Should I Sell to a Home Investor?

Learn all about selling to an investor, including what to expect and how to avoid scams.

In this article:

- What you should know about selling your house to an investor

- How traditional buyers and house investors differ

- Common reasons to sell to an investor

- Pros of selling your house to an investor

- Cons of selling your home to an investor

- How to avoid scams from home investors

Home sellers can avoid the stress of a complicated home transaction process and sell directly to a traditional investor or an iBuyer. These kinds of sales may allow sellers to bypass things like inspection contingencies and avoid appraisal concerns or buyer financing issues.

Even if you start off intending to sell to a traditional buyer, you might end up getting a compelling offer from an investor, perhaps one with minimal contingencies and the promise of a quick close. But before you accept, it's important to understand how the process differs from a typical transaction. And if it feels too good to be true, it probably is.

Read on for everything you need to know about selling your home to a professional home investor.

What you should know about selling your house to an investor

- Selling to an investor saves time and hassle, but it's not for everyone.

- Personal situations, like a job relocation, divorce or potential foreclosure, are some common reasons people end up quickly selling a home to an investor.

- There's a new type of home investor, called an iBuyer.

- Whether you sell to a traditional investor or an iBuyer, you can expect a quicker close, an as-is sale and an all-cash offer.

- When selling to a private investor without a listing agent, you need to do your research to protect yourself from scams. There are plenty of companies that buy houses — make sure to use a reputable one.

How do traditional buyers and house investors differ?

The term buyer is used to broadly describe people who buy homes, but buyers can come in varying forms — traditional buyers, traditional investors and iBuyers. The type of buyer you accept an offer from can impact the rest of the transaction process.

Who are traditional home buyers?

Traditional buyers are people like you, when you bought your current home. They're looking to purchase a property to reside in, either as their primary home or as a vacation home.

A traditional buyer will make an offer based on their perception of your home and their research on its market value. There's also an emotional component to the purchase. Maybe your home has a unique quality they've been looking for, like a big yard for their kids or the perfect layout for their needs. Traditional buyers may pay more than market value for the features they crave, or they may be willing to pay above asking price in a multiple-offer scenario.

According to the Zillow Group Consumer Housing Trends Report 2018, these attributes comprise today's average traditional home buyer:

- 41 years old

- College-educated couple

- Middle-class income

- Looking for a single-family home

Who are home investors?

A professional home investor is either an individual or a company that buys residential properties as part of a business or investment strategy. Individual investors may own just one or two investment homes (that they either keep and rent out or flip and quickly resell), but companies that buy houses usually do so in bulk. Home buyer investors usually employ one of four key strategies.

Buy-and-hold investment

A buy-and-hold investment strategy helps an investor grow a real estate portfolio over time. An individual might use this strategy to buy a home to rent for side income. They use something called a cap rate to determine their yearly expenses versus their potential profit and see if an individual investment pencils out before buying. A larger corporate investor may buy a home without renting it if they're simply trying to grow their portfolio or want to wait for improved market conditions.

Wholesale investment

Investors who buy properties and then resell them very quickly (and without making any improvements) are using a strategy called wholesale investment. They buy homes at well below market value, with the goal of selling to another investor for a higher price. Successful wholesalers usually have a large list of buyers lined up beforehand and use direct marketing to identify inactive or off-market homes they can buy inexpensively.

House-flip investment

Individuals or companies who buy houses, renovate them, and then sell them at a higher price are called home flippers. While the level of renovation needed and completed varies by the individual home and the local market, the goal is to make a profit on the resale, even after clearing all renovation expenses.

Buy/flip/hold investment

This type of investment is a hybrid of some of the other strategies covered above. In this case, individuals or companies buy a property, renovate it (in either minor or major ways), and then rent it out at a premium, while maintaining ownership.

Who are iBuyers?

Like other professional home investor companies, an iBuyer is a house-buying service (not an individual). What makes an iBuyer different is that they use technology to streamline the selling process, which can mean less hassle for you as the seller. iBuyers rely on a wealth of data and comparable home sales to make offers, often sight unseen.

Common reasons to sell to an investor

While most people sell their home the traditional way, there are a few scenarios where selling to an investor might make the most sense.

Inherited home

If you've inherited a property from a family member and you don't plan to live in the home, you won't want it to sit empty for too long. Not only can a vacant home be a target for vandalism, but if you sit on the property in a fast-moving real estate market, you could be on the hook for capital gains taxes.

Foreclosure

If you're behind on payments and need to sell quickly, an investor might be a good option.

Disrepair

If your home requires a lot of updating or repair work to be attractive to traditional buyers, it may be appealing to sell your home as-is to an investor.

No financing possible

If the home you’re selling doesn’t meet safety or permitting standards, most lenders won’t finance a loan for the property, which can make it hard to sell to a traditional buyer.

Need timeline flexibility

If you’re selling on a very specific timeline, you usually have more control over the close date with an investor, since they’re not timing a move-in date the same way a traditional buyer is.

Currently in escrow

If you're trying to time a sale and a purchase at the same time and your new purchase is contingent on your old home selling, going with an investor offer can speed up the process.

Relocating for work

Often a job relocation requires a faster-than-average timeline. Selling to an investor can be faster than waiting for the perfect buyer.

Divorce

Divorce settlements require both parties to divide the assets, and selling fast and splitting proceeds can often be an easier way to go.

Tenant occupied

Doing repairs, taking listing photos and scheduling showings with tenants living in a house can be complicated, so people owning rental properties often turn to investors when it's time to sell.

Pros of selling your house to an investor

Even if your personal situation doesn't fall under the common reasons listed above, you might benefit from selling a house to an investor. Here are some of the biggest benefits.

No prep work

With a traditional home sale, you'll have to do a lot of preparing before you list, from cleaning and decluttering to taking listing photos and staging. In fact, according to Zillow research, the average seller spends $6,570 prepping their home for sale. That figure includes hiring a professional for projects like painting, staging, house and carpet cleaning, lawn care and gardening.

Most investors care more about the financials and less about how your home looks. After all, they're going to either turn around and quickly resell your home or renovate anyway once the deal has gone through.

Note that to attract a traditional investor, you'll still have to have your home listed on the MLS and all the major real estate sites, like Zillow and Trulia. Be sure to include some clear photos and some terms that will attract investors — things like 'fixer upper' or 'needs TLC.' And keep in mind that there will still be showings, negotiating on price, and probably an inspection, just like if you were selling to a traditional buyer.

If you sell to an iBuyer, you don't have to list your home on the market at all, nor do you have to accommodate showings. That's what makes selling to an iBuyer so convenient. You'll typically receive an offer as soon as a few minutes after submitting a request or within a few days. And since an iBuyer has no emotional connection to the home, there is usually less back and forth than there is with a traditional buyer.

Quick escrow period

Unlike in a traditional sale, where a buyer will require a 45-day escrow period to allow enough time for inspections, appraisals and mortgage approval contingencies, a traditional investor can close in less than a month — and sometimes even faster.

An iBuyer can close even more quickly.

Simplified transaction

Because the home is being sold as-is, you won't need to worry about making any repairs before closing, whereas it’s common for traditional buyers to request repairs as part of their home inspection contingency.

Additionally, 21 percent of sellers offer to pay some or all of their buyers’ closing costs to seal the deal, according to the Zillow Report.

All cash offers

Both traditional investors and iBuyers usually buy in cash, so there's no danger in a buyer's appraisal coming in below the offer price and killing the deal. And in general, cash offers can close more quickly.

Securing a cash offer is especially important if your home can't qualify for financing — for example, if it doesn't meet the Federal Housing Administration's (FHA) minimum property standard, which states that homes being financed with FHA-backed loans must meet safety, security and soundness guidelines.

Flexible timeline

When selling to a traditional buyer, you have to agree upon a closing date that works for both parties, though usually the buyer calls the shots. And that means you have to be out of the house on the closing date — no exceptions.

Investors may be more flexible with the close date than a traditional buyer. You may also be able to leave stuff behind that you don't want, which isn't an option in a traditional sale.

With an iBuyer, you have even more control. The closing date is up to the seller, within reason, so you're free to choose that date that works best for your timeline, whether that means selling ASAP or timing it just right with the close of your new house.

Cons of selling your home to an investor

Although the process is faster and less complicated, selling your home to an investor isn't always the best idea if you're looking for top dollar.

Lower offers

The offer you receive from a professional investor will almost always be lower than what you would receive from a traditional buyer, especially if you're selling in a slow real estate market. An investor will still give you a fair market value, but keep these factors in mind:

- You won’t pay for prep work: The average home seller who hires professional help spends almost $5,000 getting their home ready to sell, including things like painting, staging, cleaning and lawn care. When you sell to an investor, these steps aren’t required.

- The offer reflects needed repairs: If your home is already in disrepair, an investor has factored the cost of needed repairs into their offer.

- Lack of emotional connection: Since a professional investor won’t be buying your home to live in with their family, there’s no emotional connection, which can sometimes lead traditional buyers to offer more for a house they love.

Possible scams with all-cash offers

Unlike real estate agents, who have to be licensed to represent buyers and sellers, investors don't need any credentials to buy property. This lack of licensing or any sort of professional affiliation leaves sellers susceptible to 'we buy houses' scams. Always do your due diligence when you're considering an investor offer.

How to avoid scams from home investors

If you decide not to have a listing agent represent you, you'll need to do a lot of research to make sure the offer you're considering is legitimate and that you aren't being taken advantage of. Here are a few important steps you should take:

- Call their office using the published number you were provided. Ask for a list of recent purchases.

- Check their website. If they don't have a website, ask the investor if they have any materials to support their business claims.

- Read reviews online. Most professional investors, even if not part of a large investment company, have some sort of online presence.

- Check your local Better Business Bureau for warnings.

- Never give any money to the investor until the closing date, and even then, all transactions should take place through a closing or escrow agent.

Written by

Kristijonas Umbrasas

11.26.2019

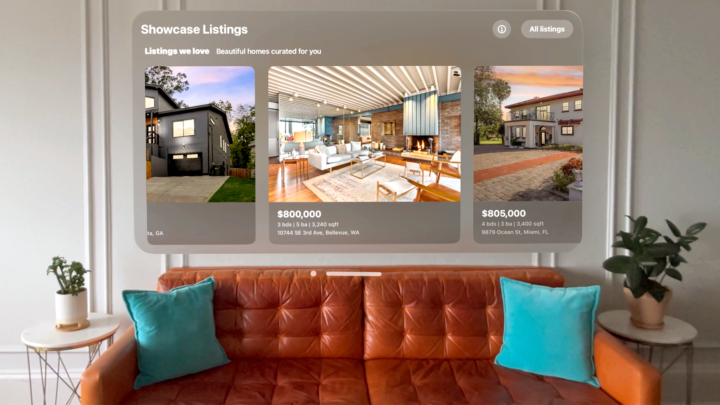

Ready for a new address?

Get an instant cash offer or list with a local partner agent.

Explore selling options