We demystify life as an expat, providing you information and actionable solutions for living and working outside of your home country.

Get proprietary and curated news and information—

user-friendly, actionable intelligence for taking charge of your path forward.

The perfect jumping-off point: Our free 2-minute assessment shows you what countries may suit you best as an expat.

Got a question? We’ve got answers about SX Expat’s range of products and services. Should you have additional questions, please contact us via our Support page.

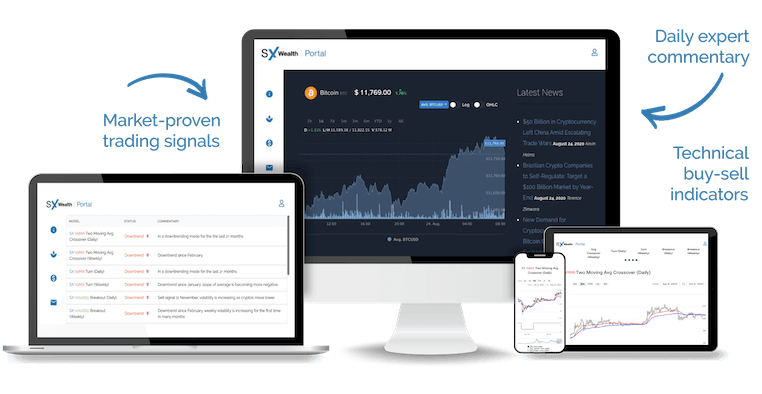

Discover how our proprietary, time-tested trading signals, technical indicators, and analysis and commentary can simplify yours trading strategies, helping to change your investment practices.

Gain perspectives that will help you to integrate innovative, sustainable trading strategies and tactics into the DNA of your day-to-day and long-term investment practices.

Get introductory answers to frequently asked questions about our advisory platform services. Should you have additional questions, please contact us via our Support page.

Our SX Signals Advisory Services—Crypto trading signals, plus our Master Class series and menu of consulting services—can help turn your greatest risk into your best asset.

Take advantage of a comprehensive library of SX Intel user guides that show you how to optimize the us of our SX Signals Advisory Platform, including SX Crypto, SX Precious Metals, and SX Macro.

Our premium e-Books, e-Reports, and e-Briefs, Masterclass Series, and consulting services help you internationalize by design rather than default.

Our SX Expats Master Class series presents a compelling case for living and working outside of your home country, with information that presents pragmatic solutions for achieving life as an expat.

As on-demand or retained consultants, our leadership can help clarify and simplify often complicated building blocks and practices of successful trading—helping produce an uncommon yet pragmatic competitive edge for you or your team.

Our SX Signals Advisory Services—Crypto trading signals, plus our Master Class series and menu of consulting services—can help turn your greatest risk into your best asset.

Our SX Signals Master Class series presents distinct, easy-to-understand online sessions with one intent: to unlock knowledge that will allow you to invest and grow wealth by design rather than by default.

Learn from the best: Whether you want to become a foreign resident, get a second passport, set up a business outside of your home country, or invest in foreign-domiciled companies, we can help you make it happen, designing and simplifying customized solutions.

Got a question? We’ve got answers ranging from customer and member support to SovereignX.com and how both SX Expats and SX Signals can help provide intelligent, action-solutions to living, working, and investing on your terms.

Contact Sovereign X initially online via our Contact form, and we’ll connect you to an expert and respond as soon as possible. Be sure to include your telephone, email, and, if you have one, your Twitter handle.

Take advantage of a comprehensive library of SX Intel user guides for your SX Signals Advisory Services. These free, easy-to-understand briefs show you how to optimize use of all of our SX Signals Advisory Services, including SX Crypto, SX Precious Metals, and SX Macro.

Get proprietary and curated news and information— user-friendly, actionable intelligence for taking charge of your destiny in separate SX Expats and SX Signals news and blog sections.

Our Sovereign X team has curated a list of their respective books, stories, articles, and online posts for your reading and viewing.

We simplify complex, often complicated information in two though-provoking premium Master Class series, proprietary video vignettes, and our SX Signals podcast series.

Sovereign X features a collection of regularly-posted humor and news satire from cartoons curated by its staff that focusing on global politics, investment, and the world of the absurd.

We’ll send you an email reminder before your trial expires.

Our VolatilityEdge© technology powers SX Signals Advisory Services— informing institutional-grade research, proprietary trading signals and technical indicators, and advanced trading analysis, showing you how to turn crypto’s volatility into your greatest asset while earning superior returns versus a conventional “buy and hold” strategy.

SX Signals™ VolatilityEdge© synthesizes everything L. Glenn Lawrence has learned about investing, market modeling and trading signals, and risk mitigation over the past three decades. Your 60-day test drive includes a free Zoom consultation with Lawrence.

See for yourself: SX Signals' models prove themselves, whether the crypto market has been up or down. As a subscriber, we provide you with full access to our historical archive of technical signals to review our past signal's success.

There's finally an adult in the room: L. Glenn Lawrence synthesizes all of SX Signals' model signals into a daily summary of the overall technical condition of the crypto markets. His daily analysis includes targeted market positions for various subscriber types: Trend Traders, Long-term Trend Followers, Tactical Asset Allocators, and Hedgers / Short-Sellers.

SX Signals' agnostic, market-proven algorithms—designed to turn volatility into an asset—drive our technical buy and sell signals, removing the guesswork from your decision-making and helping you develop and sustain successful and sustainable trading skills.

SX Signals' crypto market analysis models and research include a suite of proprietary volatility-adjusted algorithms designed to help you harness the potential benefits—and avoid the painful downside—of the tremendous volatility in crypto markets.

Your private dashboard offers 24/7 access to 16 charts of SX Signals' various models with unambiguous buy, sell, and neutral signals. Your dashboard also includes a status table with a clear summary of the current signal conditions of each model, Buy and Sell Gauges, target market positions, and daily market commentary—all proprietary to SX Signals.

We worked for more than four years to develop, optimize, and program our 11 proprietary models. SX Signals™ VolatilityEdge© translates complex market data into easy-to-understand information and actionable solutions. We show you “when to buy” and “when to sell” any of the top 50 traded cryptos.

We’ve successfully used these same high-tech models for a roster of global institutional and individual clients since 1998. And, now you can take advantage of them directly.

As part of your FREE 60-day test drive, you’ll also receive a one-on-one consultation with our managing partner L. Glenn Lawrence.

Test-drive our SX Signals Advisory Services—powered by SX Signals VolatilityEdge™—for FREE. Cancel anytime, no questions asked—we promise.

SX Signals is the culmination of everything L. Glenn Lawrence has learned about investing, investment modeling and signals, and risk mitigation over the past three decades.

Lawrence is old-school, having discreetly served a who’s who of private global institutional and individual clients since the early 1990s. He raised his family as expats, traveling the world as a consultant. He currently resides in southern Spain. He has a degree from the University of Texas at Austin.

Using his proprietary algorithms, Lawrence has built multiple trading systems for private clients since 1998. In 2018, after gaining significant historical market data for crypto, he began backtesting and market testing these same trading algorithms for public use—optimizing them specifically for cryptocurrency assets.

Lawrence invested an incredible amount of time and funds developing and testing SX Signals’ VolatilityEdge™ systems. He retained a prodigious team of experts including a Rice University-educated wealth manager, systems analysis, and computer scientist, a former tenured crypto analyst from Goldman Sachs, and a talented technology designer and programmer to help backtest, optimize, and program market models.

The end result? SX Signals’ Advisory Services show you how to turn crypto market volatility into your greatest asset, earning superior returns versus a conventional “buy and hold” strategy.

Hart is a Greenwich, Connecticut-based commodity trading advisor, programmer, and systems consultant for a boutique investment management group—a seasoned Series 65 registered investment advisor combining deep financial and technology capabilities with extensive operational and team management experience in an entrepreneurial setting.

He is the former founder and managing partner for Raylor, responsible for investments supervision, development, and maintenance of all trading and technology systems and infrastructure, compliance, and risk management for high-wealth individuals and family offices. Hart founded Xplor Capital Management in 2001 in Greenwich, which was combined to form Raylor in 2011.

Hart earned a master of computer science and a B.A. in chemical physics summa cum laude from Rice University.

Cranston is an entrepreneur, consultant, investor, and proponent of an international lifestyle and cryptocurrencies as an alternative to fiat monetary systems.

After earning undergraduate and graduate degrees in business at NYU, his first position was as a consultant at McKinsey & Company in New York. He then worked in the financial services industry in Manhattan as a dealer in precious metals and foreign currency, and then for two major investment banks, including as an equity derivatives trader for Goldman Sachs.

In 2001, wanting his children to become bilingual and be educated outside of the U.S., Cranston moved his family to San Miguel de Allende. His two daughters both live and work in Geneva.

Brett is a serial entrepreneur and communications strategist offering a unique perspective earned from 30+ years working from Los Angeles, Austin, and San Miguel de Allende. He has started up and turned around several ventures, including the e-commerce venture, iShop, Trelus, a private equity platform, Nulo, a premium pet food, and Toddy, a cold brewed beverage development group. After the dot-com boom in 2001, he moved his family to the mountains of central Mexico, working remotely before it was cool.

Since 2010, he has worked as a consultant for a number of for-profit, nonprofit, and philanthropic organizations and ventures in the U.S., Mexico, Canada, the UK, Ethiopia, and Rwanda. In addition, he continues to be a discreet source for trends, issues, and opinions for major news organizations. He earned a B.A. in journalism and business at Baylor University and studied at the post-graduate level at U.S.C. Brett has three children—a venture capitalist in San Francisco, and a filmmaker and designer, respectively, both in New York.

Your 60-day test drive includes a one-on-one consultation with co-founder L. Glenn Lawrence.

per month (no contract—cancel anytime)

per month (no contract—cancel anytime)

SX Signals includes three advisory services—SX Advisory | Crypto, SX Advisory | Precious Metals, and SX Advisory | Macro. The latter two will be introduced in Spring 2023.

Our robust, proprietary trading signals, technical tools, market analysis, and daily commentary have worked successfully since 1998 for our private clients.

Our VolatilityEdge© technology powers SX Signals Advisory Services— informing institutional-grade research, proprietary trading signals and technical indicators, and advanced trading analysis, showing you how to turn crypto’s volatility into your greatest asset while earning superior returns versus a conventional “buy and hold” strategy.

We suggest registering for a 60-day risk-free trial. You can cancel at anytime. After your free first month, your subscription is month-to-month, cancel anytime.

With your risk-free trial, you’ll get a one-on-one consultation via Zoom with L. Glenn Lawrence, Sovereign X’s co-founder.

What’s at the heart of SX Signals? Although each advisory platform is driven by its own unique set of trading models, our trading signals and jargon-free recommendations are driven by our proven proprietary timing algorithms, optimized to reduce the risk and adverse effects of volatility while preserving profit potential—offering you the opportunity to capture superior returns with less risk.

We invite you to view the historical performance of our models for yourself. You can do

so by investing two minutes of your life—sign up for SX Signals’ risk-free 60-Day premium subscription and test drive our proprietary online advisory platform.

Our robust, proprietary trading signals, technical tools, and market analysis have worked successfully since we introduced these tools to our private clients in 1998. Our time-tested models harness market volatility, turning your greatest risk into your best asset.

Our first advisory platform, SX Advisory | Crypto, provides a first-of-its-kind advanced trend trading technology for cryptocurrencies.

SX Crypto’s objective is to apply the analytical approaches and proprietary trading tools used by hedge funds and private trading companies to benefit individual traders and investors.

At the heart of our analysis are price and volatility algorithms designed to reduce the risk and adverse effects of volatility while preserving profit potential.

SX Signals has adapted market-tested, proprietary technical price analysis models and methods that have worked successfully in other financial markets. Our algorithms were robustly backtested and optimized—assuring traders a fundamentally sound platform.

The platform provides the tools to produce superior returns with significantly less risk in the frequently volatile crypto asset market.

We invite you to view the historical performance of our models for yourself. You can do so by investing two minutes of your life—sign up for SX Signals’ risk-free 60-Day premium subscription and test drive our proprietary online advisory platform.

The primary competitive marketplace is concerned with which cryptos to own rather than providing objective and clear buy-sell signals, timing, analysis, and commentary. From where we sit, our SX Advisory | Crypto advisory platform is nonpareil, based on our proprietary algorithms, objective analysis techniques, and decades of experience in trading, risk mitigation, and wealth management.

There’s no doubt we’re going to have some false buy and false sell signals—trend traders have to deal with false starts from time to time. However, our models have been proven to identify and stay with the long-term trends that cryptos are famous for and to cut losses short when the trend changes. Our objective, market-tested, mathematically-driven tools and algorithms help navigate the rollercoaster markets of cryptocurrency investing—helping to mitigate risk and maximize profits.

We invite you to view the historical performance of our models for yourself. You can do

so by investing two minutes of your life—sign up for SX Wealth’s risk-free 60-Day premium subscription and test drive our proprietary online advisory platform.

We’re confident that the most historically profitable approach—offering the most significant reward relative to the risk taken and to the resources required—is a trend following approach.

Trend following does not mean trying to predict where a market is going in terms of price. It means objectively determining the predominant direction of price movement, jumping on board during the trend, and riding it until it loses momentum.

Historically, the most profitable and most efficient trading approach in commodity markets has been a long-term trend following.

References to support this statement are plentiful—simply search for academic studies on ‘trend following’ and review the substantial evidence supporting the long-term success of many hedge funds and commodity trading advisors.

The benefits of trend following include capturing significant market moves, high ratios of profits compared to losses, and reduced trading, which minimizes transaction costs.

We invite you to view the historical performance of our models for yourself. You can do

so by investing two minutes of your life—sign up for SX Signals’ risk-free 60-Day premium subscription and test drive our proprietary online advisory platform.

Investors and traders need to pursue trading approaches that conform to their beliefs about how markets work. You can only consistently achieve success by trading in alignment with your ideas.

We believe that this market will continue to move from periods of 1. rampant enthusiasm (“bitcoin is the future of currency and is going to go to at least $250,000”), 2. widespread pessimism (“bitcoin’s going to become worthless because Elon Musk said it was a ‘hustle’ on Saturday Night Live”), and 3. idle indifference (“the boom is over, and bitcoin isn’t going anywhere”).

These dramatic swings between enthusiasm and despair, representative of the human element that drives all freely-traded markets, seem to be carried out in the extreme with crypto assets. The swings in sentiment cause substantial and reasonably sustained moves in asset prices. These can be captured using technical market measurements and trading techniques.

Our beliefs for the cryptocurrency market align with a trend following (trend trading) approach—periods of volatility and trending lend themselves to the pursuit of trend following approaches.

Whereas during periods of market idleness mean we need to minimize false entry signals during periods of sideways behavior. Large potential profits during times of enthusiasm can more than make up for small losses on false entry signals.

We invite you to view the historical performance of our models for yourself. You can do

so by investing two minutes of your life—sign up for SX Signals’ risk-free 60-Day premium subscription and test drive our proprietary online advisory platform.

Not seeing your question? View more by visiting our FAQs page or Contact Us.

Note: Testimonials were requested from individual SX Signals members by Sovereign X, and have been edited with permission for brevity and style.

Beat the crypto market with institutional-level research

per user/month

per user/month

Need Help?

Get updates on new products, compelling stories, and useful information.

Q: Why SX Expats?

A: Living life on your terms is having the freedom, flexibility, and self-reliance to live with purpose and do what matters most to you. Start your journey with SX Expat Advisor, our basic online assessment that shows you which countries suit you best to live and work based on your specific needs, wants, and requirements. Click here for your free assessment.

Q: How do I take advantage of SX Signals?

A: Invest two-minutes of your life—sign up for SX Signal’s free 60-Day Premium Trial and test drive our proprietary online advisory services. Gain access to our robust, objective, proprietary technical tools, market analysis, and trading signals that have worked successfully since 1998 for our private clients. Click here for a free, risk-free 60-day test drive.

© 2023 SX Partners, LLC. All rights reserved. Privacy Policy. Terms of Service.

Featuring new products, compelling stories, and useful information. You’ll receive only quality content. Promise.

I agree to Sovereign X’s privacy policy. I can opt out at anytime with one click.

“Buy and Hold” vs Trading Signals

Too many investors make the mistake of using a traditional “buy and hold” strategy— using their own “crystal ball” to make sense of the market’s volatility.

SX Signals’ VolatilityEdge™ technical trading methodology offers you a systematic way to buy and sell cryptocurrencies that helps to remove the uncertainty, and gives you a disciplined approach designed to help you make more from your

investments while managing the market’s wild swings.

But don’t take our word for it.

Enter a dollar amount into our widget and see an example of what you could earn from utilizing SX Signals’ trading signals vs. a “buy and hold” strategy.

Then take advantage of 60-days of premium services risk-free—the same trading system we’ve used successfully for private individuals and institutional clients since 1998—backtested and optimized for crypto assets.

Try VolatilityEdge™

SX’s Technical Trading System

Enter the amount you want to invest: