NetZero Pathfinders Africa

Scaling-Up Renewable Energy in Africa

A NetZero Pathfinders report

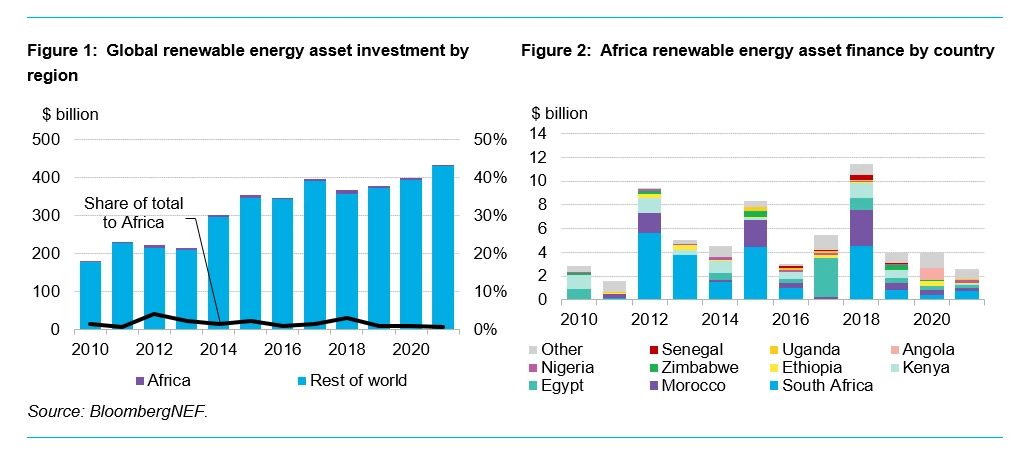

The ongoing global transition from high to low carbon emitting sources of energy has the potential to transform Africa: mass deployment of new, low-cost clean technologies should trigger billions in investment, expand energy access to millions, and help mitigate the worst effects of climate change. Despite the continent’s abundant natural resources that make clean power the least-cost option today, it has reaped limited benefits from the energy transition. In fact, in 2021, Africa’s clean energy investment fell to its the lowest level since 2011 – of the $434 billion invested globally to build wind, solar, and other clean power projects, only 0.6% or $2.6 billion, went to Africa.

The spotlight on Africa at COP27 in Egypt offers an opportunity to take stock of how far the continent’s energy transition has advanced – and how much work remains to be done. In answer to this, several questions arise: What practical solutions could shift investment trends while ensuring a just and equitable transition for Africans? What policy infrastructure- and finance-related barriers have artificially inflated local clean technology costs and slowed deployment? Most importantly, how can these obstacles be overcome?

This report, jointly produced by BloombergNEF and Bloomberg Philanthropies, as part of the broader Bloomberg NetZero Pathfinders initiative, discusses the state of the energy transition in Africa, the key barriers that limit investment flows, and highlights solutions that have been implemented in other emerging markets to address similar challenges. The key barriers were identified based on BloombergNEF’s survey of investors, developers, policy makers, and other stakeholders in 42 African nations during the first half of 2022. Bloomberg and Pathfinders encourage the input of all stakeholders and invite feedback on this report. To share measures that have successfully worked in your region, please contact us.

Key Highlights

0.6% Share of total global renewable energy investment in Africa in 2021

1.3% Share of total global solar capacity in Africa in 2021

36 Number of African countries with renewable energy targets out of 42 analyzed by BNEF

Key findings

- Clean energy investment in Africa reached the lowest level since 2011. Renewable energy power-generating assets attracted $434 billion worldwide in 2021, but just 0.6% of that ($2.6 billion) went to African nations.

- Investment is highly concentrated in a handful of markets. South Africa, Egypt, Morocco, and Kenya have since 2010 accounted for nearly three-quarters of all renewable energy asset investment, at $46 billion. All others have secured just $16 billion over that time.

- Over half of Sub-Saharan Africa still lacks access to electricity. In 2020, barely half of the population in Sub-Saharan Africa had reliable electricity service, according to The World Bank. That trailed far behind the Middle East & North Africa region at 97.4%, Latin America and the Caribbean (98.5%) and South Asia (95.8%).

- Clean energy investment in Africa reached the lowest level since 2011. Renewable energy power-generating assets attracted $434 billion worldwide in 2021, but just 0.6% of that ($2.6 billion) went to African nations.

- Investment is highly concentrated in a handful of markets. South Africa, Egypt, Morocco, and Kenya have since 2010 accounted for nearly three-quarters of all renewable energy asset investment, at $46 billion. All others have secured just $16 billion over that time.

- Over half of Sub-Saharan Africa still lacks access to electricity. In 2020, barely half of the population in Sub-Saharan Africa had reliable electricity service, according to The World Bank. That trailed far behind the Middle East & North Africa region at 97.4%, Latin America and the Caribbean (98.5%) and South Asia (95.8%).

- Electricity supply growth has slowed. The rate of new electricity generating projects added to Africa’s grids has slowed since 2018. Year-on-year installed capacity growth averaged 6.6% annually from 2011 to 2018, but only 3.8% over 2019-2021.

- Fossil fuels meet three quarters of Africa electricity demand. Gas, coal and oil accounted for 75% of electricity produced in Africa in 2021. Gas was 41%and coal 27%. Hydro continues to play an important role, accounting for 18% of output. Wind and solar are a combined 5%.

- High fossil fuel prices are straining national government budgets. Africa’s dependence on gas- and coal-fired electricity puts the continent at risk of economic shock when commodity prices fluctuate. At least 28 countries meet at least half of their power demand with fossil fuels, of which 16 rely on fossils for 80% or more of their power.

- Africa has abundant solar energy potential but is home to just 1.3% of global solar capacity. Existing capacity is 13GW or 5.5% of Africa’s total. South Africa, Egypt and Morocco account for two thirds of the solar capacity.

- Despite the small numbers, solar usage is increasing. In 2021, as many as 24 countries installed at least 1MW of solar – a new high following five years of stagnation. Solar was also the top technology for new capacity added in 11 countries in the region in 2021. The modular nature of PV, along with steep equipment price declines over a decade helped drive the technology’s deployment.

- Inadequate policies and enforcement are limiting investment opportunities. The share of African nations with long-term clean power targets in force jumped to 86% in 2022 from 57% in 2019, but the implementation of enforcement mechanisms to ensure the goals are met has been weak.

- Half of the countries have policies to hold reverse auctions for clean power delivery contracts, but far fewer have successfully held tenders. Net metering policies, which allow owners of distributed solar systems to be compensated for excess generation they feed back into the grid, are on the books in 29% of African nations.

- Most African governments have energy access targets in force. Access strategies generally prioritize grid expansion, with 64% of countries either placing high or medium priority on this. However, expanding grids to reach the entire population is often not viable. More than half of African countries have rural electrification initiatives that also rely on “offgrid” measures such as deploying mini-grids, or solar home systems.

- Three barriers that limit clean energy deployment are common to many African nations: (1) lack of consistent clean power procurement practices, (2) poor planning around electricity access and grid expansion efforts and (3) lack of knowledge of clean energy opportunities from domestic investors. Addressing these could unlock significant renewable energy investment flows.

- Consistent clean power procurement processes signal investors and developers to build project pipelines. Although demand for electricity is growing rapidly in Africa, government-organized efforts to ensure that the rising demand is met with the proper volumes of supply have been sporadic. Auctions and tenders have been the most successful procurement mechanism around the world, but contracts signed in Africa only represent 4% of the global total.

- Improving on- and off-grid infrastructure is key to delivering reliable, cost-effective, low-carbon electricity. Thoughtful, clearly communicated grid planning is key but just a third of African nations have transparent grid extension plans in force.

- Local capital providers can do more. Africa-based lenders and investors can play a fundamental role in scaling on-grid and off-grid renewables deployment. National commercial and development banks, for example, can offer in-depth knowledge of local clean energy sectors that foreign investors may lack; they have unique connections to local communities. Domestic financiers can also serve as intermediaries between international sources of capital and local projects or communities. Many local institutions still lack knowledge of the risks associated with clean technologies, but this could change through greater outreach efforts.

Access the full report here.