E-Commerce Purchasing Behavior at Independent Auto Repair Shops

In July 2021, IMR interviewed 500 independent automotive repair shops, nationally representative by location in the U.S., to get insights into their use of publicly available websites for parts purchasing (such as Amazon, eBay, JC Whitney, RockAuto.com, etc.), whether use of publicly available websites for parts purchasing has changed over time, if shops plan on increasing or decreasing purchasing parts from these websites, if they compare prices to their regular suppliers and much more.

During the height of the pandemic, 74.7% of independent repair shops reported that they were using publicly available websites (such as Amazon, eBay, JC Whitney, RockAuto.com, etc.) for parts purchases. As of July, 2021, 50.2% of shops reported using publicly available websites as a source for purchases. While usage is still higher than 2019 (36.2%), shops are currently indicating that they do not intend to increase purchasing from this channel.

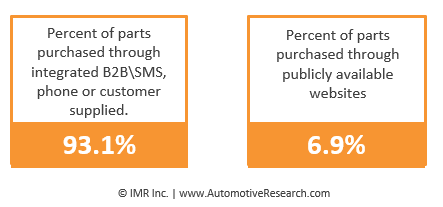

Parts purchasing through publicly available websites is declining as a percentage of the shop’s total purchases as well. In fact, as measured in July, 2021, the percentage of parts purchased from traditional supplier sources has returned to pre-pandemic levels. On average, independent auto repairs shops purchase 6.9% of their parts from publicly available websites, down from 12.0% in 2020. However, smaller shops continue to have a higher propensity to purchase more from publicly available websites.

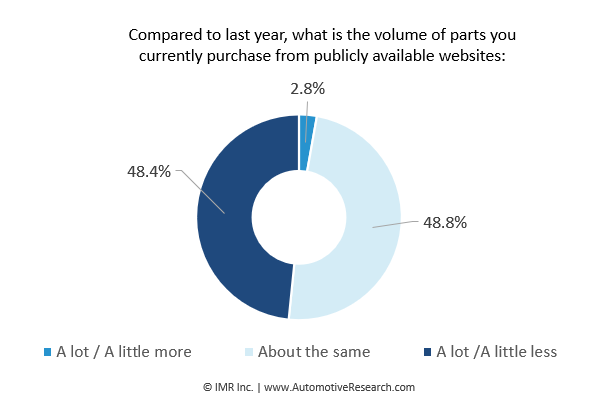

Overall, 48.4% of independent auto repair shops report purchasing ‘a lot less’ or ‘a little less’ from publicly available websites compared to last year. Smaller shops with 1 – 3 bays say they are purchasing about the same volume as last year (76.3%) while 54.0% of shops with 4+ bays say they are purchasing ‘a lot less’ or ‘a little less’.

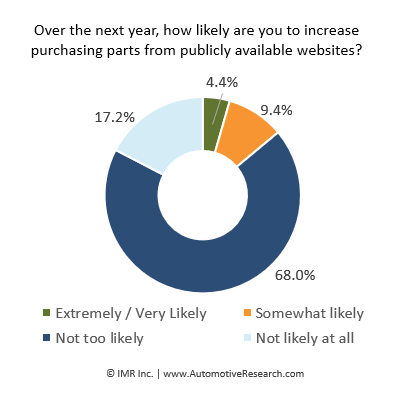

Over the next year, 86.2% of shops say they are ‘not too likely’ or are ‘not likely at all’ to increase parts purchasing from publicly available websites while few shops (13.8%) expect the frequency of their purchases from publicly available websites to increase at some level.

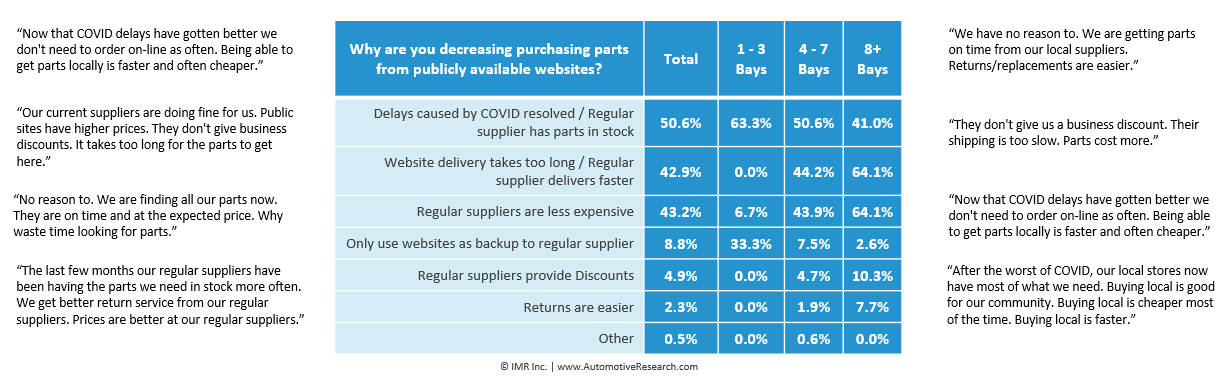

When asked why they intend to decrease purchases from publicly available websites, 50.6% say the delays caused by COVID have been resolved\suppliers have the parts in stock; delivery from publicly available websites takes too long\regular suppliers deliver faster (42.9%) and, lastly, 43.2% say their regular suppliers are less expensive. Shops with 4 – 7 bays and 8+ bays overwhelmingly comment that their regular suppliers deliver faster and are less expensive.

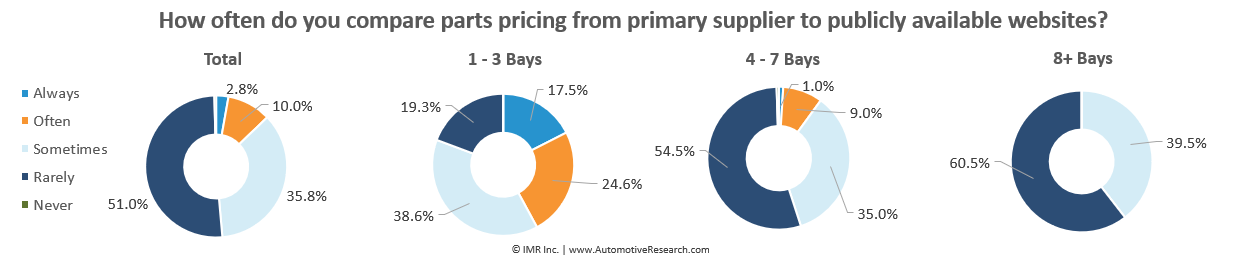

Most shops (51%) rarely compare prices from their regular suppliers to publicly available websites while 12.8% ‘always’ or ‘often’ compare prices. Smaller shops, with 1 – 3 bays, have a much higher likelihood to ‘always’ or ‘often’ compare parts prices (42.1%).

Learn More About IMR’s Continuing Consumer Automotive Maintenance Survey (CCAMS)

Interested in automotive market research?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.If you enjoyed this article, please check out some additional posts

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Challenges for Independent Repair Shops and Technicians in 2020

Cell Phone Usage in Bays at Independent Repair Shops

The Hispanic DIY Auto Maintenance & Repair Consumer