The most recent Equipment Leasing & Finance Industry Horizon Report emphasizes forward-looking economic and industry insights related to the U.S. economy—including near- and medium-term economic risks. The Foundation commissioned Keybridge Research to conduct this comprehensive research on the size and expected growth of the U.S. equipment finance market.

Key Findings

Equipment and software investment growth in 2021 was historically strong after a weak year in 2020 in which nominal investment fell by nearly 4% due to the pandemic-triggered recession. In 2021, equipment end-users invested in equipment and software at a pace not seen in at least two decades.

Highlights from the 2022 Equipment Leasing & Finance Industry Horizon Report include:

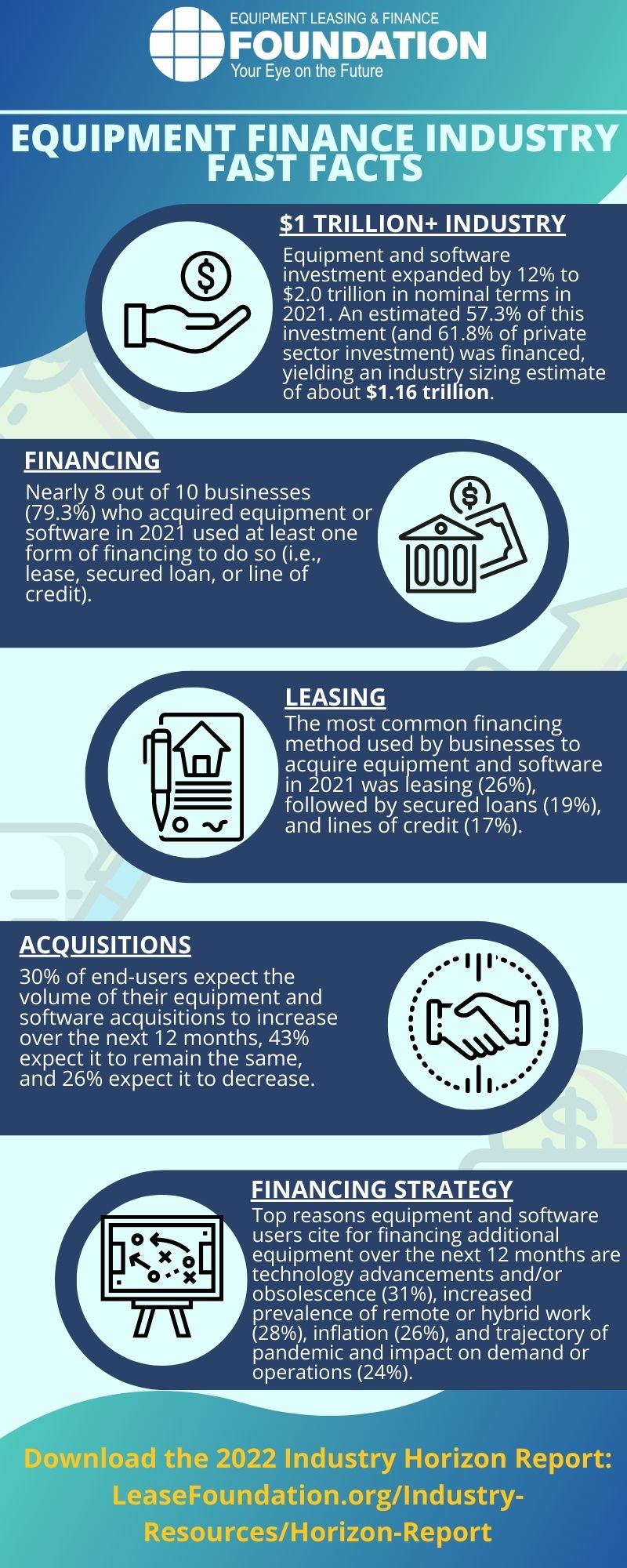

- Majority of equipment and software acquisitions are financed. Equipment and software investment expanded by 12% to $2.0 trillion in nominal terms in 2021. An estimated 57.3% of this investment (and 61.8% of private sector investment) was financed, yielding an industry sizing estimate of about $1.16 trillion.

- Share of businesses using financing remains steady. 79.3% of survey respondents who acquired equipment or software in 2021 used at least one form of financing to do so (i.e., lease, secured loan, or line of credit). This is nearly identical to the Foundation’s estimate for 2018, which was based on a 2019 end-user survey.

- Leasing remains the most used method of finance. The most common payment method used by businesses to acquire equipment and software in 2021 was leasing (26%), followed by secured loans (19%), and lines of credit (17%). Among non-financed acquisitions, cash (19%) and paid-in-full credit card purchases (19%) comprised similar shares.

- Medical equipment leads among verticals most likely to be financed. Of the 13 equipment verticals for which a sufficient number of responses were collected to produce statistically viable results, medical equipment was the most likely to be financed, with an estimated 75% of acquisition volume secured through a lease, loan, or line of credit. Other verticals with relatively high financing activity include other industrial equipment (69%) and construction machinery (67%).

- Professional services sector leads among industries most likely to use financing. Of the six end-user industries for which a sufficient number of responses were collected, professional services firms were most likely to use financing (70%), followed by construction (67%), and healthcare (64%) businesses. In all six industries, leasing remains the most popular method of finance used, with secured loans being the second-preferred option in most cases.

- Small firms less reliant on traditional financing. In terms of both sales revenue and number of employees, small firms are generally less reliant on financing methods when acquiring equipment or software. The propensity to finance ranged from 56–65% across most revenue brackets, but in the two smallest sales brackets (i.e., less than $250,000 and $250,000 – $1 million) it was just 30% and 41%, respectively. Similarly, firms with less than 20 employees were far less dependent on traditional financing methods than mid-size and large firms, choosing instead to rely heavily on credit cards. Firms with 50+ employees financed the majority of their equipment and software acquisitions.

- Banks lead in financing volume. As in previous years, banks were the biggest player in the equipment finance industry in 2021, with 53% of equipment and software financing volume. Of this amount, roughly two-thirds was attributed to the end-user’s primary bank and the remaining one-third to a secondary bank. Manufacturers and vendors accounted for 17% of financing volume, independents comprised 14% of volume, and fintechs comprised an additional 14%.

- Access to up-to-date equipment and technology among top reasons to finance. Businesses were equally likely to cite “protection from equipment obsolescence” (64%), “tax advantages” (64%), and “optimization of cash flow” (62%) as the primary reasons for financing their equipment and software acquisitions. Compared to the 2019 survey, end-users were significantly more likely to cite each of these reasons this year.

- Positive outlook for 2022 acquisitions. A plurality of respondents expects the volume of their equipment and software acquisitions to remain the same over the next 12 months (43%), while a roughly equal percentage expect their acquisitions will increase (30%) vs. decrease (26%). The most commonly selected equipment investment verticals among end-users who plan to boost their equipment and software acquisition are computers (43%), software (38%), office equipment (36%), and communications equipment (28%), reflecting the importance of these verticals to business operations in a post-pandemic environment. Of those who expect acquisitions to increase, a sizeable majority (69%) expect to use a financing method to cover at least a portion of the cost.

- Technology considerations lead reasons for future financing. A variety of factors were cited as reasons for financing additional equipment over the next 12 months. The most frequently cited factor was “technology advancements and/or obsolescence” (31%), followed by “increased prevalence of remote or hybrid work” (28%), “inflation” (26%), and “trajectory of pandemic and impact on demand or operations” (24%). This year’s survey suggest that equipment and software end-users are thinking more about inflation, the Fed’s response to it, and implications for their business strategy.