April 2024 Results

Small business optimism in Canada

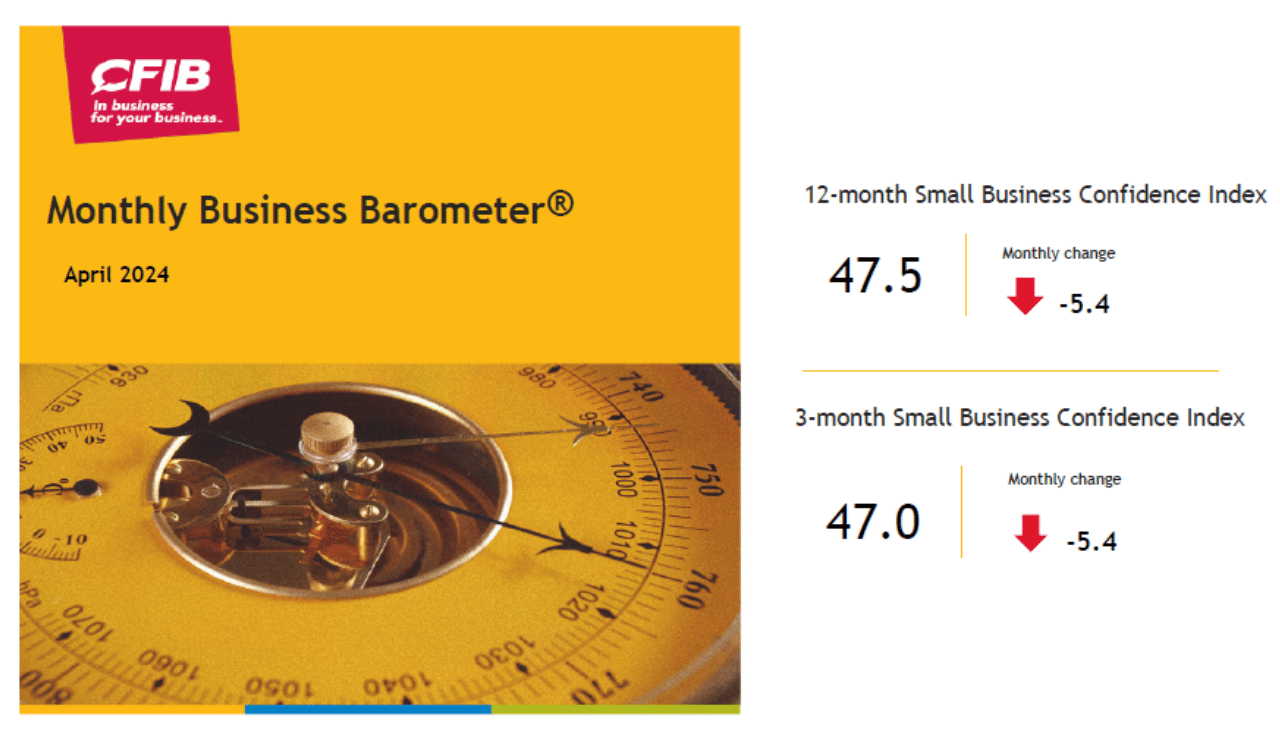

CFIB’s Business Barometer® long-term index, which is based on 12-month forward expectations for business performance, has seen a sharp drop in April, to reach 47.5. The short-term optimism index, based on a 3-month outlook, also lost five points, and reached 47.0. Both indexes are at about the same levels as they were at the beginning of the year.

12-month and 3-month small business confidence index, Canada

Provincial picture

The drop in long-term confidence touched most provinces also. Saskatchewan (-7.0) and Ontario (-6.7) have seen the most severe declines, and both settled just below 50 at 49.2 and 47.6 respectively. The two largest provinces, Ontario and Quebec, are sitting at historically low levels and below the 50-mark casting a glooming light on the Canadian economy overall.

Sectoral picture

The sectoral monthly changes are more mixed. Some sectors have registered modest gains (such as professional services +2 points, manufacturing +1.9 points) while others have seen decreases (health and education -5.5, agriculture -3.9, and construction -2.4).

Inflation indicators

For the first time since May 2022, the average price increase indicator gained abruptly (+0.5 points) and reached 3.2. This breaks the series of gradual decreases or minor gains and jumps above the upper limit of the inflation range of 3.0.

Average wage increase plans for the next 12 months also increased from 2.5 in March to 2.9 currently.

Future price and wage increase plans

Demand indicators

Slightly more business owners report insufficient domestic/foreign demand as main limitation on sales or production growth 52%.

Main costs on business

The share of businesses citing insurance costs as a challenge has increased even more (72%)– a new record for this indicator. Wage costs (68%) had seen a sharp increase also, most likely on the heals of many provinces increasing the minimum wage costs on April 1st.

Factors limiting sales or production growth - current levels and trend, April 2024

Major input cost constraints - current levels and trend, April 2024

Methodology

April findings are based on 657 responses from a stratified random sample of CFIB members to a controlled-access web survey. Data reflect responses received from April 2 to the 17. Findings are statistically accurate to +/- 3.8 per cent 19 times in 20. Every new month, the entire series of indicators is recalculated for the previous month to include all survey responses received in that previous month. Measured on a scale between 0 and 100, an index above 50 means owners expecting their business’s performance to be stronger over the next three or 12 months outnumber those expecting weaker performance. An index level near 65 normally indicates that the economy is growing at its potential.

The next Business Barometer will be released on May 30, 2024.

Andreea Bourgeois, Director of Economics

Simon Gaudreault, Vice-President, Research and Chief Economist

Related Documents

| Release Date | Report | Download |

|---|---|---|

| April 2024 | Business Barometer® National Summary |

PDF (2.7 MB) |

| April 2024 | Business Barometer® Provincial Summaries |

PDF (1.3 MB) |

| April 2024 | Business Barometer® Industry Summaries |

PDF (1.5 MB) |

| April 2024 | Business Barometer® Data Table |

Excel (550 KB) |

| January 2024 | Current Survey |

PDF (603 KB) |

| April 2020 | Survey - before 2024 |

PDF (804 KB) |

Share Article

Share Article

Print Article

Print Article