years, which initially might sound like a measure of deployment, but access is defined as the number of households that report access to the Internet. This is a different question than whether broadband service is available at their home and in fact measures adoption, not deployment.

Because many conflate deployment and adoption, reliable deployment data is limited. The most comprehensive U.S. deployment dataset is the information collected by the FCC‘s Form 477, which has its own shortcomings. Form 477 data is drawn directly from providers’ mandatory biannual reports, but it counts by census blocks (the smallest geographic Census unit) such that an area may appear completely served even if actual deployment in the census block is more limited. This method can result in overcounting and has therefore been widely criticized.[2]

Ubiquitous deployment is a baseline requirement for universal connectivity.

Better U.S. data should exist, and hopefully will by mid-year 2023. In 2020, Congress passed the Broadband DATA Act, which requires the FCC to begin the process necessary to create more accurate broadband maps.[3] However, it took the FCC until June 2022 to open its Broadband Data Collection Program with the goal of aggregating more granular, location-based deployment data for public use by the fall.[4] Even that modest goal, it appears, may not be met: Though the new maps are slated to be published in November 2022, that will begin an iterative process of appeals and revisions. A recent statement by Assistant Secretary Alan Davidson estimates the actual finalization of the maps to be sometime in 2023, and the allocation of funds will be delayed along with it.[5] Ultimately, until a better reporting tool takes its place, current Form 477 data offers the most thorough, up-to-date report of U.S. broadband deployment available.

Besides the existence of service, the quality of the service delivered and differences between dense urban centers and sparsely populated rural areas are also relevant to an analysis of broadband deployment. A healthy marketplace offers consumers a choice among multiple providers at the speeds they need.

Broadband Technologies

Wireline Internet service, transmitted through fiber optic cables, copper telephone lines, or coaxial cables, is still the primary method of home broadband deployment. Wireless broadband, however, is an increasingly viable substitute. Though wireless connections have limitations—connections are sometimes vulnerable to weather conditions and require a direct line of sight between the tower and the connected household—they have improved significantly, particularly as 5G technology is rolled out across the nation.[6] And LEO satellites are coming online with the locational flexibility of traditional satellite technology but significantly lower latency.

Many broadband services have historically been packaged in plans that include data caps, which are limits on the amount of data a customer may consume monthly, after which extra charges are imposed or the connection is throttled (its speed slowed by the provider until the next billing cycle). Some mobile wireless plans in particular had lower data caps that could impinge on consumers’ use. Today, many providers have increased the limits of their data caps toward irrelevance or removed them entirely. Working or studying from home generally requires an average of around 600 gigabytes (GB) of data per month.[7] Cable and fiber Internet plans with caps frequently meet or exceed 1 terabyte (1,000 GB), whereas DSL and wireless caps, where they exist, tend to be around 10–500 GB or more.[8]

As investments into network expansion continue apace with bandwidth-hungry applications, we should expect these limits to continue to rise or even disappear. An increasing number of providers now offer unlimited data plans instead, or data caps high enough to be nearly inconsequential. New in-home 5G services, such as Verizon 5G Home Internet and T-Mobile Home Internet, offer unlimited data plans.[9] T-Mobile’s fixed wireless home Internet offering, in fact, is the fastest-growing home broadband service in the country, gaining one million home Internet customers within a year of its inception.[10]

Competing broadband technologies also differ in their deployment costs. Wireless deployments, for example, often make more financial sense in less-dense areas where the alternative is to spend far more laying long lengths of fiber or cable to connect a single house. Satellite broadband is also sometimes the most viable option in the most remote areas. Emerging LEO satellite providers have made great progress in reducing latency and raising data caps, both of which were characteristics of older satellite broadband that attracted perennial criticisms. LEO satellites are deployed at orbits closer to the Earth’s surface, which results in lower latency that consumers experience at faster speeds. And between Starlink, which has deployed almost 2,000 LEO satellites, and other companies and other governments that have initiated their own offerings, there has been a dramatic increase in total satellite bandwidth.[11]

All these technologies offer their own advantages, given the geographic diversity of the United States. By all metrics, they have all grown significantly in the last decade.

Coverage

In 2013, data reported by the National Telecommunications and Information Administration (NTIA) and the FCC through the National Broadband Map (NBM) painted an encouraging picture of the U.S. state of connectivity: More than 99.9 percent of Americans had access to broadband with download speeds exceeding 3 megabits per second (Mbps) through satellite, terrestrial wireless, or wired broadband.[12] Of this, 96.3 percent had access to wired broadband, 84.3 percent to cable modem service, and 82.2 percent to DSL from traditional telephone companies.[13]

Even assuming some overstatement based on Form 477 methodology, developments since 2013 are promising. With the advent of new technologies and widespread reliance on online applications—a reality starkly illustrated by the COVID-19 pandemic—Internet access has become necessary for full participation in society, and broadband networks have correspondingly improved in response.

Changes in technology and the way we use it have since rendered the original 4 Mbps download/1 Mbps upload (4/1) standard less important, and its modern-day equivalent is 25/3. The vast majority of Americans have coverage that meets the newer speed benchmark: By the latest iteration of FCC fixed deployment data in June 2021, a fixed connection of at least 25/3 through ADSL, cable, fiber, or fixed wireless had been deployed to 97.6 percent of the American population.[14] Expand the list of viable technologies to include satellite, and the covered population stretches to well over 99 percent.[15]

The U.S. state of fixed broadband deployment appears to rate consistently well against other countries, especially those with roughly comparable population densities.

Though there are fundamental differences between markets, it’s valuable to assess how U.S. deployment statistics compare with those of peer nations. Appendix G of the FCC’s most recent Communications Marketplace Report (CMR) compares broadband deployment data for 26 EU member countries, using statistics reported by the 2019 Broadband Coverage in Europe Report, to that of the United States.[16] Crucially, the data measures percentages of households passed by different networks, rather than going by the proportion of the population. This is an important distinction, as looking at the percentage of the population for deployment metrics will tend to disadvantage those countries with larger household sizes (for a full explanation, see the Adoption section of this report). As of June 2019, U.S. fixed deployment, excluding satellite and benchmarked at 30 Mbps download speeds or higher to match the EU’s definition of high-speed broadband, reached 94 percent of households.[17] For comparison, deployment statistics for the 26 EU countries examined in the FCC report averaged out to 84 percent of households.

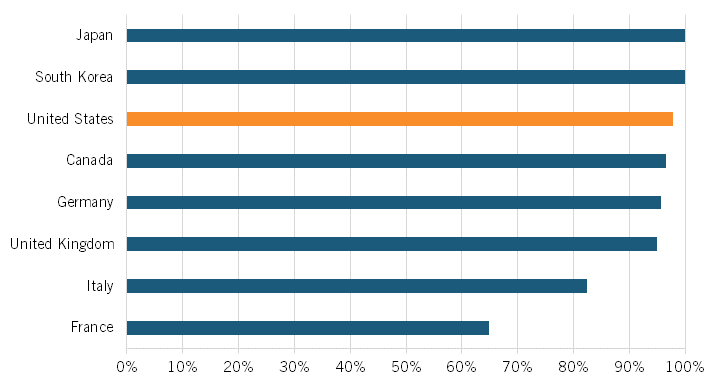

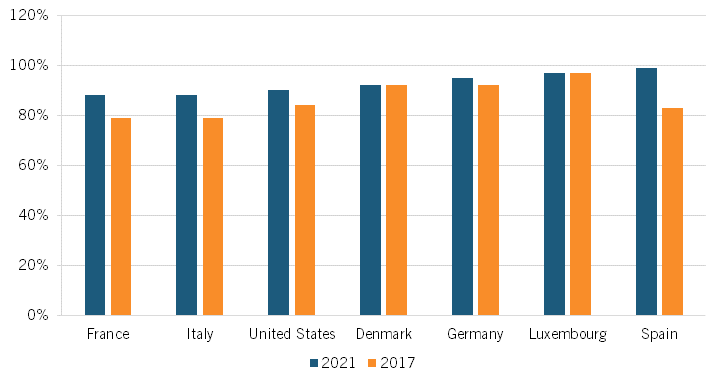

U.K. regulator Ofcom also publishes an annual International Broadband Scorecard that ranks U.K. broadband metrics against those of other countries. As of the end of 2020, 95 percent of households in the United Kingdom were in areas with access to fixed broadband (defined as ADSL, VDSL/FTTC, cable, or fiber) advertised at 30 Mbps download speeds.[18] Nearly 96 percent of German households were close to similar broadband services, as were 100 percent of South Korean households. At 97.8 percent of households, the United States ranked 6th out of the 18 countries studied.[19] Figure 1 uses Ofcom data to give a sense of how U.S. fixed coverage compares with other major countries.

Figure 1: Access to fixed technology at minimum 30 Mbps download speeds[20]

At this broad level, the U.S. state of fixed broadband deployment appears to rate consistently well against other countries, especially those with roughly comparable population densities (South Korea and Japan, for example, have such large urban populations that the cost of deploying broadband is significantly less). And deployment has only increased in the last few years; USTelecom’s 2021 Broadband Capex Report finds that broadband providers invested $86 billion in 2021, the highest level in 20 years.[21]

International comparisons of mobile deployment are also important; whether a mobile connection represents an important complement to a fixed Internet connection or (increasingly) a viable substitute, mobile connectivity remains a significant facet of broadband. The International Telecommunication Union (ITU) data hub reports historical data for a variety of coverage metrics, including the percentage of the population covered by different types of mobile technologies. In 2013, the United States was near the head of the technological frontier with its 4G/LTE networks.[22] With 97 percent of the population covered by a 4G/LTE network, the United States tied with Estonia for third among countries listed by ITU (only Sweden and Japan outranked it).[23]

Since 2013, the United States has filled in the remaining gaps in coverage (aside from a few of the most remote areas in the United States that cannot easily be reached by anything but satellite). As of 2020, U.S. 4G/LTE coverage reached 99.9 percent of the population.[24] For comparison, Japan, Korea, and the United Kingdom also stood at 99.9 percent coverage at that point. Twenty-one countries in the 2020 data outperformed the United States, but just barely (of them, 17 had 100 percent coverage).[25] Moreover, each of the leading countries had a smaller geographic area to cover, which is unsurprising considering the United States’ landmass is the fourth largest in the world.[26] In the United States, the remaining 0.01 percent of uncovered population likely resides in the remote stretches of Alaska that are too difficult to cover with anything but satellite, the likes of which don’t really exist in most other, significantly denser countries.

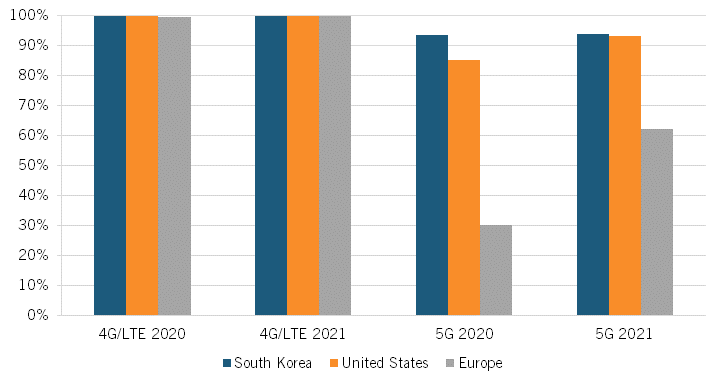

A decade of rapid technological advancement also ushered in 5G networks, which quickly became the new gold standard for mobile technologies. According to the European Telecommunications Network Operators' Association’s (ETNO’s) “State of Digital Communications 2022,” 5G covered 93.1 percent of the U.S. population in 2021.[27] This is on par with South Korea’s 5G coverage (93.9 percent) and above both Japan’s and Europe’s (81.2 and 62 percent of the population, respectively).[28] As figure 2 shows, 5G coverage is quickly becoming competitive with near-ubiquitous 4G.

Figure 2: Percentage of the population with 4G/LTE and 5G coverage[29]

But “5G” is a somewhat broad label that can encompass a wide range of speeds and actual service qualities depending on whether the carrier uses low-, mid-, or high-band spectrum. The United States has disproportionately allocated high-band spectrum to wireless carriers, and accordingly, the first attempt to measure “true” high-speed 5G availability in the United States by BroadbandNow found that high speed (at or above 100 Mbps) 5G coverage was available to some 62 percent of Americans at home.[30] This makes sense, because the United States is a frontrunner when it comes to 5G readiness, and high-band spectrum allocation in particular. The 5G Observatory, a major European hub for 5G data that is supported by the European Commission, aggregates and compares total 5G spectrum assigned to a few key economies: China, South Korea, Japan, the United States, and the European Union. Altogether, the United States sits comfortably in the lead with 5,625 MHz total of 5G spectrum made available to mobile operators, and the vast majority of that is speedy high-band spectrum.[31] South Korea is in second place with 2,400 MHz of high-band assigned.[32] Even if differences in data collection slightly overstate the U.S. numbers, it appears that the United States has prioritized high-band 5G in such a way as to ensure the majority of new 5G availability is true high-speed 5G.

Assigned spectrum is not everything—as demonstrated by the 11th-hour spat between ISPs rolling out 5G and the Federal Aviation Administration (FAA) in the United States in 2021—there are plenty of technical and political roadblocks to actual implementation that can emerge at any point in the process.[33] But overall, strong performance in the 5G arena demonstrates United States’ future-oriented approach to mobile technologies. It follows the overall trend of U.S. mobile deployment statistics consistently ranking near the top.

Rural/Nonrural

Rural coverage usually lags behind urban coverage because rural areas are less densely populated and, therefore, more expensive to serve per household. The CMR provides a breakdown of deployment data along urban and rural lines. According to Appendix G, fixed high-speed broadband deployment (again, benchmarked at 30 Mbps download minimum) reached 77 percent of rural U.S. households in 2019, compared with 99 percent of nonrural households.[34] The 26 EU countries studied in the FCC analysis average out to an urban/nonurban gap larger than the U.S. equivalent, at 61 percent and 91 percent, respectively, in 2019.[35]

A USTelecom analysis, relying on FCC, NTIA, and Digital Economy and Society Index data, extends the basic trend line by a year to find the U.S. and EU high-speed rural coverage rates at 91 and 60 percent, respectively, in 2020.[36] Once the speed restriction is loosened to include anything greater than 200 kilobits per second (Kbps), rural coverage in 2020 appeared to be even more extensive, at 98 percent (United States) and 90 percent (European Union).[37]

Individual reports provide more current insight into the U.S. urban/rural divide. FCC fixed deployment data shows the U.S. divide between urban and rural fixed coverage in greater detail as of 2021.[38] Taking 25/3 Mbps as the baseline, deployment of some form of terrestrial fixed broadband reached 90.7 percent of the rural population. Overall, 9.3 percent of the rural population had no access to fixed technology at broadband speeds, compared with 0.7 percent of the urban population.[39] On the wireless side, the CMR finds that 100 percent (which should be interpreted as at least 99.5 percent with rounding) of rural U.S. households were covered by 4G LTE technology in 2019.[40] This compares well to, for example, the 99 percent average calculated for the EU 26 by the CMR.[41] A huge amount of progress has been made to connect the rural side of the United States, but there is still room for improvement to allow high-speed coverage across wider areas. This becomes increasingly important as nascent 5G applications such as precision agriculture become viable.

Speed

As reliance on the Internet has increased and technological advances have opened the door to new possibilities, speeds have followed suit. The 2013 Whole Picture report evaluated cable broadband speeds using Data Over Cable Service Interface Specification (DOCSIS) 3 access. DOCSIS is a standard set by the cable television industry meant to ensure adequate capabilities and interoperability between modems and ISPs. It effectively certifies the ability of a cable modem to deliver certain speeds. DOCSIS 3 is still the most widespread standard and supports a downstream capacity of 1 Gigabit per second (Gbps) and 100 Mbps upstream capacity.[42]

According to the NBM, at the time of the original Whole Picture report, 39.4 percent of U.S. households had access to DOCSIS 3 at speeds of at least 100 Mbps, and 5.4 percent had a fiber option in excess of 100 Mbps.[43] The latest CMR reports that, in 2019, 83.9 percent of households had access to cable at DOCSIS 3.1; and BroadbandNow reported that 85 percent of households now have access to DOCSIS 3.[44] By this account, the majority of Americans are equipped with Internet services that are adequately prepared for future speeds.

The FCC currently defines “broadband” as a constant connection that reaches a minimum of 25 Mbps download and 3 Mbps upload speeds, raised from 4/1 in 2015.[45] There have been calls to adopt a legal definition of 100 Mbps or even 1 Gbps, but such a move would be largely political theater, untethered from real-world requirements. Consumption today demands speeds sufficient for common applications such as Zoom (3.8/3 up/down Mbps for 1080p HD video) and YouTube (20 Mbps for 4K video).[46] To be sure, a household in which several people might use a connection at once does mean the need for higher speeds, albeit less than 1 Gbps. A definition dozens of times greater than the most bandwidth-heavy services today will tend to skew the broadband ecosystem in the future. Gigabit speeds today are akin to owning a Lamborghini but traveling along interstates with a 70 miles-per-hour speed limit.

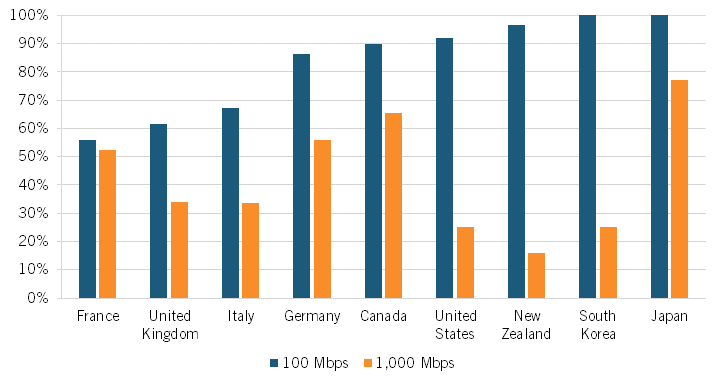

Still, an assessment of deployment at faster speeds is useful in depicting possible future-oriented broadband landscapes and could become more relevant if new bandwidth-hungry technologies emerge. The CMR finds that, as of 2019, 91.7 percent of the U.S. population had access to fixed terrestrial services reaching 100/10 Mbps.[47] Ofcom’s Broadband Scorecard likewise finds that U.S. coverage by fixed technology at 100 Mbps or higher reached 91.9 percent of households in 2020.[48] To put this in context, comparable coverage rates for both Germany and the United Kingdom were lower, at 86.7 and 61.5 percent, respectively; South Korea and Japan were higher at 100 percent coverage each.[49] The United States did, however, match South Korea in terms of fixed gigabit-level deployment in 2020, at 25 percent of households each, as figure 3 shows.[50]

Figure 3: Percentage of households with fixed high-speed coverage[51]

Overall, the United States is not always at the head of the pack, but it consistently ranks well in deployment at speeds that have a realistic place in modern-day life. Significant investment in high-speed networks has made them widespread in the United States, and improved satellite networks are poised to deliver comparable speeds throughout the country.

Fiber is generally a better technology than is telephone copper wire, where its expense can be justified by population density. The pace of fiber upgrades serves as a good measure of advanced deployment and—albeit not the ideal—a metric for international comparisons.

As a baseline, the original Whole Picture reported that 17.8 percent of Americans had access to fiber.[52] The International Broadband Scorecard finds that, in 2020, 56 percent of U.S. households were in areas served by full-fiber broadband.[53] Meanwhile, Germany, for example, lagged behind at 14 percent of households, while, expectedly, South Korea had a score of 100 percent. Overall, in terms of fiber coverage, the United States ranked 9th out of the 18 countries in the 2021 Broadband Scorecard, though of the leading countries, all but two have a higher population density.[54]

On the mobile wireless side, in 2015, the vast majority of Americans (99.6 percent of the population) already lived in an area where 4G LTE offered speeds advertised at a minimum of 5/1 Mbps.[55] Another 82.2 percent lived in areas covered by 4G LTE with a median speed of 10/3 Mbps.[56] Four years later, essentially every American (99.9 percent) had access to LTE advertised at 5/1 at a minimum, and 97.4 percent (of the 97.3 percent of the population evaluated) lived in areas with access to median speeds of 10/3.[57]

Significant investment in high-speed networks has made them widespread in the United States, and improved satellite networks are poised to deliver comparable speeds throughout the country.

Nowadays, increasingly prevalent home 5G offerings are rapidly approaching speeds that rival wireline’s performance. The three biggest home 5G providers (Starry, T-Mobile, and Verizon) each offer a home 5G plan that can surpass 150 Mbps, well above the vast majority of customers’ actual needs.[58]

While speed and latency are two measurements consumers experience directly, the technology that delivers them is not. Therefore, while gradual replacement and upgrades of old infrastructure are certainly necessary, zeal for any particular technology should not drive broadband policy. As long as a connection guarantees reliable, adequate speeds, the type of line through which that connection runs is as immaterial to the average consumer as the brand of gas they use to fuel their car.

Number of Providers

The state of overall deployment is more than a question of what speeds and technologies are available where. To a certain extent, a competitive marketplace also depends on consumers that have a choice between providers at the speeds they need so as not to be locked in with a particular provider by virtue of geography. However, competitive markets do not require that every household have multiple providers. If providers have regional deployments, discipline from a competitive market will tend to affect the offerings even in places with only one provider.

In 2013, the United States was among the leaders in intermodal competition, which at that point was best assessed by comparing concurrent deployment of cable and DSL; it ranked third in the OECD, with concurrent facilities reaching 85 percent of the population.[59] In other words, 85 percent of Americans had a choice between at least two wireline broadband providers.[60]

In 2020, USTelecom found that 87 percent of U.S. households had access to at least two wired facilities-based competing providers; the comparable EU number was just 45 percent.[61]

FCC data offers more detail: As of June 2021, 86.8 percent of the U.S. population was covered by two or more providers offering fixed broadband at 25/3 Mbps—and 60.7 percent of those had access to three or more.[62] And 61.9 percent had a choice between at least two at speeds of 100/10, with 42.3 percent of the population having at least two providers at speeds of 250/25 Mbps.[63]

While speed and latency are two measurements consumers experience directly, the technology that delivers them is not.

The CMR also reports the number of providers offering wireless service to varying segments of the population; though the FCC notes that network coverage in a certain area doesn’t always equate to service being offered in that area, wireless coverage statistics can still say something as a measure of competition. At the close of 2019, the four largest wireless providers—AT&T, Sprint, T-Mobile, and Verizon Wireless—each had estimated coverage of more than 93 percent of the U.S. population.[64] The two leading providers, AT&T and T-Mobile, covered 99.5 and 98.1 percent of the population, respectively.[65] Overall, 99.8 percent of the U.S. population had 4G LTE coverage by at least two providers in 2019, and 94.7 percent were covered by at least four providers.[66]

Since the point of mobile coverage is to provide service while traveling or out of the home, mobile providers must offer extensive total coverage that is not limited to households. The CMR estimates that AT&T and Verizon each covered about 92 percent of U.S. road miles in 2019, while T-Mobile and Sprint covered 85 percent and 57 percent, respectively—a figure that has likely only improved since their merger.[67]

Overall, U.S. fixed and mobile markets are competitive, and becoming more so. The majority of Americans are covered by two fixed providers at broadband speeds, even with satellite excluded, and coverage by four mobile providers is nearly ubiquitous.

Policy Developments

The COVID-19 pandemic both highlighted the strengths of existing broadband and raised the stakes regarding its weaknesses: social distancing and the rapid expansion of telehealth and work and learn from home, alongside the digitization of many day-to-day activities, emphasized the need not only for adequate broadband access but widespread adoption.

Two major bills passed in the last two years provide funds that should do heavy lifting to fill remaining gaps in access. The Consolidated Appropriations Act passed in 2021 includes funding for two programs specifically geared toward deployment: the Broadband Infrastructure Program,

which allocates $288 million to public-private partnerships to support broadband infrastructure deployment, and the Tribal Broadband Connectivity Program, through which $980 million is funneled toward tribal governments to buttress broadband deployment—in addition to telehealth, distance learning, affordability, and digital inclusion—on tribal lands.[68]

These acts, among others, have gone a long way in populating the last remaining broadband deserts in the United States. And as of November 2021, the $65 billion allocated to broadband through the Infrastructure Investment and Jobs Act (IIJA) should be sufficient to fund the rest.[69]

The IIJA comprises multiple programs, two of which are largely focused on deployment. Of these, the Broadband Equity, Access, and Deployment (BEAD) Program provides the lion’s share of funding, with $42.5 billion allocated to broadband deployment within states and territories. In addition to local networks, strong middle-mile infrastructure is a critical part of connecting communities to the Internet backbone, and the Enabling Middle Mile Broadband Infrastructure Program allocates $1 billion to middle-mile infrastructure across the country.

Taken together, this money, in addition to preexisting funding from ongoing programs, should provide adequate funding for the remaining gaps in deployment that are not inordinately expensive (for those areas, improved satellite broadband will remain the answer). The state of broadband deployment in the United States is not perfect, but it’s very strong and healthily funded.

Adoption

Good deployment is one part of a healthy broadband marketplace; strong adoption is the other. Adoption is the measure of households or individuals that actively subscribe to an Internet plan of some type. While deployment is the necessary precursor to a connected society, adoption rates represent the actual, not potential, uptake of the deployed broadband service.

Adoption is also ultimately the binary that dictates individual experience. When the COVID-19 pandemic sent the majority of U.S. institutions online in March 2020, it was those without an Internet subscription who spent an intermittent two-year quarantine without the lasting connection to the rest of society that an Internet connection could confer. In addition to losing the wealth of knowledge, entertainment, and creative pursuits that can be found online, individuals who have not subscribed miss out on the convenience and cost-effectiveness (telehealth, for example, can often be cheaper than its real-life counterpart) of online resources. They miss out on the opportunity to participate in some elements of society entirely: A large part of political discourse, for example, is now conducted through online platforms. As technology continues to advance, nonadopters will be excluded from entire parts of the future as well.

In 2021, 86.8 percent of the U.S. population was covered by two or more providers offering fixed terrestrial broadband at 25/3 Mbps, and 60.7 percent of those had access to three or more.

And so, adoption is a critical measure of how a society is doing in the digital age. Reasons for non-adoption vary widely and are often based on an individual’s interest, digital know-how, availability of technology, or the perceived riskiness of using the Internet. Because it is dependent on so many disparate factors, there are more opportunities for adoption to falter. U.S. adoption statistics bear this out: Where gaps in connectivity remain, it is almost unilaterally a lack of adoption rather than an actual lack of access that is driving those gaps.

In 2011, 56 percent of U.S. households had a fixed subscription that reached speeds of over 3 Mbps download.[70] Today, the FCC has set 25 Mbps or above as the new definition of broadband. The latest Internet Access Services Report (IASR) finds a total of 80,179,000 residential fixed connections (including DSL, cable, fiber-to- premises, satellite, and fixed wireless) meeting that benchmark as of 2019, which translates to about 62.4 percent of households.[71]

But lack of a fixed connection of at least 25 Mbps doesn’t necessarily translate to lack of a connection altogether. The IASR also reports the total number of residential fixed connections across the country (greater than 200 Kbps in at least one direction). At 103,043,000 connections as of 2019, the fixed adoption rate rises to 80 percent of households.[72]

The U.S. Census also regularly measures broadband adoption rates through its American Community Survey (ACS). In response to whether they have access to the Internet from home through broadband of any type (including a cellular data plan, fixed broadband, or satellite), the 2019 ACS 1-year estimates find that 86.4 percent of U.S. households had a broadband Internet subscription.[73] Of that, 70.8 percent of households had a subscription through fixed broadband such as cable, DSL, or fiber. By 2021, the broadband-connected universe had expanded to 90.1 percent of households, of which 75.5 percent subscribed to fixed broadband.[74]

At first glance, these numbers illustrate two things. First, adoption statistics can vary widely based on the included technologies, speed benchmarks, and survey methodologies. Context is critical when attempting to draw meaning or policy conclusions from them. Second, the large divergence between total Internet connections and fixed connections at broadband speed means there is clearly some value in the types of connections that don’t meet the official definition of broadband, as customers would not continue to subscribe to a connection, for any amount, that provided absolutely no value. In particular, 5G’s high speeds may allow it to be used by some as a substitute for a fixed connection, just as people began substituting landline for mobile services once the technology allowed.

Where gaps in connectivity remain, it is almost unilaterally a lack of adoption rather than an actual lack of access that is driving those gaps.

Some barriers to adoption are solvable with adjustments to the broadband marketplace, but others are more entrenched. In fact, Pew Research Center found in its 2021 broadband report that 71 percent of non-home broadband users were not interested in getting a connection at home.[75] Because uptake is dampened by a lack of interest more so than options or affordability, promoting adoption means a better explanation of the benefits and importance of the Internet, widespread education in digital literacy, and better access to both affordable Internet plans and the necessary technology.

Demographics

Adoption statistics fall to varying degrees along demographic lines. For example, the Pew report finds that smartphone ownership varies considerably by age, with older generations significantly less likely than younger ones to own one.[76] Age was also an important determinant of connectivity in the original Whole Picture report, a phenomenon that in part represents the relative youth of the Internet and the fact that older individuals are less likely—or simply less inclined—to embrace all new technology. This disparity will also likely age out of society as the newer generations are all born with the Internet. However, as technology is still changing, this does point to the importance of attempting to inculcate each generation with an appreciation of the importance of new technologies.

The 2013 Whole Picture also found that adoption rates varied further with demographic distinctions such as race, disability, income, and education level.[77] In 2010, a rough total of 65 percent of Americans subscribed to broadband of any speed, as reported by the FCC (OECD estimates found 68 percent of American households).[78] A demographic breakdown found that Blacks subscribed at rates of 59 percent; Hispanics were lower at 49 percent. Rural, disability, and low-income status all tended to correlate to lower subscription rates than the average as well.[79]

Disparities along demographic lines still exist today. Pew’s latest broadband survey finds that adults ages 30–49 were the most likely cohort to subscribe to home broadband, at 86 percent: They earned more than younger people and were more Internet savvy than older generations.[80] Subscription rates fell to 79 percent between ages 50 and 64, and further for ages 65+ (64 percent). Younger adults ages 18–29 were similarly less likely to have home broadband, at 70 percent.[81]

Rural subscription rates lag behind urban and suburban ones. And both educational attainment and income are still good predictors of home broadband subscriptions, with both college-educated adults and those making $75,000 or more subscribing at higher rates than their less-educated or lower-income peers.[82]

Racial divisions remain as well, with Black and Hispanic adults less likely (at 71 and 65 percent, respectively) to subscribe to home broadband than white adults (80 percent).[83] Because of the relationship between income, education, and broadband adoption rates, and because systemic inequalities lead to a strong correlation between income, education, and race, one might expect racial discrepancies in broadband adoption to be largely due to the link with factors such as income and education. Indeed, one cross-sectional study of digital access among Chicago families finds that once income is controlled for, there is no significant difference in high-speed Internet connectivity between Black and white families, though Hispanic families are still less likely to have high-speed Internet than their counterparts.[84] However, another economic analysis that decomposes the effects of income and education from the effects of race argues that socio-economic differences do “relatively little” to explain differences in adoption, and that differences are in fact more likely due to other factors correlated with race.[85] It is fair to say, then, that the relationship between race and connectivity is uncertain.

International Comparisons

Though differences in the marketplaces make perfect comparisons difficult, especially when so many demographic factors play into adoption, it is still valuable to assess how U.S. adoption rates stack up in the international arena.

The ITU’s regularly updated statistics have included comparisons of fixed and mobile adoption rates since 2000. However, these datasets are limited in their usefulness because they diverge from current broadband standards: Subscriptions are counted as long as they achieve a download speed of 256 Kbps, which is insufficient for certain common modern applications.

The statistics have two additional flaws. First, measuring subscriptions per 100 people distorts the actual state of broadband adoption, particularly fixed, given the nature of a home broadband subscription. Fixed broadband is something that can only really be assessed on a per-household basis, since each household generally subscribes only once regardless of the number of inhabitants. Using individual, rather than household, data, therefore, will make countries with larger average numbers of household inhabitants appear worse off than they actually are and countries (e.g., European ones) with smaller household sizes look better. Second, an ordinal ranking system is misleading when the absolute difference between adoption rates is small. The distinction between 1st and 10th place doesn’t mean much if the numerical difference is only a few percentage points.

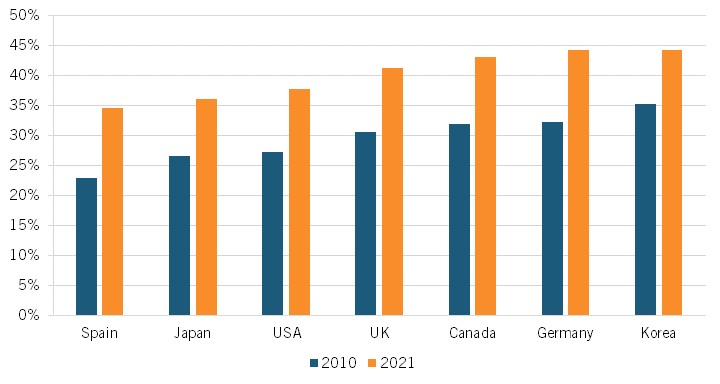

Nevertheless, ITU data can still say something about the relative trends in international adoption rates, which are displayed in figure 4. In 2010, ITU cited U.S. fixed broadband subscription rates as 27.2 per 100 inhabitants.[86] At that point, the United States ranked 15th among OECD countries. By the 2021 installment, at 37.7 subscriptions per 100 inhabitants, the United States had improved in rank to 13th in OECD (the 2021 data is, however, missing statistics from France, Luxembourg, and Norway, each of which ranked higher than the United States in 2020).[87] But per capita adoption rates are not as meaningful as percentage of connected households.

Figure 4: Fixed subscription rates per 100 inhabitants[88]

Ofcom’s International Broadband Scorecard similarly reports broadband adoption rates among the countries included in the study and ranks the distribution of broadband connections by speed, which allows for a less dated benchmark of subscriptions that advertise as 30 Mbps download or higher (though with the caveat that business, in addition to residential, lines are included in the dataset’s “connections per 100 people” measurements). In its 2021 edition, which reports data as of the end of 2020, the United States ranks 4th among the 18 countries for fixed subscriptions of at least 30 Mbps download.[89] In total, Ofcom says that 95 percent of U.S. subscriptions reach speeds of at least 30 down.

The Ofcom findings imply that the majority of U.S. subscriptions actually adhere to the modern-day speed floor. In fact, of the 18 countries included in the International Broadband scorecard, 8 have subscription rates of under 10 percent to speeds under 30 Mbps download, and only 5 subscribe to sub-30 Mbps plans at rates of above 20 percent.[90] This implies that ITU datasets may not be so skewed by low-speed plans after all, though the findings can’t reasonably be extrapolated past the countries included in both analyses.

An ordinal ranking system is misleading when the absolute difference between adoption rates is small. The distinction between 1st and 10th place doesn’t mean much if the numerical difference is only a few percentage points.

But even if ITU datasets are mostly capturing current speeds, the issues inherent in per capita rates and ordinal ranking systems remain. To the first point, the average number of U.S. persons per household was 2.5 in 2020 and 2021 according to the U.S. Census.[91] For comparison, Switzerland ranks first among included OECD countries in ITU fixed adoption statistics, at 46.1 connections per 100 inhabitants as of 2021.[92] According to Eurostat, Switzerland’s average household size was 2.2 in 2020, which is significantly lower than the U.S. average, and therefore puts Switzerland at comparatively less of a disadvantage when assessing on a per-100 inhabitants basis.[93] Denmark ranks second according to ITU, and has an even smaller average household size of 2.0.[94] And South Korea ranks third in adoption, with an average household size of 2.3.[95] In fact, 16 OECD countries rank higher than the United States according to the 2020 ITU; of them, all but 3 (Greece, Portugal, and Iceland) have a smaller—in most cases significantly so—average household size than the United States.[96] Moreover, the majority of their household sizes have actually decreased over the last 10 years, thus diminishing any disadvantage they might face from the methodology. In the EU alone, the number of single-person households increased by 28.5 percent from 2009 to 2021.[97] U.S. household size has decreased as well, but only slightly, down to 2.5 from 2.6 people per household in 2010.[98]

To the second point, recall that high-ranking Switzerland has 46.1 fixed connections per 100 inhabitants per ITU.[99] At 37.7, the United States achieves 81.8 percent of the top OECD member’s connectivity rate. It is significantly closer, therefore, to the top than to the lowest-ranking OECD member (Colombia) at 16.4.[100]

Per-household data is available through OECD, but as in the ITU data, subscriptions are counted as long as they achieve download speeds of at least 256 Kbps. Compounding the issue, OECD acknowledges that there may be methodological differences in data collection among countries. Still, the dataset can again say something for the purposes of comparisons over time, though there is no similar study with a higher speed benchmark to verify the OECD rankings.

According to OECD, in 2013, 74.2 percent of U.S. households subscribed to an Internet connection. Of that connected population, 73.2 percent of households subscribed to a broadband connection.[101] The U.S. Internet adoption rate has since increased to 81.9 percent of households, with 83.4 percent of that through a broadband subscription.[102] For the United States, data is drawn from NTIA’s Internet Use Survey, which is performed by NTIA and the U.S. Census Bureau as a periodic addition to the Current Population Survey.[103] OECD’s measure of Internet subscribers is drawn from NTIA’s count of households with home Internet access (excluding mobile, but including fixed broadband, satellite, and dial-up).

But as stated, since some households rely on mobile, there is comparative value in looking at total share of households with a broadband subscription through a wider lens that encapsulates a broad range of speeds and counts mobile connections in addition to fixed. The ACS broadband subscription estimates, as mentioned previously, measure share of households that subscribe to broadband when broadband is defined as a mobile, fixed, or satellite connection. Again, all told, the ACS 2021 estimates that 90.1 percent of American households subscribe to broadband of any type. A study with similar criteria by Eurostat places U.S. adoption rates roughly in the middle of peer EU nations, but significantly closer to the top of the range than the bottom. Of the 20 EU countries that have higher adoption rates than the United States, the results are strongly clustered, with 15 countries at 95 percent or below, including six at 91 percent.[104]

Figure 5: Percentage of households with broadband subscriptions[105]

The United States also struggles with major determinants of Internet adoption that are not dictated by the broadband marketplace itself. In 2018, the United States was ranked only 125th in the world in literacy, below such major OECD nations as Japan, France, Germany, Spain, and Korea.[106] Illiterate individuals are unlikely to subscribe to a plan regardless of how it’s packaged or how cheap it is if they cannot read well enough to make use of any of the information on the Internet. And general illiteracy likely correlates with digital illiteracy. A post-COVID survey on the digital divide classified 36 percent of respondents as having low levels of digital skills based on their self-assessed ability to complete certain online tasks; only 45 percent of respondents, for example, said they’d be confident applying for government services online.[107] Unsurprisingly, the report finds a correlation between digital literacy skills and how much respondents valued their Internet connection—in other words, the ability to use the Internet plays a role in how much an individual values (and is thus willing to purchase) that service at all.

In addition to low literacy rates, though the United States is a rich nation in absolute terms, high levels of income inequality and relative poverty among the U.S. population leads to relatively lower purchasing power among certain groups. At an 18 percent poverty rate in 2019 according to OECD (calculated as the ratio of the number of people whose income is below the poverty line, which is half of median household income), the U.S. performs more poorly in terms of income inequality than, for example, France, Denmark, and the United Kingdom.[108] Even with higher absolute income levels, relatively lower income among subsets of the population lowers their purchasing power for broadband.

All told, the United States stacks up well against the majority of countries in fixed broadband subscriptions, despite some major demographic limitations. Moreover, the ranking alone does not reflect that fact that absolute adoption rates are increasing in the United States alongside other countries.

The United States is doing better on the mobile front. The ITU found that in 2010, the United States was among the leaders in mobile subscriptions; it ranked seventh out of OECD countries at 60.3 subscriptions per 100 inhabitants.[109] By 2021, the U.S. rank had further increased to third among the OECD, with 165.8 mobile subscriptions per 100 inhabitants.[110] While mobile usage has increased substantially among all OECD countries, the United States is still above the median, which is 108.3 subscriptions per 100 inhabitants.

Ofcom’s International Broadband Scorecard ranks the United States 3rd out of 18 countries studied in 4G connection rates, with an average of 139.2 connections per 100 people.[111] In penetration of 5G it ranks fifth (5.1 connections per 100 people).[112] Mobile subscription rates are more difficult to accurately count by country because the premise of a mobile connection is locational flexibility. But the U.S. mobile metrics rank favorably against peer nations.

All told, the United States stacks up well against the majority of countries in fixed broadband subscriptions, and it has some major demographic limitations to contend with.

There are low points and high points, but overall, the United States’ world-leading performance in broadband deployment is not matched by its adoption rates, which are closer to average for developed countries.

Reasons for Lack of Connectivity

Improving the standing of U.S. broadband adoption requires solutions tailored to the causes of the problem.

When asking for the most important reason people do not subscribe to home broadband, the Pew Research Center found that nonadopters cited satisfaction with their mobile connection and cost constraints nearly equally, at 19 percent and 20 percent, respectively, in 2021.[113] Further, while the share of those who cite “my smartphone does everything I need” has increased by 7 percentage points over time from 12 percent in 2015, the share of nonadopters that cite cost of a home broadband subscription as the most important barrier to adoption has been on a steady decline (down from 33 percent in 2015).[114]

NTIA regularly puts forth a survey that is similar to Pew’s, called the Internet Use Survey. Results from its last update are decisive: Of non-Internet using households, a majority (57.5 percent) cited no need/not interested as the main reason they were not online in 2021.[115] NTIA’s estimation for the percentage of households for which cost of a subscription is the main barrier is similar to the Pew estimate, but it is proportionately lower in the ranks, in second place at 18.1 percent.[116]

Improving U.S. broadband adoption requires solutions tailored to the causes of the problem.

Other common reasons for the lack of a subscription include the existence of other options for Internet access outside the home, unavailable or too-slow service, and the cost of a computer. Some of these barriers are symptoms of remaining problems of deployment, which should continue to subside as private and public investments continue. Broadband prices being unaffordable for some is not, however, necessarily synonymous with prices being too high, since even a reasonable price may be too high for some individuals to afford.

To the extent that affordability remains a barrier, it is a matter of degree. NTIA found that, among people who cite cost as their main reason for not adopting broadband, most would be willing to pay $10 per month to get it.[117] Some determinants of adoption, therefore, could be remedied with marginal adjustments in policy programs. For example, while an additional $10 spent on deployment wouldn’t do much to get an additional person online, an individualized voucher handed to NTIA’s cost-based non-adopters would.

In sum, many remaining barriers to universal broadband adoption are wholly unrelated to deployment but still related to financial constraints. Others, such as the smartphone-only users and those with adequate access to the Internet outside the home, could be the preference of users and not necessarily a problem in need of a solution.

Speed

Of equal importance to how many Americans subscribe to home broadband is the quality of those plans themselves. And perhaps the most important metric when it comes to broadband quality is speed.

Broadband speeds are really a product of two technical components: bandwidth and latency. Bandwidth refers to the amount of data that can be transmitted simultaneously; though it is really a measure of a network’s capacity, it is essentially what most consumers experience as speed for one-way applications. Latency, which is the lag between the time that the data makes it from one end of a connection to the other, also plays a part in ensuring a seamless connection.

Fixed speed data today is drawn from Speedtest by Ookla, which aggregates and ranks participating countries’ average speeds. As of October 2022, the U.S. median fixed download speed is 182.6, and its mean is 248.6, both many times the 25 Mbps criteria set by the FCC.[118] In fact, the United States ranks sixth and rising in median speeds out of all included countries. Its median upload speed is 22.4 Mbps with a mean of 91.9, which again surpasses the FCC benchmark of 3. Finally, the United States has a median fixed latency of 13 milliseconds (ms), and a mean of 22 ms.[119]

One confounding factor in speed analyses is the variable gap between the speed that is advertised and the speed that is realistically achievable. The United States has historically performed well compared with other countries when it comes to matching advertised speeds, and it appears to have maintained this trend over time.

The U.S. median fixed download speed is 182.6 Mbps, many times the criteria set by the FCC.

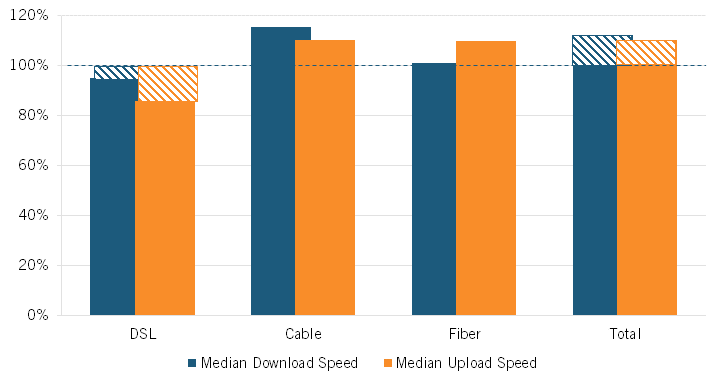

The original Whole Picture found that U.S. broadband speeds generally came close to matching or even exceeded advertised speeds. In a 2012 FCC study, average cable and fiber sustained download speeds reached 99 and 116 percent, respectively, of advertised speeds.[120] Upload speeds performed better across the board, with each technology achieving a sustained average upload speed of more than 100 percent of the advertised speed.[121]

Figure 6: Percentage of advertised speeds achieved by studied providers[122]

Today, the FCC’s 2021 installment of Measuring Broadband America describes a steadily narrowing gap between advertised and actual sustained speeds.[123] By 2020, median download speed ratios improved to an average of over 110 percent of advertised speeds for measured plans including DSL, cable, and fiber.[124] Among participating providers, DSL’s performance was behind the rest, with two of the providers offering speeds somewhat below advertised maximums, though all achieved over 70 percent of that maximum. Among the fiber and cable providers, only one put out an average download speed below what was advertised; the rest met or exceeded it. Across providers, median upload speeds held steady at 110 percent of advertised.[125]

Another facet of speeds is relative subscription rates to superfast plans. Although excessively fast subscriptions are not a critical part of a connected society, uptake rates to faster plans over time can serve as a rough proxy for upgrade pace. The FCC Broadband Deployment Reports have long published analyses of U.S. uptake rates at different speed tiers. In 2010, the FCC found an adoption rate of 24 percent (calculated as the number of residential subscriptions divided by the number of households with access to the service) to a fixed plan of 6 Mbps download, which was above the definition of broadband at that time.[126] According to the most recent installment using data from 2019, the adoption rate grew to 64.8 percent at a plan of 50/5 Mbps, and to 50.9 percent at a plan of 100/10 Mbps.[127]

The International Broadband Scorecard shows the progression of high-speed uptake by reporting distribution of fixed connections by advertised speed. As of 2020, 26 percent of U.S. subscriptions were to speeds advertised between 30 and nearly 100 Mbps download.[128] Sixty percent of subscriptions were to speeds between 100 and under 300 Mbps. For comparison, Japan's shares of subscribers to 30–100 and 100–300 Mbps connections are similar (20 and 57 percent, respectively), though its marketplace is skewed toward higher speeds, with a larger proportion of subscriptions to even faster plans than the United States.[129]

For mobile data, we can look back to Speedtest data, which reports mobile speeds and latency as well. The October 2022 edition ranks the United States 23th in median mobile download speeds, at 72.3 Mbps, with a mean of 146.2 Mbps.[130] It reports median and mean mobile upload speed of 8.8 and 15.7 Mbps, respectively.[131] Median mobile latency, meanwhile, is 31 milliseconds.

Like the share of high-speed fixed connections, 5G connections as a proportion of total mobile connections can indicate the affordability, relevance, and dissemination of the newest standards of technology. Per the International Broadband Scorecard, 5G makes up 3.3 percent of total U.S. mobile connections; among the 18 countries included, the United States ranks fifth, behind only South Korea, the United Kingdom, China, and Ireland.[132] However, this reflects, in part, differences in adoption rates of newer 5G-enabled smartphones.

If the majority of nonsubscribers put irrelevance as the main reason they don’t subscribe, building another network for them to reject will do next to nothing.

Overall, the United States falters more in terms of adoption than it does in deployment. In some areas, such as mobile uptake and relative uptake of higher-speed connections, it compares well to peer nations. In the overall adoption of fixed broadband, there is certainly room for improvement. But adoption rates should be looked at in concert with the reasons for a lack of adoption to inform an effective policy response.

If the majority of nonsubscribers put irrelevance as the main reason that they don’t subscribe, building another network for them to reject will do next to nothing. That money would be better spent on targeted outreach or classes on digital literacy. For those who cite affordability as a factor, the United States has taken good initial steps in creating consumer-targeted programs to subsidize the cost of a connection, such as the Affordable Connectivity Program as of 2021—though ideally this subsidization would be expanded to include computers and digital literacy programs as well. The individual choice of whether to adopt is determined by multiple factors, and the answer to society-wide low adoption rates is to address each factor individually.

Price

U.S. broadband critics overwhelmingly rely on a simple charge: that “Americans pay the most for the worst Internet service.”[133] The second clause lacks an empirical basis, as the data shows. The first is equally misleading.

Evaluating relative prices is not, however, as simple as comparing two prices from two different countries and expecting the results to speak for themselves—at least not if that data doesn’t address the problems inherent to comparing international price data. There are a plethora of differences between broadband plans and marketplaces that can skew conclusions drawn from comparative pricing. The difference between plans that bundle multiple services, between quality factors such as bandwidth and data caps, between determinants of the cost of deployment such as population density and demand, between average income and costs of doing business, and the regulatory framework that shapes everything from permitting to a provider’s supply chain all play a part in what price the market will set. Looking at the dependent variable (or price) and ignoring the disparate factors that feed into it limits informed policy and begets unhelpful conclusions.

International Comparisons

ITU has been producing international information and communications technology (ICT) price basket datasets since 2008, including the price of various broadband baskets. ITU data provides a helpful trend line stretching back years, is fairly comprehensive, and does a good job addressing some of the biggest flaws inherent to comparing broadband prices: The data collected from each country or territory is reasonably comparable, and is reported in purchasing power parity (PPP) and percentage of gross national income per capita (GNIpc), both of which give a sense of what the average consumer actually pays to subscribe to a service, not just how much in dollar equivalents.

Evaluating relative prices is not as simple as comparing two prices from two different countries and expecting the results to speak for themselves.

But the datasets are collected using a somewhat arbitrary methodology: ITU data simply defines a fixed broadband basket, for example, as the cheapest possible plan from the largest operator in each economy that provides at least 5 GB of monthly high-speed data (again, for the purposes of these datasets, ITU defines high-speed data as reaching a minimum of 256 Kbps). Because of this relative lack of selectiveness, plan elements from data caps to bandwidth run the gamut and are not accounted for in the ranking system. Residents of a country in first place, therefore, may indeed be paying the lowest relative price, but they may get a plan with the lowest relative worth because of other shortcomings. (To avoid ambiguity in the following analysis, for the purposes of this section, the lower the ordinal number of the country ranking the better performing it is. For example, ranking first means a country is in first place, offering the cheapest price out of included countries.)

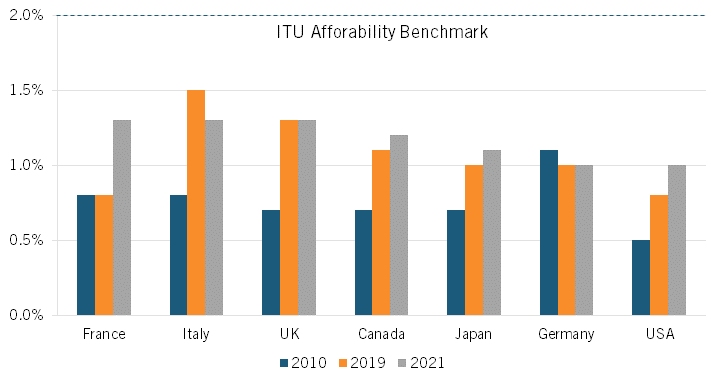

In 2010, a fixed broadband basket cost an average of 0.5 percent of the U.S. GNIpc.[134] This put the United States in second place out of all high-income countries and territories with available data in the ITU dataset; only Macao, China was cheaper at 0.4 percent of GNIpc. The methodology was updated in 2018, at which point the criteria for a fixed broadband basket was raised to provide at least 5 GB (up from 1 GB) of monthly data. Even with this break in trends, U.S. entry-level prices continued to fare well; 2019 ITU data showed U.S. fixed prices tied for sixth place among high-income OECD countries, at 0.83 percent of GNIpc.[135]

As shown in figure 7, U.S. fixed prices are still competitive but constitute a larger percentage of U.S. GNIpc, at 1 percent.[136] They rank 10th among high-income OECD countries in the most recent iteration of ITU data as of 2021. This backward slide may be partially attributable to the fact that the U.S. offering’s plan qualities changed significantly between the 2019 and 2020 datasets; bandwidth doubled from 100 to 200 Mbps, and the data cap rose from 1,024 GB to unlimited.[137] Because of the arbitrary nature of ITU data collection, an increase in plan quality can deflate a country’s rating, since there is no accounting for the added (though likely diminishing) value of the higher speeds or for differences in data caps. In the 2020 data, in fact, the bandwidth offered by the U.S. plan is higher than that of every country ranked above it, save Singapore, Hong Kong, and Romania.

The U.S. ranking may also be partially explained by the fact that relative broadband prices increased globally in the last two years following the COVID-19 pandemic, likely in part because the economic downturn precipitated by the pandemic caused reductions in gross national income (GNI), which increased the proportionate cost of services.[138] Moreover, ITU data includes only standard prices and excludes specific deals or promotions, while many providers offered some type of special promotion or pricing during the pandemic.[139]

Figure 7: G7 fixed broadband basket prices as a share of per capita income, ITU[140]

Interestingly, there is a lack of a correlation between prices and uptake rates that lends credence to the relative price indifference of nonadopters. This was also true in 2010, when countries with some of the highest adoption rates (e.g., Korea and Singapore) in fact had entry-level prices significantly above those in the United States.[141] In 2020 ITU data, the two high-income OECD countries with the lowest-priced fixed plans were Luxembourg and Israel, both at 0.8 percent of each nation’s GNIpc.[142] Luxembourg ranks well in contemporaneous fixed adoption statistics (37.3 connections per 100 inhabitants) but not at the top, suggesting that price is at least not the most important determinant of adoption.[143] Israel ranks lower than the United States in adoption, at 29.7 fixed connections per 100 inhabitants. Meanwhile, the OECD country with the highest adoption rate—France, at 47.5 in 2020—does not even rate in the top 15 cheapest plans among high-income OECD countries, at 1.2 percent of GNIpc.

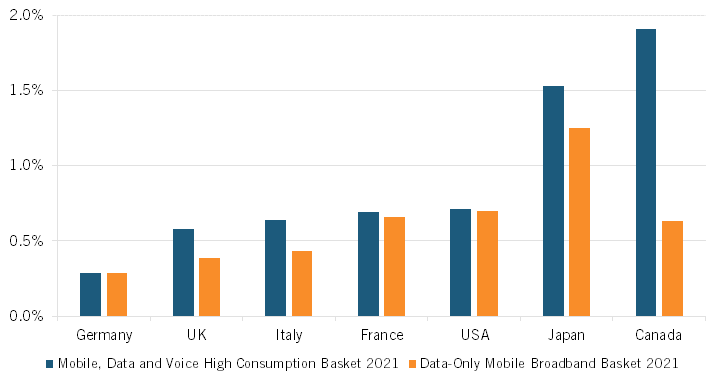

ITU also reports the price of various mobile baskets, the most basic of which is the data-only mobile broadband basket, which is the cheapest plan of at least 2 GB of data monthly from the largest operator in each country. In 2013, the U.S. data-only basket sold for 0.4 percent of GNIpc, which was the eighth cheapest offering among high-income OECD countries and 276.9 percent of the cheapest high-income OECD offering.[144] In 2020, the selected U.S. mobile broadband basket ranked 10th, still at 0.4 percent of GNIpc (though it had risen by 0.04 since 2013).[145] It was, in fact, the same price as those charged in Italy and high-adoption nation Korea. However, in 2021, the price of the U.S. basket increased to 0.7 percent of GNIpc, which put it second from last among high-income OECD countries. Even though these numbers are small in an absolute sense, the dramatic increase in price over just one year more likely reflects a change in the sort of plan ITU was measuring, rather than an actual increase in price.

On the other end of the scale is ITU’s collection of mobile data and voice high-consumption baskets, which include the cheapest market-capturing offering that provides 140 minutes of voice, 70 SMS, and 2GB of data monthly. Here, the United States ranks ninth from last at 0.7 percent of GNIpc.[146] Both Korea and Japan are pricier, at 0.9 and 1.5 percent, respectively.

But here again, a focus on ordinal rankings can tend to skew conclusions. As shown, ITU has set a broadband affordability target at 2 percent of GNI, a benchmark the United States handily meets with every basket. Further variations within that limit inevitably run into fundamental differences between countries, such as variances in their respective labor costs, subsidy rates, or average incomes. (The higher the GNI, the lower relative broadband prices can appear to be while providers pull in the same profits as relatively lower-income countries. Luxembourg, for example, has a GNI of PPP 83,230, which makes it feasible for providers to offer a mobile data and voice high-consumption basket sold at only 0.2 percent of GNI.)[147]

Overall, the higher-income OECD countries offer, for example, mobile data and voice high-consumption baskets ranging in price from 0.2 to 1.9 percent of GNIpc. The median price is 0.5 percent; the United States, at 0.7 percent, sits significantly closer to that—and to the best, cheapest score—than it does to the most expensive end of the price range.[148]

So at a glance, the United States appears more expensive because its rank puts it closer to more expensive countries, which is not reflected by its near-average position in terms of raw numbers.

Figure 8: Mobile basket prices as a share of GNI per capita, ITU[149]

At a glance, the United States appears more expensive because its rank puts it closer to more expensive countries, which is not reflected by its near-average position in terms of raw numbers.

In fact, the United States performs well according to the Inclusive Internet Index (III), which rates 100 economies on their overall Internet performance in the four categories of availability, affordability, relevance, and readiness. In the latest iteration, the United States stood in 10th place in the affordability category, a ranking that takes income and competition into account in addition to price.[150]

Tenth place may not confer bragging rights, but it also belies common claims of the United States ranking dead last or even faring worse than average.

Relative Prices over Time

The passage of 10 years adds another distorting element: the confounding factor of inflation over time. Broadband prices are also a product of the overall price market just as any other good is, and inflation can distort a trend line until a convex angle reads as concave.

USTelecom publishes a pricing index that tracks the price of various broadband Internet services over time. The most recent iteration in 2022 finds that prices of services have consistently declined over time, even in the face of high inflation rates.[151] The BPI-Consumer Choice index finds that the real price of the most popular service tier (the speed tier with the most connections in 2015 and the plan most comparable to it in 2022) has declined by 44.6 percent since 2015, and 14.7 percent in the last year alone.[152] At the same time, in the last year, the overall CPI-U recorded a price increase of 8.5 percent across the board.[153]

Moreover, the USTelecom report finds that BPI-Speed, which measures the price of the fastest plan available in the base year and its equivalent in 2022, has decreased since 2015 (by 52.7 percent in real terms) and since 2021 (by 11.6 percent in real terms).[154] The BPI-Speed Index is constructed with the fastest speed offerings in the original year (in this case, 2015) and the most comparable offering in 2022, and in that way it gives a good look at the way cutting-edge technologies generally cheapen with age even as they improve and their use is required by more of the populace. To put a finer point on it, the price of utilities in the CPI-U, especially electricity and gas, increased from 2021 to 2022.[155] In the same time period, innovation enabled the overwhelmingly privately-owned broadband marketplace to lower the price of the BPI-Speed offering by 1.7 percent, even in nominal terms.[156]

Determinants of Price

Even where all these disparities are accounted for, the price of broadband is less clearly defined than it appears to be at the outset. First, price does not always reflect all the money a consumer must actually pay for a service. There is a catalogue of associated fees such as setup costs and one-time payments that are not always or consistently captured in a measure of price. An accurate price comparison should also attempt to navigate the murky world of government subsidies, as a taxpayer dollar spent in the service of broadband is a dollar spent for broadband, no matter the degree of separation.

In addition, some price measurements that might initially seem like appropriate means of comparison are not so. For example, Cable.co.uk’s Global Broadband Pricing League measures and compares international prices per megabits. However, as ITIF has pointed out before, the gains accrued by increasing the speed of a populace’s broadband are nonlinear.[157] Economic and social gains peak when nonusers first get online on a basic plan with speeds sufficient for everyday use, after which each iterative increase in speeds achieves diminishing returns. This is not to say that higher speeds are not useful—they are. It is also not to say that the bar won’t rise as new technologies heighten minimal speed requirements—it will. But attempting to disaggregate each dollar spent on broadband by each megabit gained is not the best way to compare plans.

The ideal price comparison would attempt to account for the largest fundamental differences between broadband markets and the populations they serve, including important price-determining distinctions such as population density (which varies even among urban areas), demographics, topography, and quality factors such as speed and data caps.

Economic and social gains peak when nonusers first get online on a basic plan with speeds sufficient for everyday use, after which each iterative increase in speeds achieves diminishing returns.

The FCC attempted such a comprehensive evaluation in Appendix G of its most recent CMR. It weighted a sample of representative plan data from U.S. and international providers by quality factors to calculate an average plan price for each community, and then controlled for market differences and plan characteristics in a hedonic pricing index.[158]

A hedonic pricing model disaggregates a product’s quality factors and attempts to describe their relationship with the product’s price. In this way, it levels the broadband playing field and compares prices without other factors clouding the analysis.

The FCC model draws a few key conclusions, though it’s important to note that the relationships found between variables are correlative and not necessarily causal.[159] First, the relationship between per capita income (PCI) and price in a country is both large and statistically significant, largely because countries with higher PCI have higher labor costs. Though population density and educational attainment are not statistically significant, terrain ruggedness—another determinant of cost—again has a large, statistically significant and positive association with price.

The proxy variable used for content availability and quality, which essentially measures per capita rates of available webpages in a language that is accessible to each country’s public, also has a strong positive association with prices.[160] This relationship suggests that the volume of usable content accessible through an Internet connection varies widely between countries and likely plays a role in the price of broadband. In 2015, an economic analysis of France, the United States, and the United Kingdom used a similar content-quality variable—in this case, using an index that included television channel availability and the availability of “premium content” (e.g., sports and movies).[161] That analysis also found that content quality had an effect on the price of Internet services.

The iterative rankings of the FCC’s hedonic pricing model help show the complexity of comparing international broadband plans and the extent to which unaccounted-for differences in marketplaces can skew the data at first glance: Pre-treatment, the data shows that the United States ranks 21st out of the 26 OECD countries included in the fixed broadband price analysis.[162] Once average income and terrain ruggedness are standardized across countries, the United States performs comparatively much better—moving up by a full nine ranks—which suggests it is strongly disadvantaged by environmental factors in most untreated price analyses. The next model, which incorporates fixed broadband network quality (essentially, speed), does not change the U.S. ranking. However, once the content quality proxy variable is added, the United States moves all the way up to second place, which suggests that overall, U.S. subscribers are getting more bang for their buck than all but one of the included OECD countries.[163]

The quality of content accessible through an Internet connection varies widely between countries and likely plays a role in the price of broadband.

While hedonic pricing presents significant difficulties for data collection and methodology, it is the sort of analysis that is necessary to make an apples-to-apples comparison of international broadband prices. Looking only at bottom-line prices in a vacuum is misleading.

International comparisons of broadband pricing can tell us something insofar as they allow for a loose assessment of how a country stacks up against its peers. But as long as one country’s ISPs don’t have profit margins exorbitantly above those of comparable ISPs, differences in the cost of broadband can be largely attributed to fundamental differences in the marketplaces that cause the cost of deploying broadband to vary between countries. In fact, an ITIF report comparing the broadband marketplaces of several European countries to that of the United States finds that broadband deployment costs providers proportionately more in the United States than in the European countries.[164] U.S. providers pour greater percentages of their revenues into labor costs, spectrum licenses, and capital expenditures.

One final way to determine whether private U.S. broadband prices are where they should be, or the broadband naysayers have it right when they say the market demands a total revision (most often to something akin to the public utility sector or government ownership) is to compare private ISPs’ prices against those offered by municipal providers. A common argument holds that municipal broadband prices can be set very low and therefore provide more inclusive access to lower-income communities.

This argument fails in two respects. First, as has been shown both through survey responses and through the lack of a correlation between prices and adoption, the price of plans offered is not the main barrier to adoption. Second, municipal and private U.S. prices are not substantially different when all the associated costs of both are taken into account.

A 2021 ITIF report on the longstanding assumption that high broadband prices are a barrier to adoption examines one such study, in which the prices offered by various U.S. municipal networks were touted as lower than anything the private sector had to offer.[165] Instead, the results were a product of incomplete pricing data on both ends of the scale. In fact, in one such example—the municipal network in Ammon, Idaho, whose prices were found to reach $9.99 a month—the base cost advertised failed to account for monthly utility and construction fees, after which the cost to consumers was similar to those offered by private providers (almost $40 a month).[166] Ammon’s network aside, of the other four cities with municipal networks, only one offered prices at or below $50 per month. Of the cities with municipal broadband that ITIF examined, each had at least one nonmunicipal provider offering a subscription of $50 or less.[167]

This is all in addition to the fact that municipal broadband comes with additional costs (the network in Ammon, for example, doesn’t pay taxes to the city, since its infrastructure is government provided and was in fact funded by over $1.1 million in loans at low interest rates), and further ignores the fact that private providers generally offer low-cost or subsidized programs predicated on affordability.[168] And relatively comparable prices between public and privately-owned broadband indict the municipal “cherry-picker,” which often limits its deployment to high-population density areas that are cheaper to serve.