Beneficial owners are defined as any individual who ultimately owns or controls a legal entity or arrangement, such as a company on whose behalf a transaction or activity is being conducted. It is increasingly a matter of global concern that allowing such beneficiaries to remain anonymous has enabled the concealment of considerable questionable financial activity, and many governments are demanding greater transparency about beneficial ownership. As countries act to improve financial transparency, making disclosure of beneficial ownership as simple and inexpensive as possible will promote compliance and help achieve the ultimate aim of greater corporate accountability.

Why is beneficial ownership transparency important?

Anonymity enables many illegal activities, such as tax evasion, corruption, money laundering, and financing of terrorism, to take place out of the view of law enforcement authorities. For example, anonymous companies were used in the majority of corruption cases reviewed by the Stolen Asset Recovery Initiative, an initiative of the World Bank Group and the United Nations Office on Drugs (UNODC). Billions of dollars can be transferred in corrupt assets, complex money trails, strings of shell companies, and other legal structures behind which the so-called beneficial owners can hide.

As evidence of such activities has come to light, many governments have sought to prevent the misuse of companies for money laundering or other illegal activities. To increase transparency in business transactions, governments have begun to require the public disclosure of beneficial ownership information, that is, to reveal the identity of individuals who ultimately enjoy the benefits of property rights, even if they are not legal owners. Transparency about beneficial ownership is aimed to preventing companies’ owners from operating in secrecy.

Who is implementing new policies around the world?

Over the past few years, the issues of identifying ultimate beneficial owners and improving financial transparency more broadly have become increasingly important around the world. In April 2021, the United States Financial Crimes Enforcement Network (FinCEN) solicited public comments on the implementation of the beneficial ownership information reporting provisions of the U.S. Corporate Transparency Act (CTA). CTA requires certain newly formed and existing corporate entities to identify and disclose information about their beneficial owners to FinCEN.

The United States is not the only country to seek to improve corporate transparency. In 2016, in response to the “Panama Papers,” documents that exposed widespread wealth concealment and tax avoidance, the European Commission initiated requirements related to beneficial ownership transparency by introducing the 5th EU Anti-Money Laundering Directive (AML 5). Among other measures, the Commission suggested introducing public registries of beneficial owners, and requiring EU member states to establish public registries listing beneficial owners of companies. Companies, for their part, would be required to provide accurate and up-to-date information on their beneficial owners.

Beneficial ownership transparency is also being addressed in several developing economies. In November 2018, Tunisia adopted a new legal framework on beneficial ownership transparency, including creating a beneficial ownership registry. In 2019, India amended its Companies Rules to impose stricter regulation, and under the latest amendment, a “significant beneficial owner” is defined as someone who has at least 10% ownership of a company. Ghana and Kenya launched online central beneficial ownership registries in October 2020 to comply with international transparency standards. Companies registered in Kenya are now required to maintain a registry of their beneficial owners and to submit a copy of this list to the state Registrar of Companies.

Most economies still do not require legal entities to disclose beneficial ownership information within a clear time frame

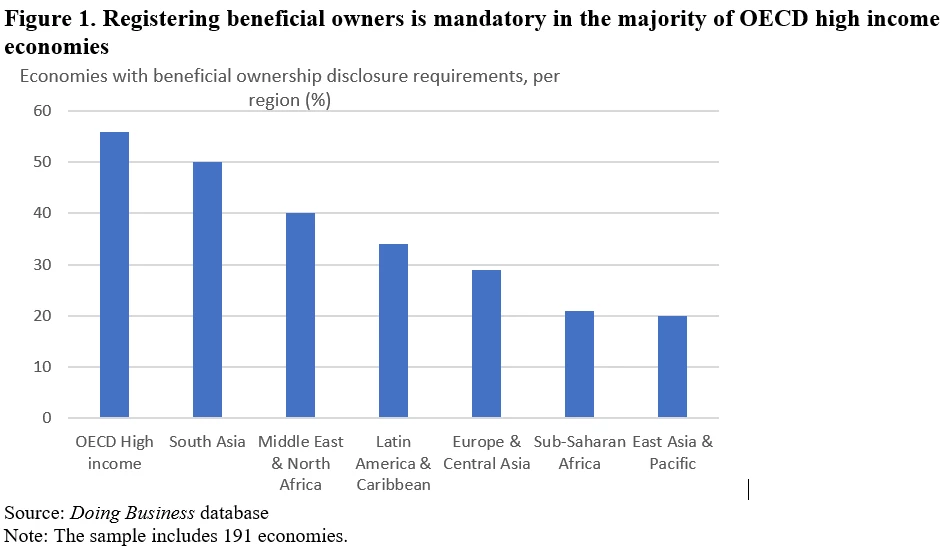

Registering beneficial ownership was mandatory in 64 economies in 2020. This requirement is more common among Organisation for Economic Co-operation and Development high income economies, where more than the majority of countries have adopted it. Only 20% of East Asia and Pacific economies and 21% of Sub-Saharan African countries ask companies to submit information on beneficial owners. Moreover, less than 14% of low-income economies require this disclosure, compared with 51% of high-income economies.

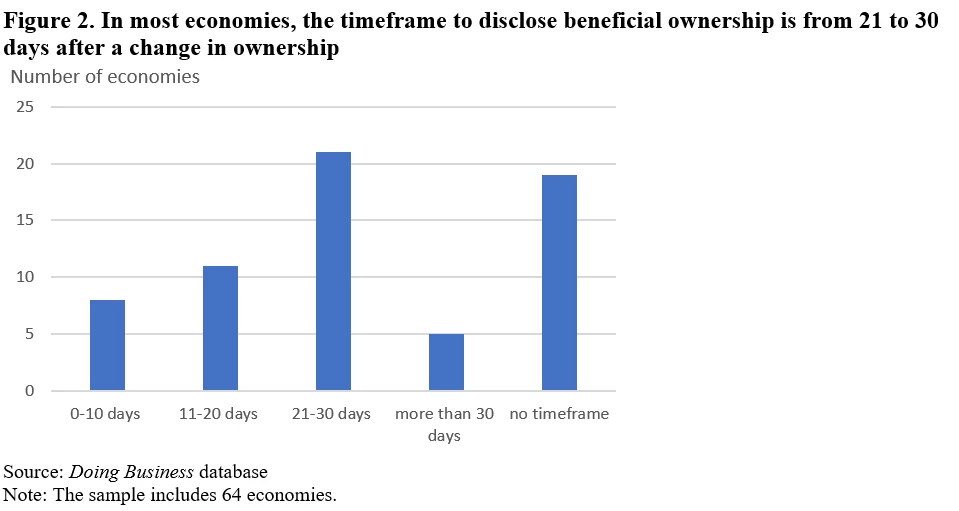

Out of the 64 economies where the declaration is mandatory, 19 economies do not set a time limit for filing information on beneficial ownership. Elsewhere the timeframe varies from five days in Paraguay to one year in Argentina. The median timeframe for disclosing the information is 30 days. In India, beneficial owners must communicate their status within 30 days and companies are responsible for reporting the changes to the Registrar of Companies.

Filing of beneficial owners’ information is free of charge in the majority of economies. However, a few economies charge an administrative fee. For example, in Czech Republic, legal entities that are registered in the commercial registry are subject to an administrative fee of US$ 47. In France, while filing of beneficial owners is done at the same time as registration, an extra fee of US$ 21 is charged for filing with the business registry. In Luxembourg, the notary must pay an Effective Beneficial Owner registration fee of US$ 18. In Sweden, it is compulsory to register beneficial ownership information online using the website of Bolagsverket at a cost of US$30.

Economies implemented beneficial ownership policies in various ways in practice

For entrepreneurs starting a company, beneficial ownership reporting requirements can take various forms.

To make these mandates less cumbersome, many economies have chosen to allow newly formed companies to file beneficial ownership information with the business registry along with their application for business registration. This avoids the need for a second interaction. In Portugal, company shareholders must declare the company's ultimate beneficial owner at the time of its incorporation at the country’s one-stop shop for business registration. In Mauritius, company founders can submit beneficial ownership information directly to the Corporate and Business Registration Department of the Ministry of Finance, Economic Planning and Development at the time of incorporation. In Argentina, companies located in Buenos Aires must submit an affidavit on ultimate beneficial owners while registering their bylaws with the public registry of commerce.

Other economies are requiring separate filings directly with a specific registry. In Belgium, the Ultimate Beneficial Owners (UBO) Register was launched in October 2018 for new companies, and existing companies had until the end of September 2019 to register their UBOs. Slovenia was one of the earliest countries to implement a specific registry and require that all businesses with more than one shareholder or director report actual owners. Newly established companies are required to register directly with the registry of beneficial owners within eight days of incorporation.

In other economies, such as Uruguay, information on beneficial ownership is given to a notary who reports to the Central Bank of Uruguay.

In conclusion, filing information on beneficial owners increases transparency and supports the integrity of the financial sector and law enforcement efforts. Making the beneficial information registration process easy and inexpensive can promote compliance. Adopting streamlined procedures is therefore important for economies as they implement new transparency policies.

Join the Conversation