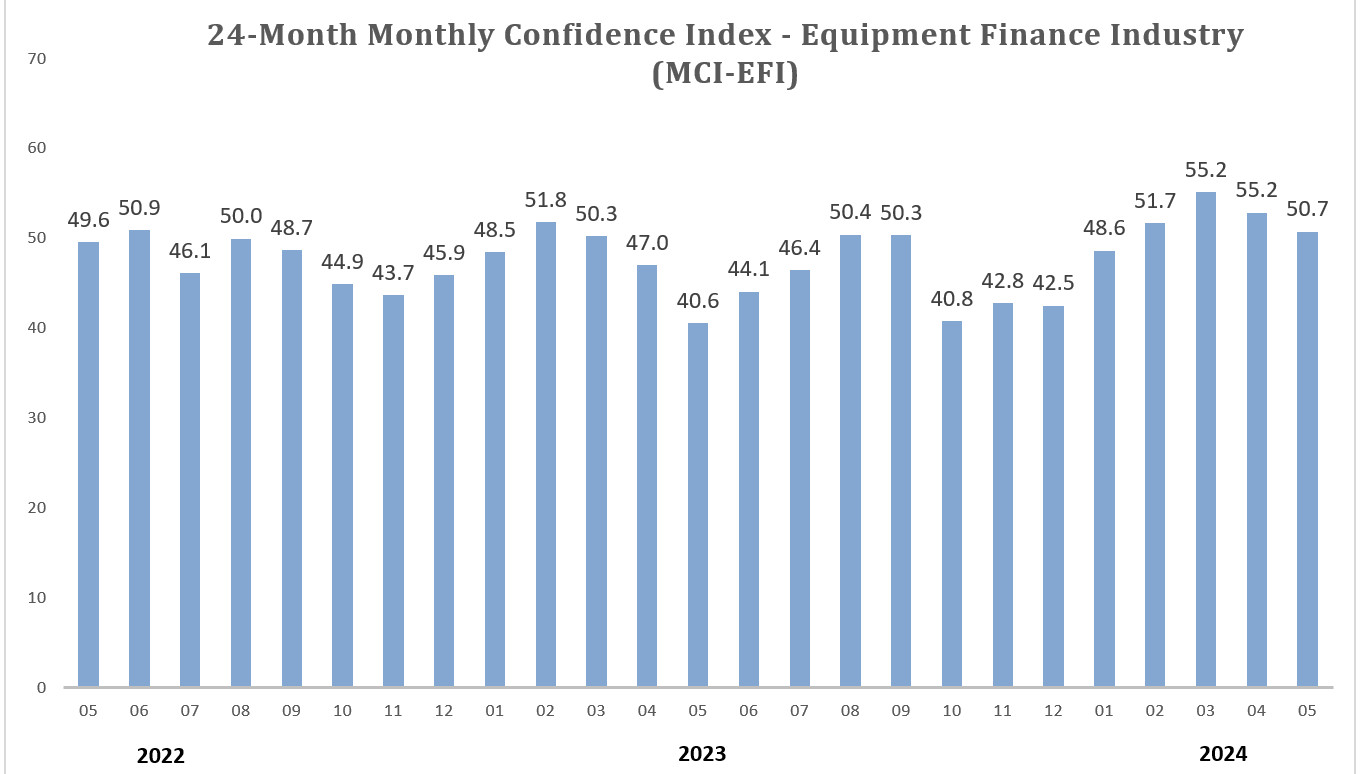

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 50.7, a decrease from the April index of 52.9.

When asked about the outlook for the future, MCI-EFI survey respondent Bruce J. Winter, President, FSG Capital, Inc., said, “This year, the story of our industry centers on the availability of funding, creating a world of ‘haves’ versus ‘have nots.’ Undoubtedly some active funders today will become ‘have nots’ as their traditional funding mechanisms change. This will create substantial opportunities for strong and experienced participants to pick up not only market share, but more importantly, key personnel that have become displaced from their historical employers. Making the right move(s) now in this time of market disruption will allow these entities to grow and diversify their businesses while others are unable.”

May 2024 Survey Results

The overall MCI-EFI is 50.7, a decrease from the April index of 52.9.

- When asked to assess their business conditions over the next four months, 11.1% of the executives responding said they believe business conditions will improve over the next four months, a slight increase from 10.7% in April. 77.8% believe business conditions will remain the same over the next four months, down from 85.7% the previous month. 11.1% believe business conditions will worsen, an increase from 3.6% in April.

- 11.1% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 7.1% in April. 81.5% believe demand will “remain the same” during the same four-month time period, down from 92.9% the previous month. 7.4% believe demand will decline, an increase from none in April.

- 14.8% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up slightly from 14.3% in April. 77.8% of executives indicate they expect the “same” access to capital to fund business, up from 71.4% last month. 7.4% expect “less” access to capital, down from 14.3% the previous month.

- When asked, 22.2% of the executives report they expect to hire more employees over the next four months, an increase from 17.9% in April. 74.1% expect no change in headcount over the next four months, up from 71.4% last month. 3.7% expect to hire fewer employees, down from 10.7% in April.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 85.2% of the leadership evaluate the current U.S. economy as “fair,” down from 92.9% in April. 14.8% evaluate it as “poor,” up from 7.1% last month.

- 7.4% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 17.9% in April. 63% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 71.4% last month. 29.6% believe economic conditions in the U.S. will worsen over the next six months, an increase from 10.7% the previous month.

- In May, 11.1% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 17.9% the previous month. 81.5% believe there will be “no change” in business development spending, up from 78.6% in April. 7.4% believe there will be a decrease in spending, up from 3.6% last month.

Survey Demographics

Market Segment

- Bank 53.8%

- Captive 15.4%

- Independent 26.9%

- Other 3.8%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 11.5%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 30.8%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 57.7%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 14.8%

- $50 Million – $250 Million 14.8%.

- $250 Million – $1 Billion 33.3%

- Over $1 Billion 37%

May 2024 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Businesses will always need equipment. There may be a few less buyers, but in times like these there is less competition as lenders pull back so it evens out. Having a strong sales team to find those buyers and the right program structure to attract those buyers is key.” Donna Yanuzzi, EVP, 1st Equipment Finance, Inc. (FNCB Bank)

Bank, Middle Ticket

“The delay of expected or hoped-for interest rate reductions seems to be leading some entities to reconsider capital projects. To date, volume and credit quality have held up, but it’s not clear what the future will hold.” Jason Lueders, President, Farm Credit Leasing

Back to Top