AGA Gaming CEO Outlook

Gaming Industry Outlook: Gaming Sector Expansion Continues, With Future Sentiment Firming

U.S. gaming industry growth continued during the first quarter of 2024 at a pace of expansion that is slower but more sustainable than in prior years, according to the AGA Gaming Industry Outlook.

The Gaming Industry Outlook provides a snapshot of the current and future economic health of the industry based on executive sentiment, casino-visitation plans, gaming revenue and economic indicators. The Outlook includes two separate indices:

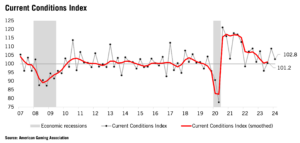

- The Current Conditions Index for Q1 2024 was 102.8, which is consistent with real annualized growth of 2.8 percent. The Current Conditions Index measures real economic activity in the industry, as measured by gaming revenue, employment and employee wages and salaries.

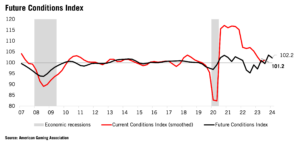

- The Future Conditions Index, a leading indicator of changes in industry conditions, measured 102.2 in Q1. This indicates an environment in which real economic activity in the gaming sector, after controlling for underlying inflation, is expected to moderately increase over the next six months (2.2% annualized rate).

The Future Conditions Index reflects gaming CEO growth expectations that remain positive: Executives’ views on current conditions have moderated somewhat while the outlook for future conditions marginally improved. Additionally, the Index accounts for an economy that has proven more resilient than anticipated, but which is expected to slow moderately through the year.

Index Highlights

The Current Conditions Index indicates that real economic activity in the industry, as measured by gaming revenue, employment and employee wages and salaries, slowed during 2023 relative to 2022 and 2021. With that said, the Index remained positive, with recent readings for Q4 2023 and Q1 2024 showing solid industry growth. The Current Conditions Index for Q1 2024 was 102.8, which is consistent with real annualized growth of 2.8 percent, follows a strong 108.8 index reading for Q4 2023 (consistent with 8.8 percent annualized growth). Because gaming revenue and employee wages are adjusted for inflation, the Current Conditions index was tempered by still-high inflation through Q1 2024.

The smoothed version of the Current Conditions Index, which is reported with a two-quarter lag and is less impacted by short-term fluctuations, stood at 101.2 in Q3 2023 (three-quarter weighted average). This indicates that industry activity has been expanding in recent quarters at an annualized pace of 1.2 percent, representing sustained real growth even when controlling for the effects of inflation.

Growth expectations of Gaming CEOs are about even compared to six months ago, according to the Gaming Executive Panel, a major input in the Future Conditions Index. In aggregate, across a set of outlook questions, the share of positive responses on measures such as future business conditions outweighed negative responses by 6.3 percentage points this quarter, compared to 6.4 percentage points in Q3 2023.

The Future Conditions Index also reflects the current Oxford Economics forecast that U.S. economic growth will slow during 2024 but will avoid tipping into recession. Higher interest rates represent a drag on consumers and businesses, but inflation is anticipated to resume its decline, and with labor markets still strong, gains in real disposable income are expected to support ongoing growth in consumer spending. This outlook is more optimistic than six months ago, as economic activity has proven more resilient than anticipated. It expects an improved level of household net worth relative to the prior forecast and only a slight increase in the unemployment rate by the end of the year. Inflation, as measured by the PCE price index, is expected to slow moderately to 2.4 percent year-over-year by the fourth quarter of 2024. The share of consumers that expect to visit a casino over the next 12 months remains solid, though it is slightly lower than it was a year ago.

The Future Conditions Index provides a leading indicator of changes in industry conditions. The 102.2 reading on the Future Conditions Index in the first quarter indicates an environment in which real economic activity in the gaming sector, after controlling for underlying inflation, is expected to moderately increase over the next six months (2.2% annualized rate).

Gaming Executive Panel Highlights

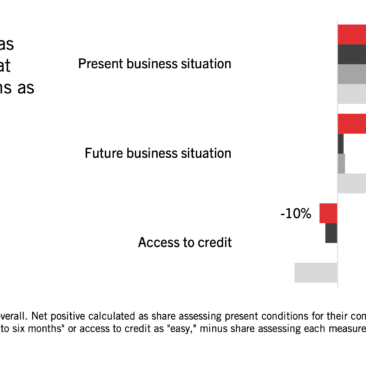

Gaming executives have a slightly more positive outlook, with nine-in-ten executives expecting the next three to six months to be better (32%) or the same (58%), compared to eight-in-ten last fall. Overall, almost all respondents characterize the current business situation as good (44%) or satisfactory (50%).

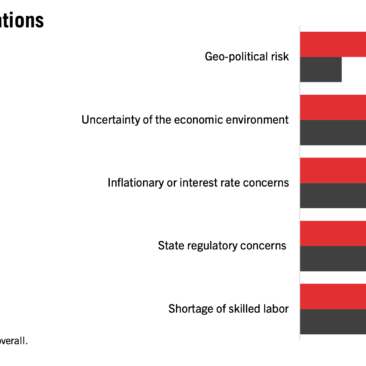

Financial conditions continue to remain restrictive. Despite a declining share of gaming executives describing access to credit as tight (19%) compared to the previous survey (26%), few executives report access to credit as easy (10%). Inflationary or interest rate concerns continue to be a major factor limiting operations (28%), but these have been overtaken by geo-political risk (34%) and uncertainty of the economic environment (34%) as the biggest limiting factors in the most recent survey.

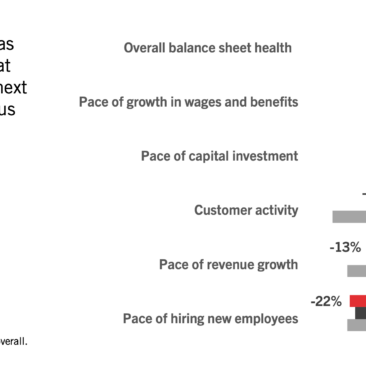

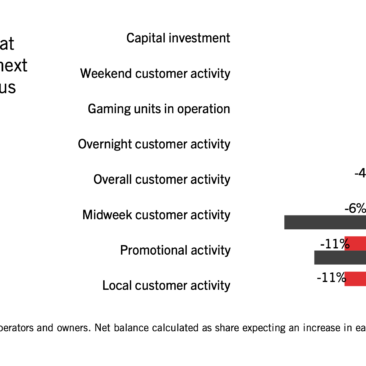

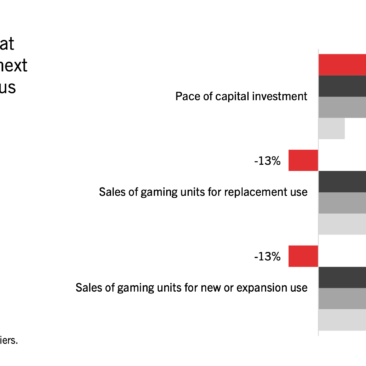

Gaming executives have become more positive in their views that overall balance sheet health will improve (42% net positive), but they expect the pace of revenue growth (13% net negative) and new hiring (22% net negative) to slow. These expectations for decelerating growth have reduced expectations for increases in capital investment and gaming units in operation with smaller net positive sentiments than before.

Gaming equipment suppliers have turned slightly pessimistic about the sale of gaming units for replacement use (13% net negative) and new or expansion use (13% net negative), in contrast to net positive views in the prior survey. However, they remain optimistic about the pace of capital investment (38% net positive).

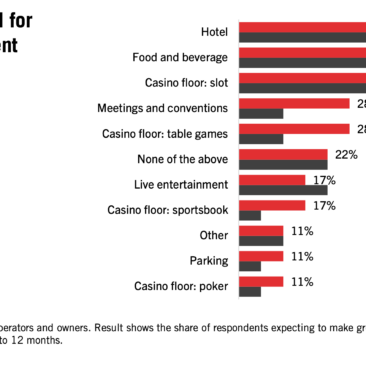

Hotel investment has risen as a priority area for investment in the coming year among half of executives, while 44 percent of respondents state food and beverage investment will be targeted – a decline from two-thirds in the prior survey.

Detailed Findings

Background & Methodology

The Gaming Industry Outlook Index is prepared on the behalf of the American Gaming Association by Oxford Economics. It provides a timely measure of recent growth and future expectations. This is the sixth release of the index.

Current Conditions Index:

- The Current Conditions Index measures activity in the U.S. casino gaming industry during the most recent quarter. It is based on three components: gaming revenue, employment and wages and salaries. Each component is adjusted to control for seasonal patterns and monetary measures are adjusted for inflation. Data is estimated through the most recent quarter for each index component based on available monthly data as of the point of index calculation. The index is re-estimated as additional information becomes available for past quarters.

- The Current Conditions Index reflects the composite growth of the three components, on an annualized basis. Index values above 100 indicate activity expanded during the quarter, while index values below 100 indicate a contraction. Index values are scaled to be consistent with annualized growth. For example, an index value of 103 is consistent with a 3 percent annualized pace of growth. The index controls for typical seasonal patterns, and index values may be directly compared to the pace of change in previous periods.

- When shown graphically, the Current Conditions Index compresses the most extreme values (index values below 80 or above 120). Individual observations are shown as well as a smoothed series, similar to a moving average, to help convey shifts in industry conditions.

Future Conditions Index:

- The Future Conditions Index measures the expected direction of conditions in the U.S. casino gaming industry over the coming six months. It is based on the following three components: economic conditions (measured as Oxford Economics’ forecast for growth in personal disposable income, household net worth and consumer spending on services), consumer intentions to visit a casino in the future, and the aggregate sentiment expressed in the Gaming Executive Panel. The Future Conditions Index is scaled so that index values correspond to the expected growth rate in industry conditions as measured by the Current Conditions Index. For example, an index value of 103 is consistent with a 3 percent annualized pace of expected growth.

- The economic conditions measure is based on Oxford Economics’ forecast of growth in real disposable income, household net worth, and consumer spending on services. The components of the index were selected based on the contribution each indicator makes to predicting future movements in the Current Conditions Index. Casino executive sentiment is measured through the aggregate measure of positive responses minus negative responses across a set of survey questions.

-

- For example, one of the survey questions included in this aggregate is the pace of hiring new employees. The net positive response for that question is calculated as the share of responses that expect an increase in the pace of hiring new employees over the next three to six months, minus the share that expect a decrease in hiring. This net positive response is averaged with responses to a selected set of other survey questions (e.g., pace of revenue growth, pace of growth in wages and benefits, expectations of future business conditions) to calculate the average net positive response as a measure of casino executive sentiment.

- The Future Conditions Index is based in part on Oxford Economics’ outlook for the economy:

- U.S. economic growth will slow during 2024 but will avoid tipping into recession. Higher interest rates represent a drag on consumers and businesses, but inflation is anticipated to resume its decline, and with labor markets still strong, gains in real disposable income are expected to support ongoing growth in consumer spending. This outlook is more optimistic than six months ago, as economic activity has proven more resilient than anticipated. It expects an improved level of household net worth relative to the prior forecast and only a slight increase in the unemployment rate by the end of the year. Inflation, as measured by the PCE price index, is expected to slow to 2.4 percent year-over-year by the fourth quarter of 2024.

- Each of the economic drivers in the Future Conditions Index (disposable income growth, household net worth and consumer spending) are expected to show positive growth in real terms, though growth in the second half of the year is expected to be weaker.

Gaming Executive Panel

- The Gaming Executive Panel consists of senior-level AGA member executives selected to represent the breadth of the casino gaming sector. Respondents were segmented across three primary categories: casino operators and owners, gaming equipment suppliers and iGaming and/or sportsbook operators.

- The Q1 2024 survey was conducted between March 28 and April 10, 2024. A total of 32 executives responded, including executives at the major international and domestic gaming companies, tribal gaming operators, single unit casino operators, major gaming equipment suppliers and major iGaming and/or sports betting operators.