Low-Carbon Hydrogen Market Size, Trends, Country Analysis, Production Process, Cost by Technology, Key Players and Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insight from the ‘Low-Carbon Hydrogen Market’ report can help you:

- Facilitate decision-making by providing trend analysis in the low-carbon hydrogen market.

- Develop business strategies by understanding the drivers and challenges of the market.

- Position yourself to gain the maximum advantage of the industry’s growth potential.

- Maximize potential in the growth of the low-carbon hydrogen market

- Identify key partners, geographies, and business-development avenues.

- Analyze the key end-users, market size, growth, demand, as well as the cost of production by technology.

- Anticipate expected changes and the key trends shaping the market and adjust your business development strategies.

How is the ‘Low-Carbon Hydrogen Market’ report different from other reports in the market?

- The report provides an in-depth qualitative analysis of the macroeconomic, technology, and regulatory trends shaping the industry.

- It offers a quantitative analysis of the key segments in the low-carbon hydrogen industry.

- The report provides data and analysis on low-carbon hydrogen production and technology, electrolyser capacity, policy, low carbon hydrogen scenario, major active and upcoming plants, and market drivers and challenges.

- It provides a detailed analysis of the end-users (refining, chemicals, steel, power generation, transportation, and buildings).

- The report will give you a deeper understanding of the potential regions (Europe, Americas, and APAC) as well as target countries such as the US, Germany, Canada, France, Spain, Portugal, China, Japan, India, South Korea, and Australia.

- It provides a list of the projects, deals, and milestones.

- The report offers a list of major companies, major participants in the low-carbon hydrogen value chain, as well as company profiles.

We recommend this valuable source of information to anyone involved in:

- Hydrogen Project Owners and Developers

- Fuel Cell Manufacturers

- EPC Contractors Focused on Hydrogen projects

- Electrolyzer Manufacturers

To get a snapshot of the low-carbon hydrogen market report, download a free report sample

Low carbon Hydrogen Market Overview

Hydrogen is mainly used in oil refining and the production of fertilizers. The demand for hydrogen in industrial applications has more than tripled since 1975 and the demand is also increasing in meeting the climate change targets of different countries. Countries such as the US, Canada, the Netherlands, the UK, and Australia are making substantial investments in hydrogen technology. Hydrogen has ample possibilities in steel, iron, cement manufacturing and other industries. Hydrogen also has potential applications in fuel cell trucks and cars and shipping and aviation. Already, cars such as the Toyota Mirai and the Hyundai ix35 are powered by hydrogen fuel cells.

| Market Size (2022) | 1,698 ktpa |

| Key Processes | Steam Methane Reforming (SMR), Autothermal Reforming Biomass Reforming, Electrolysis, Photo Electric Chemical (PEC) Water Splitting, Thermochemical Water Splitting, Biomass Gasification, Coal Gasification, And Methane Pyrolysis |

| Key Energy Source | Natural Gas, Solar, Wind, Hybrid, Biomass, Geothermal, Hydro Energy, and Tidal |

| Key End-Product | Hydrogen, Ammonia, Liquified Hydrogen, Methane, and Methanol |

| Leading Players | Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd |

The low carbon hydrogen production capacity was 1,698 ktpa in 2022 and it is anticipated to reach 1,11,326 ktpa in high case scenario by 2030. Low-carbon hydrogen production has shown slow growth in the past. Over the last few years, low-carbon hydrogen production has been flat. However, the trend reversed, and the production increased to 0.66Mtpa in 2021, and the trend is projected to be the same over the coming years.

The low-carbon hydrogen market research report provides a market study at the global level, and a key country level covering eleven key countries in depth. The report also provides key growth drivers and challenges at a country level.

Low-carbon Hydrogen Market Trends

Low-carbon hydrogen is produced in a way that generates little to no GHG emissions. Low-carbon hydrogen can be produced using water and electricity through a procedure called electrolysis, employing biomass through gasification, or adding carbon capture use and storage to a carbon-intensive way of generating hydrogen.

The rising implementation of hydrogen refueling stations, advancements in hydrogen pipelines and the end use of hydrogen in the heating and energy sector, the shift towards green hydrogen, and the growing emphasis on hydrogen for decarbonization goals among others are some of the trends expected in the hydrogen technology over the next couple of years. Approximately 700 hydrogen stations were deployed globally by the end of 2021 of which half were in South Korea, Japan, and China. The largest number of hydrogen fuel stations are in China.

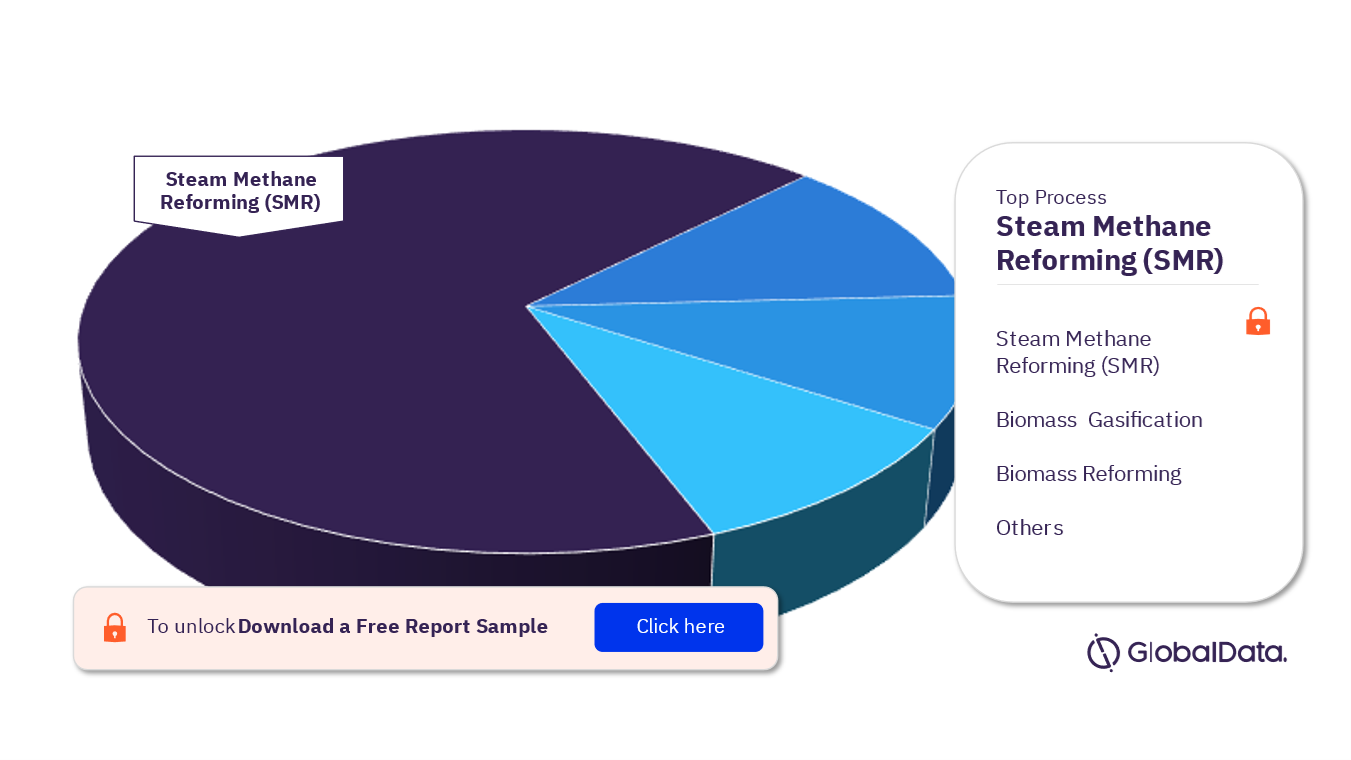

Low-carbon Hydrogen Market Segmentation by Process

The processes in the low-carbon hydrogen market are Steam Methane Reforming (SMR), auto thermal reforming (ATR), biomass reforming, electrolysis, photoelectric chemical (PEC) water splitting, thermochemical water splitting, biomass gasification, coal gasification, and methane pyrolysis. In 2022, Steam Methane Reforming (SMR) led the market for low-carbon hydrogen production with a capacity share of more than 87%, followed by electrolysis and coal gasification.

In the SMR process, high-temperature steam is used to convert methane such as natural gas into pure hydrogen, carbon monoxide, and a relatively small amount of carbon dioxide. The hydrogen produced is purified to quality as per the customer’s specifications. SMR is the most common and economical way to produce hydrogen, which can be used to produce electricity, refine oil, and carry out numerous chemical processes and other industrial applications.

Low-carbon Hydrogen Market Analysis by Process, 2022 (%)

For more insights into the low-carbon hydrogen market segments by process, download a free report sample

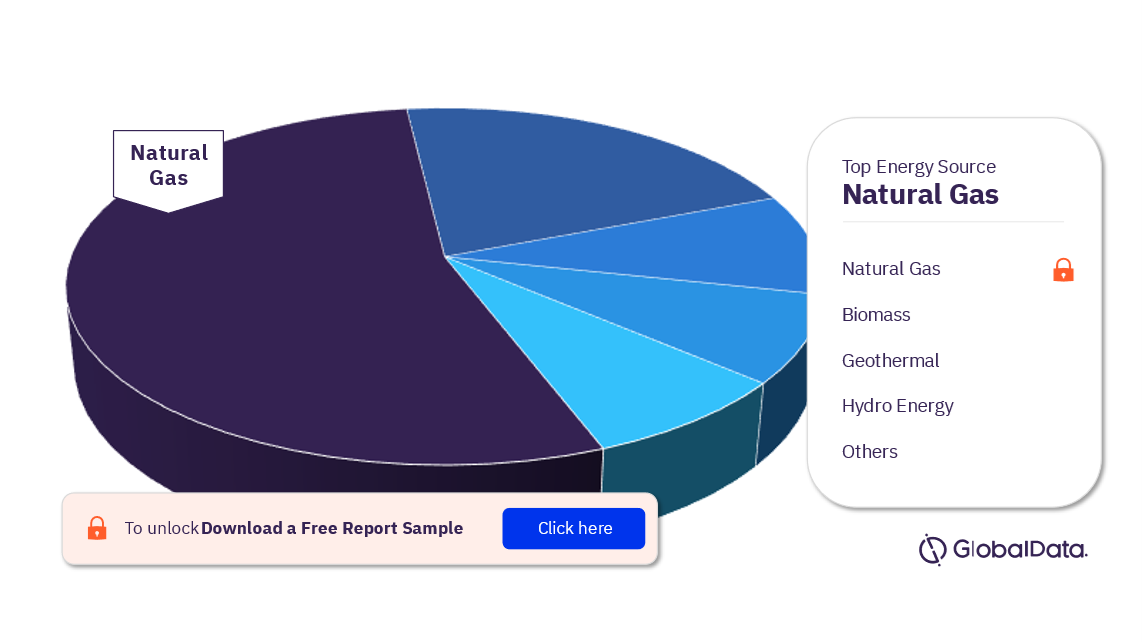

Low-carbon Hydrogen Market Segmentation by Energy Source

The key energy sources in the low-carbon hydrogen market are natural gas, solar, wind, hybrid, biomass, geothermal, hydro energy, and tidal among others. In 2022, natural gas secured its position as the leading energy source for producing low-carbon hydrogen followed by coal and solar power. However, it is anticipated that wind is going to be the major source for low carbon hydrogen production and is expected to secure major share by 2030.

Low-carbon Hydrogen Market Analysis by Energy Source, 2022 (%)

For more insights into the low-carbon hydrogen market segments by energy source, download a free report sample

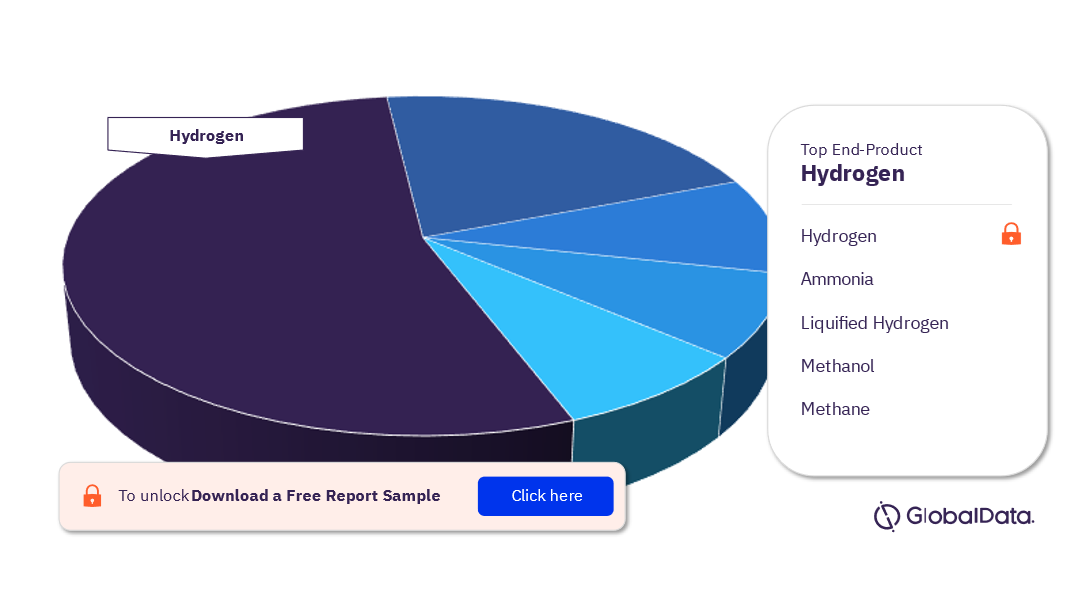

Low-carbon Hydrogen Market Segmentation by End-product

The key segments of the low-carbon hydrogen by end product are hydrogen, ammonia, liquified hydrogen, methane, and methanol. In 2022, Hydrogen led the market for low-carbon hydrogen by end product accounting for a share of more than 85%, followed by Ammonia. The target for clean energy has a positive impact on the demand of low carbon hydrogen worldwide.

Low-carbon Hydrogen Market Analysis by End Product, 2022 (%)

For more insights into the low-carbon hydrogen market segments by end product, download a free report sample

Low-carbon Hydrogen Market - Competitive Landscape

Key hydrogen operators in the low-carbon hydrogen market include companies such as Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd among others. Green Hydrogen International holds the major share of the market.

Low-carbon Hydrogen Market Analysis by Companies (%)

For more company insights into the low-carbon hydrogen market, download a free report sample

Segments Covered in the Report

Low-carbon Hydrogen Market Process Outlook (2022-2030)

- Steam Methane Reforming (SMR)

- Autothermal Reforming Biomass Reforming

- Electrolysis

- Photo Electric Chemical (PEC) Water Splitting

- Thermochemical Water Splitting

- Biomass Gasification

- Coal Gasification

- Methane Pyrolysis

Low-carbon Hydrogen Market Energy Source Outlook (2022-2030)

- Natural Gas

- Solar

- Wind

- Hybrid

- Biomass

- Geothermal

- Hydro Energy

- Tidal

Low-carbon Hydrogen Market End-Product Outlook (2022-2030)

- Hydrogen

- Ammonia

- Liquified Hydrogen

- Methane

- Methanol

Low-carbon Hydrogen Market Technology Outlook (2022-2030)

- Natural Gas W/O CCUS

- Natural Gas W CCUS

- Coal W/O CCUS

- Coal W CCUS

- Onshore Wind

- Offshore Wind

- Solar PV

- Nuclear

Scope

The report includes –

- Low-carbon hydrogen market study at the global level, and at a key country level covering eleven key countries in depth.

- Key growth drivers and challenges at the global level.

- Low-carbon hydrogen production capacity globally and country-wise.

- Hydrogen policy analysis in each of the key countries

- Low hydrogen carbon and electrolyser data analysis globally and in each of the key countries

- Key participants in each region.

Key Players

RWE AGNV Nederlandse Gasunie

European Energy AS

Orsted AS

DH2 Energy SAS

Copenhagen Infrastructure Partners Inc

The ERM Group Inc

Uniper SE

Air

Liquide SA

Equinor ASA

Green Hydrogen International

Total Eren SA

Linde plc

Humboldt Hidrogeno Verde

Enegix Energy Pty Ltd

Proton Ventures BV

Casa dos Ventos Energias Renovaveis SA

Air Products and Chemicals Inc

Clean Hydrogen Works

Exxon Mobil Corp

Intercontinental Energy Corp

Fortescue Future Industries Pty Ltd

Province Resources Ltd

Woodside Energy Group Ltd

Beijing Jingneng Power Co Ltd

Elixir Energy Ltd

Stanwell Corp Ltd

Aqua Aerem Pty Ltd

H2U Group

SEDC Energy Sdn Bhd

Table of Contents

Table

Figures

Frequently asked questions

-

What was the capacity of the low-carbon hydrogen production market in 2022?

The low-carbon hydrogen production capacity was 1,698 ktpa in 2022.

-

Which region held the highest low-carbon hydrogen market share?

North America leads the market in terms of low-carbon hydrogen active production capacity.

-

Which process held the highest low-carbon hydrogen market share?

In 2022, Steam Methane Reforming (SMR) led the market for low-carbon hydrogen production.

-

Which energy source held the highest low-carbon hydrogen market share?

In 2022, natural gas secured its position as the leading energy source for producing low-carbon hydrogen followed by coal.

-

Which end-product held the highest low-carbon hydrogen market share?

In 2022, Hydrogen led the market for low-carbon hydrogen.

-

Who are the major players operating in the low-carbon hydrogen market?

Key operators in the low-carbon hydrogen market include companies such as Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.