ESG assets may hit $53 trillion by 2025, a third of global AUM

This analysis is by Bloomberg Intelligence Head of ESG and Thematic Investing EMEA Adeline Diab and BI Chief Equity Strategist Gina Martin Adams. It appeared first on the Bloomberg Terminal.

Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management. A perfect storm created by the pandemic and the green recovery in the U.S., EU and China will likely reveal how ESG can help assess a new set of financial risks and harness capital markets.

No niche at $50 trillion in ESG assets

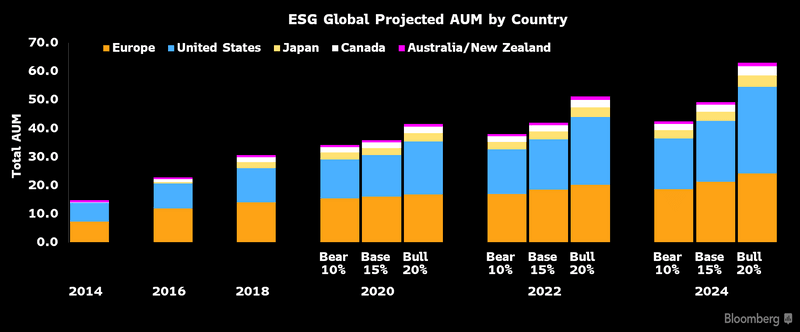

Assuming 15% growth, half the pace of the past five years, ESG assets under management could climb to more than a third of the projected $140.5 trillion global total by 2025. ESG assets are on track to reach $53 trillion, based on our analysis, up from $37.8 trillion by year-end. They jumped to $30.6 trillion in 2018 from $22.8 trillion in 2016.

While Europe accounts for half of global ESG assets, the U.S. has the strongest expansion this year and may dominate the category starting in 2022. The next wave of growth could come from Asia — particularly Japan. Exclusionary screening based on religious values and other criteria makes up the biggest chunk of ESG investing, at about $20 trillion globally in 2018, according to McKinsey and the Global Sustainable Investment Alliance.

ESG projected global AUM

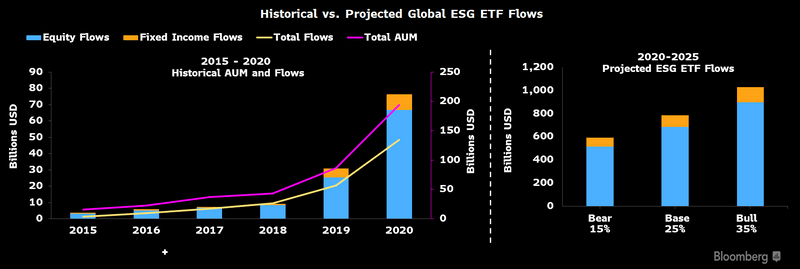

ETFs set for $1 trillion ESG organic growth

ESG exchange-traded funds’ cumulative inflows should surpass $135 billion before 2021, and we expect growth to accelerate, with $1 trillion possibly entering such ETFs globally in the next five years. Of the $203 billion in 2020 ESG fund inflows through 3Q, about $49 billion — or 24% — went into ETFs. The pace isn’t slowing, with investments in ESG ETFs expanding for a 27th straight week and November inflows reaching a monthly record of $13 billion.

ESG ETF assets should surpass $190 billion by year-end and account for almost 13% of global ETF asset growth. Though Europe has dominated ESG ETFs, U.S. products may bring the next wave of organic expansion. As of September, the U.S. ESG ETF market had risen over 318% in 2020 and captured 90% of smart-beta flows.

Trending up for ESG

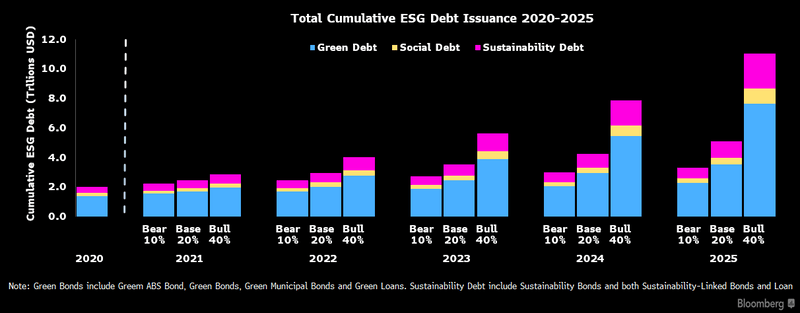

Debt may be $11 trillion ESG opportunity

The $2.2 trillion ESG debt market could swell to $11 trillion by 2025, assuming it expands at half the pace of the past five years. Green, social and sustainability bonds are poised to surpass $2 trillion in cumulative volume by the end of 2020, a milestone reached with this year’s meteoric rise of social bonds.

Organic growth in ESG debt is unlikely to slow — driven by companies, development projects and central banks — with pandemic and green-recovery efforts helping to scale up the market in the short term. EU pledges of 100 billion euros to support employment and 225 billion euros to fund a post-pandemic recovery, U.S. President-elect Joe Biden’s $2 trillion energy strategy and the challenge of China’s 2023 green-debt maturities all signal ample room for new issuance.

ESG debt issuance 2020-25 forecast

European ESG gold rush should spread globally

Europe’s ESG fund growth may serve as a barometer for what to expect globally. The region’s ESG mutual funds and ETFs hit the $1.1 trillion milestone in 2020, accounting for almost 10% of total European fund assets, according to Morningstar. Growth was spurred by both client demand and an unprecedented level of product development, with 330 ESG funds launched during the year through 3Q — more than 100 a quarter.

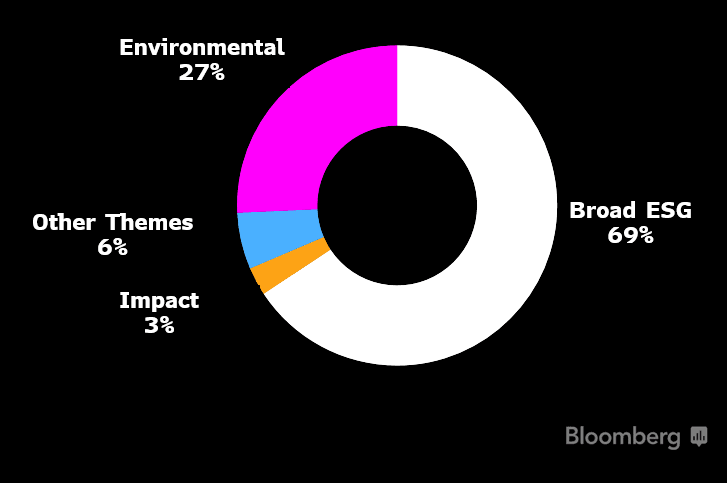

We expect accelerated growth as ESG extends across asset classes and themes. While equities dominate product development, credit represents 20% of new ESG funds. In equity, we see a diversification into thematic products. Climate remains king, accounting for about 25% of ESG funds launched in 2020.

European 3Q sustainable funds launch per theme