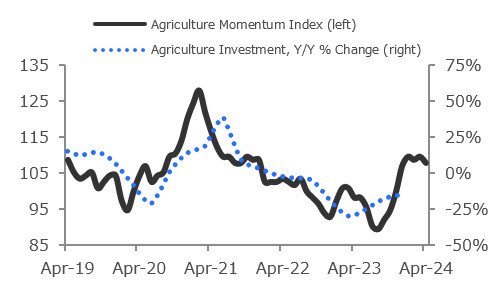

Agricultural Machinery

Investment in Agricultural Machinery fell 34% (annualized) in Q4 2023 and is now 15% below its year-ago level. The Agriculture Momentum Index decreased to 107.9 in April from 109.6 in March. In January, precipitation levels moved in a negative direction for Agricultural investment, while corn futures grew 5.3% in March. Based on the Index’s current position and recent movement, annual growth in agriculture machinery investment is expected to improve over the next two quarters.

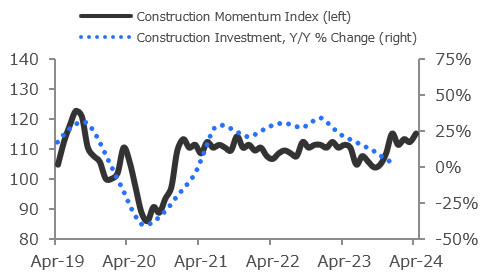

Construction Machinery

Investment in Construction Machinery ticked up 3.5% (annualized) in Q4 2023 and is 3.2% above its year-ago level. The Construction Momentum Index increased from 112.3 in March to 115.1 in April. New privately owned homes under construction increased in February, while total construction spending weakened 1.2% M/M in February. Overall, movement in the Index over recent months suggests that annual investment growth in construction machinery may improve over the next two quarters.

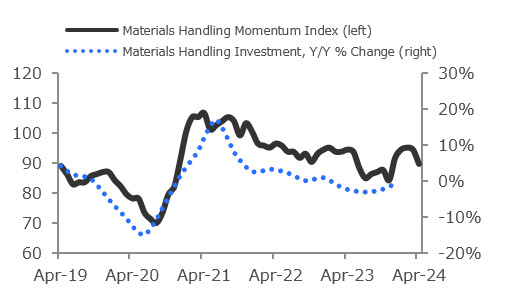

Materials Handling Equipment

Investment in Materials Handling Equipment increased 10.5% (annualized) in Q4 2023 but is slightly below year-ago levels (-0.6%). The Materials Handling Momentum Index fell sharply, from 94.6 to 89.8 in April. In January, trade prices weakened 1.4%, while manufacturing payrolls held steady in March. Overall, the Index’s recent movement suggests that annual investment growth in materials handling equipment should remain relatively flat over the next six months.

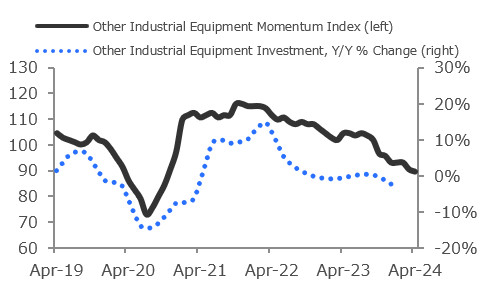

Other Industrial Equipment

Investment in All Other Industrial Equipment decreased 5.9% (annualized) in Q4 2023 and remains 2.4 below year-ago levels. The Other Industrial Equipment Momentum Index slipped from 90.4 in March to 89.5 in April. In February, non-residential construction spending ticked down, while machinery prices in manufacturers’ inventories fell 0.6%. Overall, the Index’s position and recent movement suggest that annual investment growth in other industrial equipment is unlikely to improve over the next six months and may worsen.

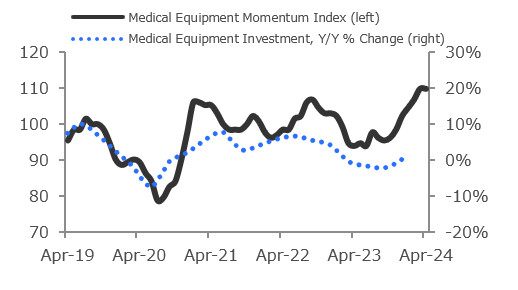

Medical Equipment

Investment in Medical Equipment increased 13% (annualized) in Q4 2023 and is now slightly positive on a Y/Y basis (+0.4%). The Medical Equipment Momentum Index held steady at 109.8 in April. In February, the medical equipment and supplies IP index improved 3.1%, while the CPI for physicians’ services fell 0.2%. Overall, the Index continues to point to stronger annual investment growth in medical equipment over the next six months.

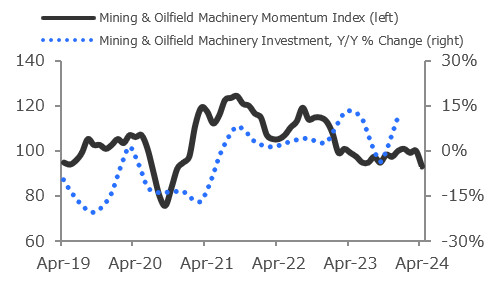

Mining & Oilfield Machinery

Investment in Mining & Oilfield Machinery increased 57% (annualized) in Q4 2023 and is 12% above year-ago levels. The Mining & Oilfield Machinery Momentum Index fell in April from 100.0 to 93.0. The EIA for oil production weakened 5.7% in January, though mining and logging payroll employment improved in March. Overall, the Index suggests that annual growth in mining & oilfield machinery investment is likely to weaken over the next six months.

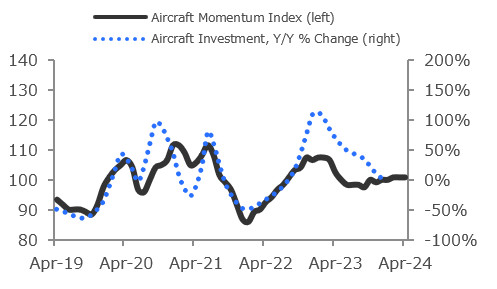

Aircraft

Investment in Aircraft decreased at a 23% (annualized) rate in Q4 2023 but remains slightly positive on a Y/Y basis (+2.1%). The Aircraft Momentum Index held steady in April at 100.8. Exports of computers and electronic products improved in February by 0.2% while the ISM New Orders Index decreased 3.0%. Overall, while investment is typically volatile in this vertical, the Index suggests little change in aircraft investment growth over the next two quarters.

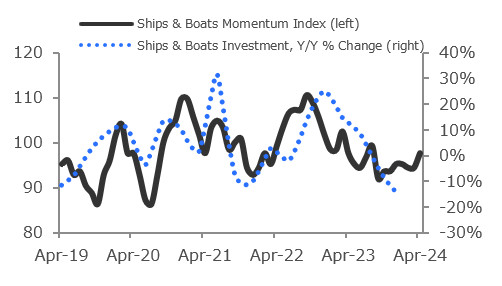

Ships & Boats

Investment in Ships & Boats fell at a 16% annualized rate in Q4 2023 and is 15% below its year-ago level. The Ships & Boats Momentum Index increased from 94.4 to 97.6 in April. In February, new orders for ships and boats weakened 37% while manufacturers inventories for ships and boats improved 4.6%. Overall, the Index’s recent movement and current position point to a modest improvement in annual growth in ships & boats investment over the next six months.

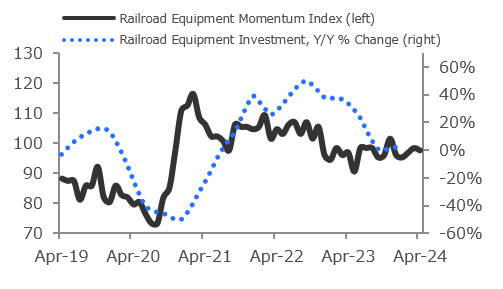

Railroad Equipment

Investment in Railroad Equipment decreased 4.5% (annualized) in Q4 2023 but is up 2.2% year-over-year. The Railroad Equipment Momentum Index decreased from 98.4 to 97.6 in April. In February, industrial production for petroleum and coal products fell 0.4%, while industrial production for railroad rolling stock increased 2.9%. Overall, the Index points to little change in annual growth in railroad equipment investment over the coming six months.

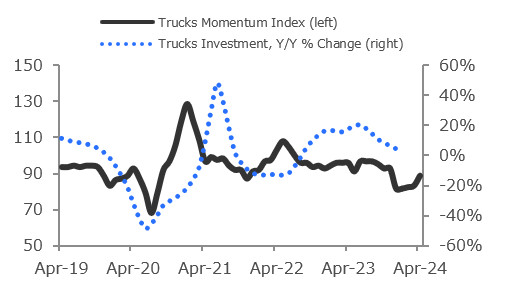

Trucks

Investment in Trucks decreased 21% (annualized) in Q4 2023 but remains 4.4% above year-ago levels. The Trucks Momentum Index increased from 83.3 in March to 88.9 in April. In February, capacity utilization of furniture and related products improved 2.0% while estimated raw steel production was flat in March. Overall, the Index indicates that annual investment growth in trucks has the potential to improve over the coming two quarters but is likely to remain relatively flat.

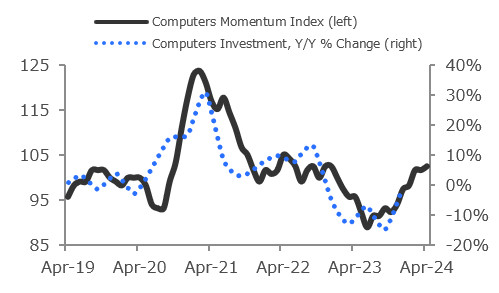

Computers

Investment in Computers increased 26% (annualized) in Q4 2023 but is down slightly on a year-over-year basis (-0.8%). The Computers Momentum Index increased from 101.7 to 102.5 in April. In March, the ISM suppliers’ deliveries index decreased 7.2%, while the value of communication equipment grew 0.4%. Overall, the Index’s current position and recent movement point to stronger year-over-year investment growth in computers over the next six months.

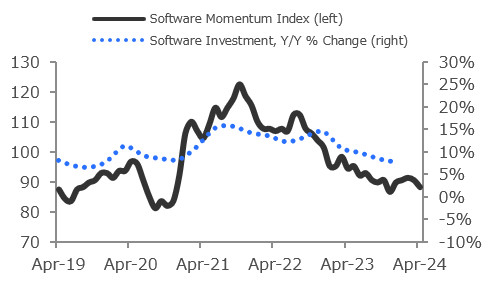

Software

Investment in Software rose 11% (annualized) in Q4 2023 and is up 7.8% from a year prior. The Software Momentum Index softened from 90.6 to 88.3 in April. In March, ISM supplier deliveries worsened 7.2%, while the unemployment rate eased 0.1 percentage point. Overall, the Index’s position and recent movement suggest that annual investment growth in software should remain steady over the coming two quarters.