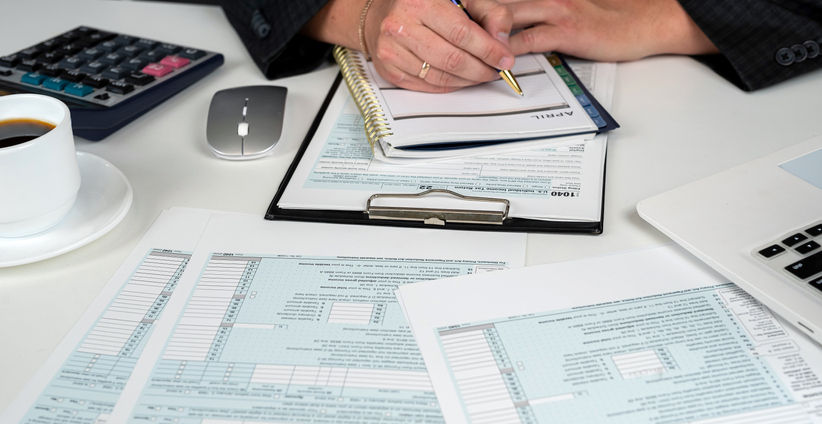

In the United States, taxpayers must file their income tax forms this year before the April 15, 2024 deadline. (In Canada? Check out our Canadian tips.)

While many will choose to use an app or purchase tax software to complete and submit their own tax forms, others are in search of some extra help in the form of a tax return preparation service or a tax consultant.

How do you know when to get help with your taxes?

Significant life changes, business ownership, or simply a lack of knowledge about the ever-changing tax laws can make finding a trustworthy tax preparer a good idea. Just like choosing an expert to put a roof on your home is probably a better idea than tackling it yourself, sometimes it just makes sense to hire a professional.

A professional tax preparer is not only familiar with tax laws and how to file but can also help navigate things like deductions, tax credits, and whether a married couple should file jointly or separately.

In addition, a BBB Accredited tax preparer has agreed to uphold the BBB standards to tell the truth, honor promises and be transparent – and most importantly, when dealing with personal information: to safeguard your privacy.

That said, not all tax preparers have the same level of experience and training. Here are tips for finding someone you can trust with your finances and sensitive personal information.

Which type of tax preparation expert is right for you?

First, it's essential to understand the different types of tax preparers and their qualifications. While all the types listed below can prepare your taxes, only enrolled agents, certified public accountants, and tax attorneys may represent their clients to the IRS on matters such as audits, collection issues, and appeals.

Tax preparers:

Thousands of people work as tax preparers in the United States. Some are full-time workers, and others work part-time or only during the tax season. These preparers must have an active preparer tax identification number (PTIN) through the IRS.

Beyond the PTIN, regulating tax preparers is done at the state level. Check with your state's department of taxation or revenue to learn more.

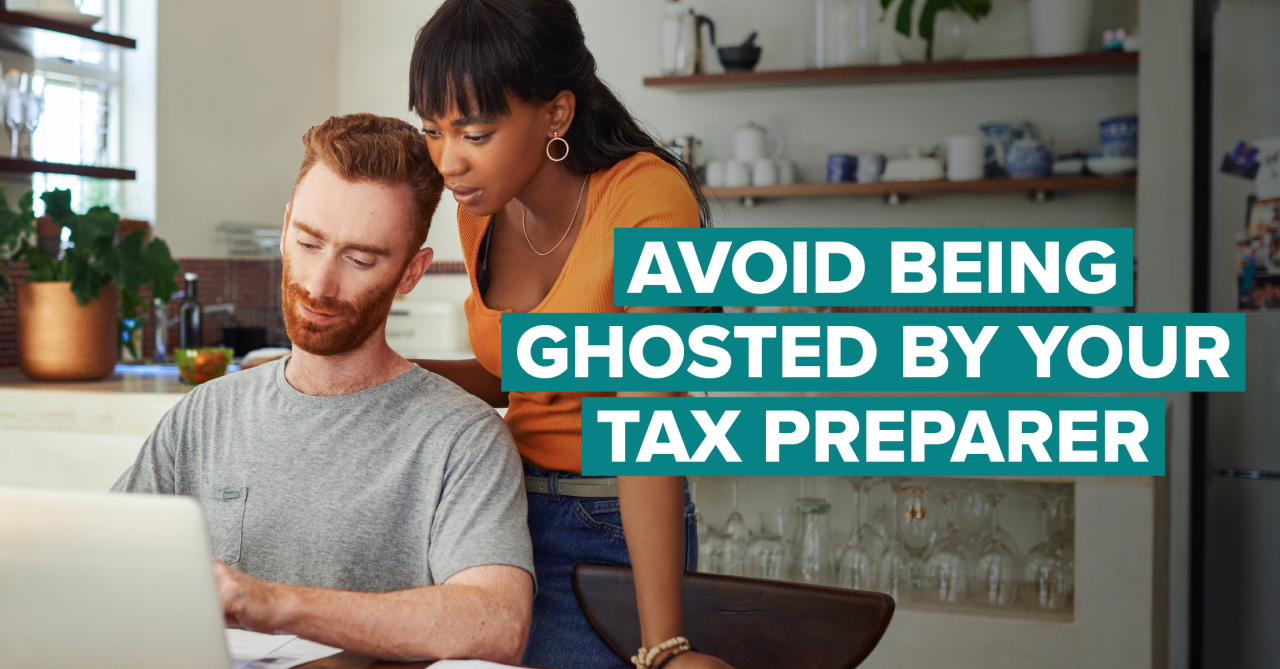

Most tax preparers are legitimate and competent, but keep in mind that without a national license requirement, they may be working off of their research and experience. Because of this, you should conduct a thorough interview with the tax preparer before hiring them.

Read about "ghost tax preparers".

Enrolled Agent (EA):

An EA is a tax preparer approved by the IRS to represent taxpayers. An EA must either have prior qualifying employment with the IRS or pass a comprehensive IRS test on individual and business tax returns. To maintain EA status, they must complete several credit hours of continuing education courses in accounting methods and tax regulations. An EA may work independently or as part of a firm and specialize in specific areas of tax law.

An EA may be a good option if you have a more complex tax situation. However, you'll want to make sure their area of expertise applies to your personal situation. An EA is also qualified to help you with financial planning and give you tips that could help you reduce your taxes in the future.

Find a Tax Enrolled Agent near you. BBB Accredited Enrolled Agents will display the BBB Seal.

Certified Public Accountants (CPA):

CPAs are licensed after passing a state professional qualifying exam. They are highly skilled in accounting. These skills and qualifications make them good candidates for complex tax planning and preparation if they have experience in handling tax matters and they enroll in continuing education programs that keep them abreast of the constant changes to tax laws.

If your return is quite complex, a CPA may be your best choice for tax preparation.

Find a CPA near you – and remember, Look for the Seal: It's the Sign of a Better Business.

Tax attorneys:

A tax attorney helps their clients with legal issues related to taxes. They can represent individuals or businesses. Hiring a tax attorney is a good option for taxpayers looking to shelter part of their income legally or for those needing specialized advice on municipal bonds, estate planning, and the like.

A tax attorney can also represent clients in tax court and draft appropriate legal documents.

If you are looking for a tax attorney near you, check for that BBB Seal.

How to choose the right tax preparer:

Choosing the right kind of tax preparer for you will depend on the complexity of your tax situation. After you've decided what qualifications your tax preparer needs, the following tips will help you choose someone trustworthy and competent:

- Review the tax preparer's credentials. EAs, CPAs, and tax attorneys are qualified to represent their clients to the IRS on all matters. Other preparers can help you with forms and basic matters but cannot represent you in case of an audit. Don't be afraid to ask about these or other qualifications before you hire someone.

- Be wary of spectacular promises. If a tax preparer promises you larger refunds than the competition, this is a red flag. Some tax preparers base their fees on the amount of your return and may be likely to use shady tax preparation tactics. In addition, you might want to avoid tax preparers who offer "refund anticipation loans" as you could lose a large percentage of your return to commission fees. Read the fine print!

- Get referrals from friends and family – and BBB. One of the best ways to find a trustworthy tax preparer is to ask your loved ones for recommendations, and another is to check your Better Business Bureau. Check BBB.org, paying careful attention to other consumers' reviews or complaint details. This research will give you a clear view of what you can expect. Look for that BBB Seal: It's the Sign of a Better BusinessSM.

- Think about availability. If the IRS finds errors in your tax forms or decides to perform an audit, will your tax preparer be available to help you with the details? Find out whether you can contact the tax preparer year-round or only during tax season.

- Ask about fees ahead of time. Before you agree to any services, read the contracts carefully and understand how much the tax preparer charges for their services. Ask about extra fees for e-filing state, federal, and local returns and fees for any unexpected complications.

- If things don't add up, find someone else. If a tax preparer can't verify their credentials, has a record of bad reviews from previous clients, or their business practices don't seem convincing, don't do business with them. Remember that if you hire them, this individual will handle your sensitive personal information – information you need to keep safe from corrupt or fraudulent tax preparers.

Additional tax resources for consumers

For more information

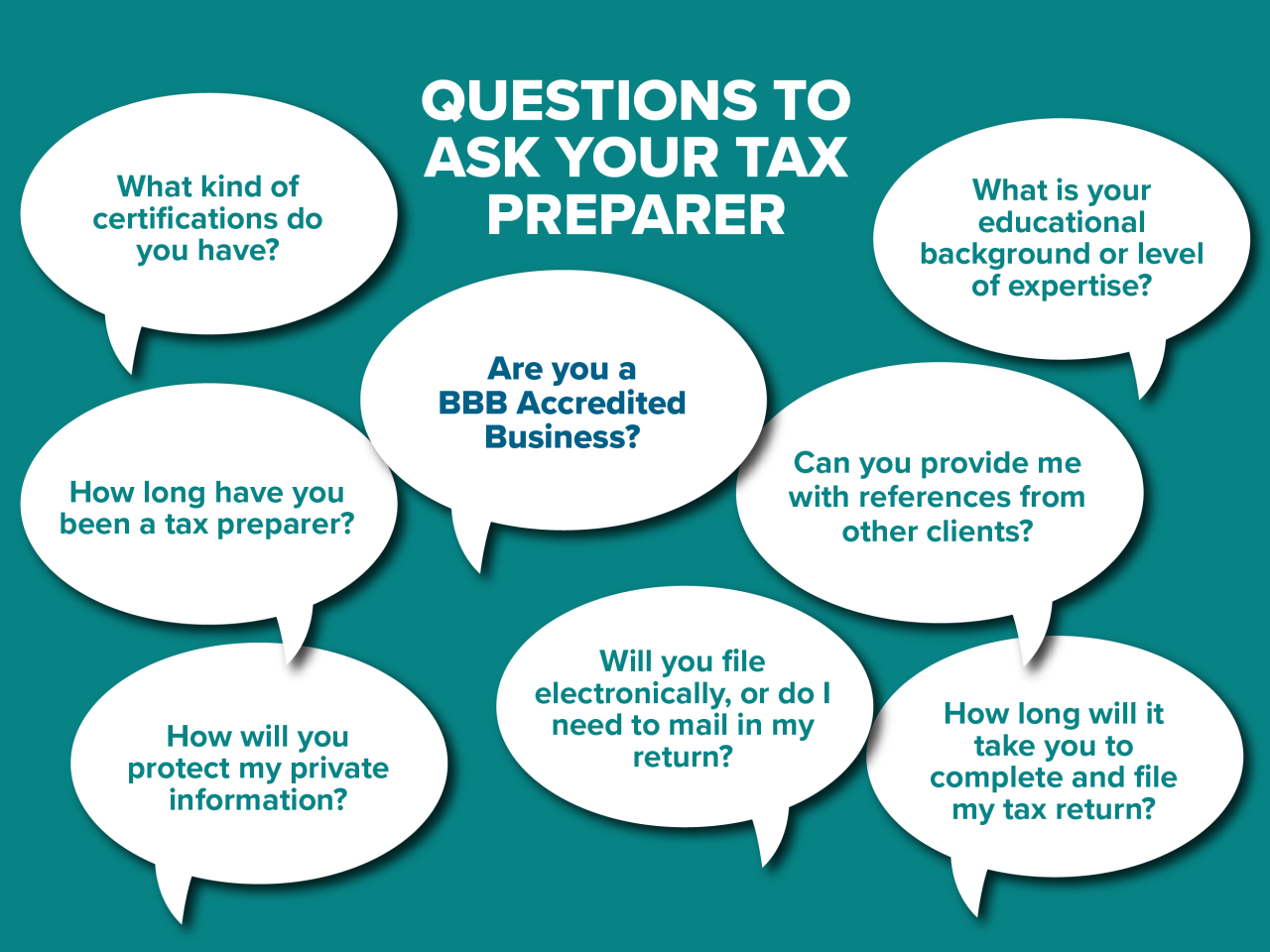

Questions to ask your tax preparer:

How long have you been a tax preparer?

What kind of certifications do you have?

What is your educational background or level of expertise?

Can you provide me with references from other clients?

How long will it take you to complete and file my tax return?

Will you file electronically, or do I need to mail in my return?

How will you protect my private information?

Are you a BBB Accredited Business?