Marcum's 2024 National Construction Survey

Discover the future of the construction sector in our country.

Every year, Marcum surveys the national construction industry. The results reveal key trends in the construction industry today – including some of the biggest issues keeping construction executives up at night – and provide valuable benchmarking for your practice.

2023 marks a deeply interesting and complex time for construction as the industry responds to economic transformation. Despite the very real challenges presented by inflation and higher rates, survey respondents demonstrate resilience as backlogs are still up and supply chains and material costs are stabilizing. However, many factors, including the skilled labor shortage, still threaten the industry in a highly competitive landscape.

Labor Shortages

Despite the one-two punch of inflation and high interest rates slowing the economy, most construction companies continue to struggle to find and retain skilled labor. Meeting labor needs often takes a bit of creative thinking that goes well beyond simply adding to your headcount, incurring the time and expense of training, or increasing wages.

Did You Know?

As labor costs increase and skilled labor becomes a precious commodity, construction companies are attacking the problem with multiple tactics, starting with compensation. A whopping 93% of respondents have increased pay. Of those increasing pay, 72% offered raises of 4% or higher, and 15% increased compensation by more than 8%.

For more information on how contractors are compensating workers, check out our PAS Contractor Compensation Quarterly.

The Competitive Landscape

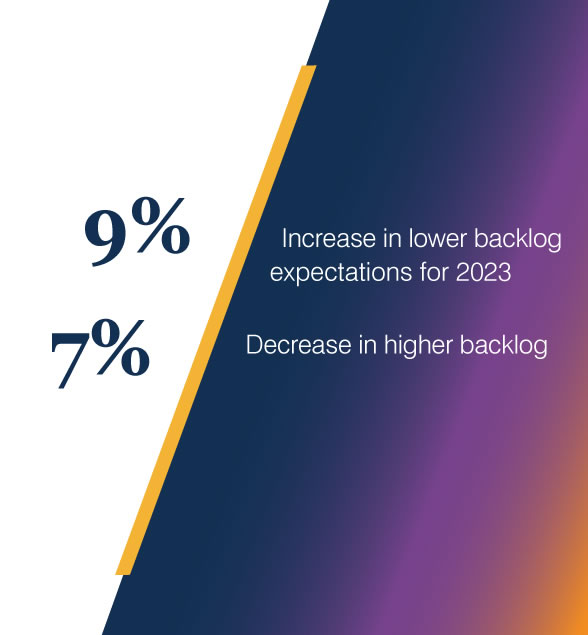

Though there is a lot of turmoil in the markets and some ominous signs ahead, the construction industry is still riding a historically strong wave, and perhaps the best illustration of that is backlogs, which are declining but remain very healthy overall. The amount of work out there is evident in how respondents viewed their backlog situation. While 23% expected lower backlogs in the coming year in 2022, that total only increased to 32% this year. And those expecting a higher backlog went from 48% last year to a still robust 41% this year.

“Many are taking fewer risks and being more selective when bidding on projects, as evidenced by a clear reduction in the number of job bidders for projects respondents bid on.”

Economic Transformation

While economic growth drives construction, most construction is really in response to economic transformation. The good news is that we are entering a period of incredible transformation right now. The healthcare revolution, alternative energy, onshoring, housing needs, and the opportunity for reusing offices are all strong growth areas. Whatever the future holds, we’ll have to build for it.

“Growth opportunities currently exist if we can get enough labor to go after the opportunities.”

Interest Rates and Inflation

For the first time this year, we specifically asked how companies were handling the dual threat of rising inflation and rising rates. Half of the respondents expect projects to be delayed or canceled, more than half anticipate difficulty in passing expenses on to customers, and large percentages delaying equipment purchases, lowering overhead spending, and expecting fewer projects to bid on.

Although inflation is not rising at the breakneck pace it was last year, it also remains a concern, with similar percentages of respondents anticipating fundamental problems like 59% worried about being unable to pass costs on to customers and the 55% concerned about delayed or canceled projects due to inflation. Inflation is clearly not fully tamed yet.

Insights & News

Marcum Construction Newsletters

Contacts

Select the region to view contacts.