Prices Increased Faster Than Inflation for Half of all Drugs Covered by Medicare in 2020

While momentum to enact the Build Back Better Act (BBBA) has stalled in Congress, public support for legislation to lower prescription drug costs is likely to persist, particularly in light of concerns about rising prices due to inflation. The House-passed BBBA would allow the federal government to negotiate drug prices in Medicare, cap Medicare beneficiaries’ out-of-pocket drug spending under Part D, cap monthly insulin costs, and require drug companies to pay rebates to the federal government when annual increases in drug prices for Medicare and private insurance exceed the rate of inflation.

As context for understanding the possible impact of the inflation rebate proposal, this analysis compares price changes for drugs covered by Medicare Part B (administered by physicians) and Part D (retail prescription drugs) between 2019 and 2020 to the inflation rate over the same period (1%) (prior to the recent surge in the annual inflation rate, which is currently 7.5%). Our analysis is based on changes in unit prices reported in the most recent drug spending data released by the Centers for Medicare & Medicaid Services (CMS) through 2020. For Part D, prices are based on total gross spending, including Medicare, plan, and beneficiary spending, but not reflecting manufacturer rebates and discounts to plans because they are considered proprietary and therefore not publicly available. For Part B, prices are based on total spending, including beneficiary liability and Medicare’s payment, which is based on the average sales price; this measure takes rebates and discounts into account. We believe our approach to measuring price changes is reasonable because the BBBA’s inflation rebate proposal for Part D drugs is based on changes in the average manufacturer price, which also doesn’t take rebates paid to plan sponsors or pharmacy benefit managers into account; and for Part B drugs, is based on changes in the average sales price. (See Methods box for additional details.)

Price Increases Outpaced Inflation for Half of all Drugs Covered by Medicare in 2020

Half of all Part D covered drugs (50% of 3,343 drugs) and nearly half of all Part B covered drugs (48% of 568 drugs) had price increases greater than inflation between July 2019 and July 2020, which was 1.0% (Figure 1).

Among the 1,947 Medicare-covered drugs with price increases above the rate of inflation in 2020, one-third (668 drugs) had price increases of 7.5% or more – the current annual inflation rate.

Among drugs covered under Part D, 17% (567 drugs) had price increases of 7.5% or more between 2019 and 2020; 11% (1,106 drugs) had price increases above the rate of inflation but below 7.5%; 9% (285 drugs) had price increases below inflation; and 41% (1,385 drugs) had price reductions.

For Part B drugs, 18% (101 drugs) had price increases of 7.5% or more between 2019 and 2020; 30% (173 drugs) had price increases above the rate of inflation but below 7.5%; 6% (35 drugs) had price increases below inflation; and for the remaining 46% (259 drugs), prices decreased.

Across all Part D drugs with price increases greater than inflation, the median price increase was 5.6%; for Part B, the median price increase was 5.4%.

Prices Rose Faster Than Inflation for Most of the 25 Top-Spending Drugs in Both Part B and Part D in 2020

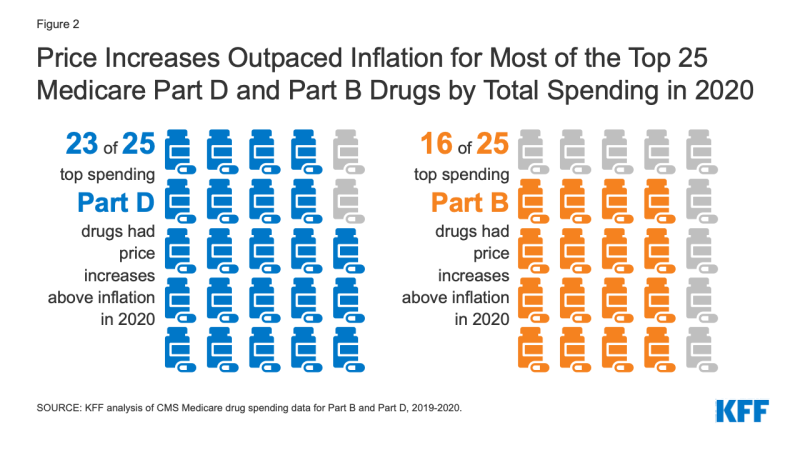

In terms of drugs with the highest total spending, 23 of the top 25 Part D drugs and 16 of the top 25 Part B drugs had price increases above inflation between 2019 and 2020 (Figure 2).

Figure 2: Price Increases Outpaced Inflation for Most of the Top 25 Medicare Part D and Part B Drugs by Total Spending in 2020

Among the 25 drugs covered by Medicare Part D with the highest total gross spending (not accounting for rebates), 23 had price increases greater than inflation in 2020 (Table 1). This includes the top 3 drugs by total gross spending in 2020: Eliquis, a blood thinner used by 2.6 million beneficiaries in 2020, with a 5.9% price increase; Revlimid, a treatment for multiple myeloma used by nearly 44,000 beneficiaries in 2020, with a 6.5% price increase; and Xarelto, a blood thinner used by 1.2 million beneficiaries in 2020, with a 4.1% price increase.

Among the 25 drugs covered by Medicare Part B with the highest total spending, 16 had price increases greater than inflation in 2020 (Table 2). This includes 2 of the top 3 drugs by total spending in 2020: Keytruda, a cancer treatment used by nearly 59,000 beneficiaries in 2020, with a 3.3% price increase in 2020; and Prolia, a treatment for osteoporosis used by nearly 600,000 beneficiaries in 2020, with a 4.7% price increase in 2020.

While drug price inflation based on changes in spending per dosage unit may appear relatively modest in dollar terms for many of the top spending drugs, administration or use of most of these drugs requires multiple dosage units. This means that a relatively small price change per dosage unit can translate to a large change in overall spending per claim.

- For example, the $50 increase (6.5%) in the average spending per dosage unit for Revlimid translates to an increase of more than $1,000 per claim (from $15,178 in 2019 to $16,237 in 2020) and nearly $12,000 in higher total costs per user in 2020 compared to 2019 (from $110,713 to $122,432). (Although these total spending amounts for Part D drugs do not account for rebates, for many higher-cost specialty drugs with less competition, like Revlimid, rebates are likely to be quite low.)

- Similarly, while the price per dosage unit for the Part B drug Keytruda increased by only $1.44 (3.3%) between 2019 and 2020, from $43.87 to $45.31, this price increase contributed to an increase of nearly $750 in average spending per claim (from $9,102 in 2019 to $9,843 in 2020) and an increase of nearly $6,000 in average spending per user (from $53,745 in 2019 to $59,642 in 2020).

Annual increases in drug price increases can translate to higher Medicare spending and higher out-of-pocket drug costs by patients. Higher out-of-pocket spending occurs when beneficiaries are required to pay coinsurance, or a percent of the drug’s price – which is common for many brand-name Part D drugs and standard for all Part B covered drugs in the form of a 20% coinsurance requirement.

The Congressional Budget Office estimates a net federal deficit reduction of $83.6 billion over 10 years (2022-2031) from the drug inflation rebate provisions in the BBBA for Medicare and private insurance. Actual savings would depend in part on the degree to which drug price increases exceed the inflation rate. In periods when inflation is running low, as it was in 2019-2020, even relatively modest drug price increases would trigger inflation rebates. But in periods of high inflation, as it is currently, only more sizable drug price increases would trigger rebates. In the absence of Congressional action on prescription drug proposals, rising drug prices are likely to continue to pose affordability challenges for many people.

| Methods |

| The analysis is based on data from the CMS’s most recent releases for Medicare Part D drug spending and Medicare Part B drug spending. In this analysis, we use weighted average spending per dosage unit as the measure of list price, which is reported by CMS for each drug per year. Changes in list prices are measured by the one-year (2019-2020) change in average spending per dosage unit amounts reported in the datasets. We compare this to the rate of increase in the Consumer Price Index for all urban consumers (CPI-U) over the same time, based on the values for CPI-U in July 2019 and July 2020. We analyze price changes for all drugs reported in the datasets in both 2019 and 2020 (3,343 Part D drugs and 568 Part B drugs), along with the top 25 drugs by total spending in each part in 2020. |

Tables