Abstract

How does advertising affect supply and demand in the entertainment industry? Different advertising and distribution mechanisms and unique product characteristics limit the transferability of findings from other industries to the entertainment industry. This meta-analysis focuses on 290 documented elasticities, drawn from 59 studies of movies and video games, and establishes new findings and empirical generalizations. First, the average advertising elasticity in the entertainment industry is .33 (method bias-corrected .20), approximately three times higher than the average identified for other industries. Second, average advertising elasticities are higher for demand (e.g., revenue) than for supply (e.g., screens). Third, elasticities of pre-launch advertising are higher than those of overall advertising budgets, but with respect to the success period, elasticities are higher for later periods, and in total, compared to the launch period. Fourth, elasticities tend to be rather recession-proof and consistent across geographic regions but decreased after the rise of social media platforms.

Similar content being viewed by others

The entertainment industry famously invests in exceptionally high advertising expenditures (Elberse & Anand, 2007; Schonfeld and Associates Inc, 2021). Marvel set a record (at the time) by spending more than $200 million on advertising for Avengers: Endgame (Katz, 2019), which then went on to become one of the most successful movies of all time ($2.8 billion global box office). But would it have been equally successful with less advertising (Kerby, 2019)? Such questions spark debates in the entertainment industry, regarding the true impact of advertising (McClintock, 2014). Mirroring these controversies among practitioners, researchers in various disciplines have investigated the impact of advertising in the entertainment industry and revealed discrepancies, such that extant studies indicate a wide range of advertising elasticities (e.g., 0.66, Basuroy et al., 2006; 0.05, Xiong & Bharadwaj, 2014).

To provide a basis for practical recommendations and explain inconsistencies in prior research, we need empirical generalizations about advertising elasticities (i.e., percentage change in a success variable given a 1% increase in advertising) and their substantive drivers (Hanssens, 2015). In this research, we therefore generalize previous findings from entertainment science domains with an extensive meta-analysis. For marketing research, meta-analyses provide critical insights; for the purposes of the current study, this approach can clarify the direction and effect sizes of the most relevant, influential drivers of advertising elasticity (Farley et al., 1995). With these findings, marketing scholars can discern how model specifications might influence the identified advertising impacts. Therefore, they can better compare multiple papers and establish empirical generalizations, as well as test theoretical approaches across studies (e.g., the impact of the life cycle on advertising elasticities). Researchers also might be interested in non-significant influences on advertising elasticity. For marketing managers, a thorough understanding of elasticities is important, because elasticities serve as input factors for budget allocation decisions (Fischer et al., 2011). Thus, managers who are considering how to spend their large advertising budgets prior to the launch of a new movie or video game seek specific insights into advertising elasticities.

Despite the importance assigned to advertising by marketing studies, recent research has not provided empirical generalizations to entertainment fields. Vakratsas and Ambler (1999) review studies of advertising effects and derive a taxonomy of advertising models and mental processes to summarize the available empirical findings. Three other meta-analyses address advertising elasticities across various industries and product types. To start, Assmus et al. (1984) find a mean advertising elasticity of 0.22. Updates by Sethuraman et al. (2011) and Henningsen et al. (2011) indicate lower elasticities of 0.12 and 0.09, respectively. However, even these meta-analyses were published more than a decade ago. Furthermore, they do not address the entertainment industry specifically. For example, Sethuraman et al. (2011) include 56 studies published between 1960 and 2008 that refer to pharmaceuticals, durables, food, nonfood, and services. However, only one working paper in their data set pertains to the entertainment industry. Investigating the global entertainment industry is relevant, considering that it generated US$2.1 trillion in 2019 revenues alone (PwC, 2020). Beyond monetary implications, entertainment products (e.g., movies, video games, music, books) have substantial cultural and economic impacts. Moreover, entertainment products and their markets differ on multiple dimensions relative to other products, such as fast moving consumer goods (FMCG; Holbrook & Hirschman, 1982). Our study establishes conceptually and empirically that the results gathered from other industries might not transfer to the entertainment industry, because of its specificities, nor do past results necessarily hold, due to the radical shifts in advertising imposed by digital channels (Shehu et al., 2021). Sethuraman et al. (2011) and Henningsen et al. (2011) focus on contextual influential factors in their analyses, but variables that reflect the specific advertising and distribution mechanisms of the entertainment industry (e.g., advertising period) likely affect advertising elasticities as well.

Noting the unique characteristics of entertainment products, the limited transferability of findings from prior research, and the need to acknowledge variables specific to the entertainment industry, we offer a meta-analysis that can establish new empirical generalizations (Farley et al., 1995). Our study also complements the meta-analyses by Kremer et al. (2008) and Capella et al. (2011), which examine advertising effectiveness in specific market settings (pharmaceutical products and cigarettes, respectively).

We gather findings from 59 studies published between 1994 and 2021, which report 290 effects of advertising on the success of movies and video games.Footnote 1 The results affirm our arguments for a dedicated meta-analysis of this sector in three ways: First, the average advertising elasticity for entertainment goods is 0.33 (with a variance of 0.26). This is approximately three times greater than the average advertising elasticity for other industries. Second, we find that advertising elasticities vary systematically with regard to three new variables, namely, success type, success period, and advertising period. These variables reflect the unique advertising and distribution mechanisms of the entertainment industry and have not been considered in prior meta-analyses, so we establish the following new important generalizations. Advertising exhibits a stronger effect on demand factors, such as revenue or sales (0.34), than on supply factors,Footnote 2 such as screens (0.21). This implies that advertising has a substantial direct effect on demand and an indirect one through supply on demand due to an increase in the distribution share—an issue raised by Reibstein and Farris (1995, p. G190) who conclude that “marketers should monitor distribution carefully.” With regard to the unique advertising and distribution patterns of the entertainment industry, we find that pre-launch advertising has a higher elasticity compared to elasticities based on the total advertising budget covering both, the pre- and post-launch periods. However, with respect to success period, the advertising elasticities are higher for later periods, and in total, compared to the launch period. Revealing such new influential factors is a key contribution of meta-analyses as it sharpens the existing knowledge on empirical generalizations and determines conditions under which advertising elasticities are significantly higher or lower than the average (Hanssens, 2018).

Third, we study the impact of contextual characteristics (e.g., geographic region) on advertising elasticities, which prior meta-analyses have focused on. The results indicate that advertising elasticities are not only higher in the entertainment industry but also more stable regarding these contextual characteristics. Sethuraman et al. (2011) and Henningsen et al. (2011) find four significant contextual factors that determine advertising effectiveness (time trend, geographic region, product type, and product lifecycle). Different from these prior meta-analyses, we find that elasticities did not decrease linearly in the entertainment industry. Instead, there seems to be a structural break after the rise of social media. Moreover, unlike in other industries, elasticities do not significantly vary across geographic regions and seem rather recession-proof. We also find no significant difference between different entertainment products (movies versus video games).

We follow the example of Henningsen et al. (2011) and provide the full advertising elasticity database (available online https://osf.io/hmnz9/?view_only=be97a8b21f834590979c7aaac6e36de9) as a starting point for further research along with guidance for continued research endeavors.

In the next section, we elaborate on theoretical differences between advertising in the entertainment industry compared to other industries. Then, we describe the variables we include in our meta-analytic model and outline the corresponding hypotheses and expectations. Subsequently, we describe the data collection, coding procedure, and analytical method, then present the resulting empirical findings, along with several robustness checks. We conclude with a discussion of the study’s implications and limitations, as well as suggestions for further research.

Advertising mechanisms in the entertainment industry

Advertising influences product success through direct effects on (1) demand, (2) supply, and (3) through an indirect effect on demand through supply (Elberse & Eliashberg, 2003). Thereby, advertising functions in two ways: It creates awareness and it reduces uncertainty for consumers as well as for suppliers (Vakratsas & Ambler, 1999; Zufryden, 1996). Both functions of advertising are especially relevant to the entertainment industry due to its unique characteristics which affect both supply and demand (Elberse & Anand, 2007). Moreover, advertising itself differs within the entertainment industry (Hennig-Thurau & Houston, 2019) as it enables product trial and has an entertaining nature, and these unique characteristics should also make it more effective in reducing uncertainty and creating awareness than advertisements in other industries. Even if other industries might share some characteristics with the entertainment industry, it is the combination of these differences that sets the industry apart (Fig. 1).

First, advertising has a direct effect on demand. It is highly difficult for customers to evaluate the quality of entertainment products prior to consumption because they are hedonic experience goods (Basuroy et al., 2006). Moreover, entertainment products evoke high social risk because each consumption decision provides a signal to others that the customer belongs to a certain social group (Hennig-Thurau & Houston, 2019). Thus, compared to other industries, customers rely relatively more on advertising as a signal to reduce the heightened level of uncertainty in the entertainment industry (Elberse & Eliashberg, 2003). Advertising can help customers reduce uncertainty in two ways. On the one hand, entertainment advertising provides consumers an opportunity to try the product prior to purchase. Trailers and video clips used across digital marketing channels are central advertising tools in the entertainment industry and are even relevant for entertainment products that rely less on visual elements, such as books (Arons, 2013; Karray & Debernitz, 2017; Liu et al., 2018). By watching these trailers, customers can experience a sample of the emotions that will be evoked when they consume the entire product (Liu et al., 2018), which should be effective in reducing their uncertainty. On the other hand, high advertising pressure, fostered by exceptionally high advertising budgets, provides a signal for the quality of the product (Basuroy et al., 2006; Vakratsas & Ambler, 1999).

Furthermore, the short lifecycle of entertainment products also heightens pressure to create high levels of initial awareness and to quickly convince customers through advertising. Products that are not sufficiently successful in the launch period might disappear from the cinema market almost immediately. A critical distinction of entertainment advertising is that advertisements themselves are more entertaining because they incorporate drama, story, and demonstrations (Bruce et al., 2012). Due to this entertaining nature, advertisements should be more likely to get shared among customers and to go viral (Akpinar & Berger, 2017), which makes them especially suitable for creating high levels of initial awareness. Compared to other industries, in which advertising seems to wear out with each repetition, advertising should also be more likely to have wear-in effects in the entertainment industry due to this entertaining nature (Chen et al., 2016; Pechmann & Stewart, 1988). Finally, both characteristics of advertising–its entertaining nature and the possibility to try the product–should lower customers’ reactance to advertising and thus increase demand (Olney et al., 1991).

Second, advertising has a direct effect on supply. Suppliers, such as theater owners and retailers, have to anticipate highly uncertain demand because they face relatively short lifecycles and exponentially declining sales patterns with peak sales during the first week (Henningsen et al., 2011; Hofmann-Stölting et al., 2017). Additionally, entertainment products differ from FMCG or services in that they evoke low repurchase rates. Advertising can help suppliers reduce this uncertainty because, unlike in other industries, studios spend most of the advertising budget prior to the product launch. Thus, suppliers can interpret the size of the studio’s budget as a credible sign for the expected success and consequently plan their offer accordingly as intensive promotion of a low-quality product could backfire for the studio (Basuroy et al., 2006; Elberse & Anand, 2007; Hennig-Thurau & Houston, 2019).

Third, advertising has an indirect effect on demand through supply. Following our prior rationale, higher advertising budgets might increase supply (i.e., availability) of entertainment products, which makes them even more visible and appealing to consumers and then determines ultimate demand through an increase in awareness (Akdeniz & Talay, 2013).

Overall, based on these differences in advertising and distribution mechanisms, advertising elasticities in the entertainment industry should differ and be higher compared to other industries.

Conceptualization

The dependent variable in our model is advertising elasticity, which indicates the percentage change in a success variable given a 1% increase in advertising. Following the studies included in our meta-analysis, we focus on advertising that is conducted by the studio or video game manufacturer–not by retailers or exhibitors (Elberse & Anand, 2007). Both demand and supply outcomes are important success indicators, because a product’s sales performance (demand) and availability (supply) are closely interrelated in the entertainment industry, due to the indirect effect of advertising on demand through supply. For movies, supply can be defined as the number of allocated screens; for video games, music, and books, supply reflects the number of platforms on which the product is offered (e.g., consoles such as Xbox, streaming services such as Spotify) or shelf space in retail stores.

We decided to use elasticities as our dependent variable for several reasons. First, unlike correlation coefficients, elasticities have the benefit that they refer to a directional effect (Hanssens, 2015, pp. 5–6). Thus, we are able to say that advertising drives the success of entertainment products instead of just stating that there is a (linear) relationship. For advertising, a positive effect is generally accepted, so the effect strength is of primary interest and can only be determined through regression-based measures. Unlike marginal effects (which are also regression-based), dimensionless elasticities are preferable given the different operationalizations of the independent and dependent variables (Bijmolt et al., 2005; Tellis, 1988).

Second, elasticities enable comparisons with all prior, major advertising meta-analyses (Assmus et al., 1984; Henningsen et al., 2011; Sethuraman et al., 2011) and with other marketing instruments and strategies (Auer & Papies, 2020; Bijmolt et al., 2005; Hanssens & Pauwels, 2016; Köhler et al., 2017; You et al., 2015). Hence, our study adds to the list of elasticity benchmarks and allows comparisons within and outside advertising research.

Third, elasticities are easily interpretable for managers in that they refer directly to the relationship between marketing activities and desired outcomes (Albers, 2012). According to the Dorfman-Steiner theorem (Dorfman & Steiner, 1954), profit maximization requires that the advertising intensity (ratio of advertising budget and revenue) must be equal to the ratio of advertising and (absolute) price elasticities. Thus, elasticities are an important effect size to determine optimal advertising budgets. Most (72%) of the studies that we include in the sample use log–log models. Therefore, we can include their coefficients directly as elasticities. In other cases, we obtained the statistics required to calculate elasticities from the manuscripts (Web Appendix A) or requested them from the authors; accordingly, missing values were not a major issue for our elasticity calculations.

We include 28 independent variables in the model that might influence advertising elasticities (Fig. 2). We differentiate between substantive drivers that are the focus of our analysis and research design characteristics. To structure the included independent variables, we categorized them into five major groups: advertising mechanism characteristics (main focus), contextual characteristics, omitted variables, data and model characteristics, and publication characteristics. Our variables cover the ones used in prior meta-analyses by Sethuraman et al. (2011) and Henningsen et al. (2011).Footnote 3 In addition, we consider 13 variables (46%) that are unique to our study and the entertainment industry (highlighted in Fig. 2). Out of those unique variables, five are among the substantive drivers. While prior meta-analyses focus on contextual characteristics as substantive drivers, we add a new group of three variables (advertising mechanism characteristics) that reflect the unique distribution and advertising mechanisms of the entertainment industry. We add the variable success type because advertising does not only have a direct effect on demand for entertainment products but also a strong indirect effect through supply and thus has two targets. To capture the unique consumption and advertising patterns in the entertainment industry, we add success period and advertising period as independent variables. These variables indicate whether success is measured in the launch period, in later periods, or in total in the primary study. For advertising, the period refers to whether only pre-launch, only post-launch, or advertising in both periods is included.

Within the contextual characteristics, we add the new binary time variable social media because the entertainment industry has been strongly affected by the rise of alternative media outlets and online word of mouth (WOM) and this development might not be fully reflected by the linear time trend investigated in prior meta-analyses. We also add the contextual variable entertainment product type, to differentiate between specific entertainment products.

In addition, seven new variables are added to the group “omitted variables.” In order to obtain unbiased elasticity estimates, it is essential to control for other variables that have been part of the respective model within the primary studies. We therefore investigated all control variables in the primary studies of our database and included those that were applied for at least 5% of all observations. The only exceptions which we did not include are the variables genre and age restriction. Both variables are represented by a varying amount of multiple dummy variables and while some studies only assign one type of genre for each movie or game, others allow membership to multiple genres (e.g., Kupfer et al., 2018). Thus, it is not possible to derive a direction for the effect and the number of dummy variables would lead to an overburdened model. Our final choice of omitted variables reflects the most frequently used control variables in entertainment research that are applicable to a variety of entertainment products (e.g., Hofmann-Stölting et al., 2017; Marchand et al., 2017). We further add the variable sample selection to research and design characteristics, because some entertainment studies limit samples to bestselling entertainment products or specific genres, which is not accounted for in prior meta-analyses.

In general, all variables in our model must account for at least 5% of all observations (Farley et al., 1995) and should be included in at least two studies from our database. Table 1 provides an overview of all variables, their operationalization, expected effects, and comparisons with findings from the recent meta-analyses by Sethuraman et al. (2011) and Henningsen et al. (2011).

In the following sections, we derive hypotheses for our substantive drivers and formulate expectations for the research design and publication characteristics. The effect of our substantive drivers on advertising elasticities can be generally explained through their influence on the two underlying mechanisms–advertising’s ability to reduce uncertainty and to create awareness.

Advertising mechanism characteristics

Success type

Advertising campaigns for entertainment products primarily target consumers through two underlying mechanisms. Raising awareness is crucial; it is the first step that initiates consumers’ purchase decision processes (Zufryden, 1996). Reducing uncertainty is an important next step, because the quality of entertainment goods is difficult to determine in advance, and the products evoke high social risk (Hennig-Thurau & Houston, 2019).

With regard to suppliers, creating awareness through advertising is not as relevant, because retailers and exhibitors are usually approached directly by distributors and well before advertising campaigns even begin. Thus, advertising affects supply mainly through its role as a quality signal. High advertising budgets indicate the studio’s commitment and high expectations of its entertainment product. Distributors use this signal to convince theater owners to assign more screens or retailers to place a video game more prominently, in anticipation of high demand (Elberse & Eliashberg, 2003). Highly advertised video games are also more likely to be launched on multiple consoles compared with those with lower budgets that are first launched on only one console. Yet advertising budgets represent only one of many factors that suppliers consider in their allocation decisions. For example, suppliers often have pre-launch access to the product (e.g., pre-screenings) and therefore can evaluate the quality of the product themselves.

Moreover, suppliers may be more critical in their decision-making than consumers, because they can assign each screen or shelf space only to one entertainment product over a comparably longer period of time, whereas consumers are less limited in their short-term consumption decisions. Suppliers even decrease their offerings, despite existing contracts, if a product does not perform according to the expectations raised by the advertising budget (Elberse & Eliashberg, 2003). Consumers cannot retract their purchase once they have consumed an entertainment product. Finally, consumers are not only directly affected by advertising but also indirectly through supply, because they tend to interpret extensive availability as a sign of popularity, which increases their interest (Vakratsas & Ambler, 1999). We thus hypothesize:

-

H1 Advertising elasticities are higher for demand than for supply.

Success period

The first week after an entertainment product is launched, which we refer to as the launch period, is particularly relevant. More than 60% of movies reach their highest revenue in the first week (Follows, 2018), and the opening weekend can account for up to 49% of overall revenue (BoxOfficeMojo, 2020). Such distribution concentrations are similar for other entertainment products such as video games (Hennig-Thurau & Houston, 2019; Marchand et al., 2017). Due to this particular sales pattern, many studies focus on the impact of advertising in the launch period. Some researchers interpret sales in this launch period as a suitable indicator of total sales, but the two variables do not necessarily correlate (Gemser et al., 2007). Some movies, such as My Big Fat Greek Wedding, became surprise hits and gained demand after weak success in their opening week (Goldenberg, 2016). We therefore differentiate advertising elasticities estimated on the basis of total revenues, revenues generated in the launch period, and revenues generated in later periods.

With regard to demand, just focusing on the launch period might underestimate the elasticity, because not every consumer is instantly exposed to or persuaded by advertising (Elberse & Anand, 2007; Garber et al., 2004). Compared to other industries in which advertising seems to wear out with each repetition, advertising is more likely to have wear-in effects in the entertainment industry due to its entertaining nature such that it becomes more influential in later periods (Chen et al., 2016). Moreover, high demand might exceed the limited supply in the launch period so that some consumers can only watch the movie or buy the game in later periods despite their initial interest.

With regard to supply, high advertising budgets indicate studios’ high expectations of success for a movie, which theater owners interpret as a sign of a potentially stronger staying power. The profit margins of theater owners increase over time, so they have a strong incentive to shift the number of screens from the opening week to later weeks for movies with stronger staying power (Clement et al., 2014). Consequently, we expect:

-

H2 Advertising elasticities are higher if success is measured in later periods or in total, rather than in the launch period.

Advertising period

Timing for advertising is a key factor that sets the entertainment industry apart from other industries. Other industries usually slowly increase advertising over time and spend the majority of their advertising budget after the product or service has been introduced to the market, but between 52 and 76% of the advertising budget is spent prior to the product launch for entertainment goods, to create hype (Hennig-Thurau & Houston, 2019).

The absence of other information sources enhances consumers’ focus on advertising in the pre-launch period. In contrast, post-launch advertising likely loses impact as a quality signal because other, more reliable sources of information, such as WOM or critics’ reviews, become more widely available to consumers (Desai & Basuroy, 2005). Furthermore, each product’s small post-launch advertising budget must compete with extensive pre-launch campaigns for other entertainment products and therefore may be less effective in creating awareness. Suppliers also base their allocation decisions mainly on pre-launch advertising budgets (Elberse & Anand, 2007). Pre-launch budgets signal the studios’ expectations of success; post-launch budgets represent their reactions to success in the launch period. After the launch, suppliers no longer need to make decisions based on expected success but instead can observe real success in the launch week and adjust their offerings accordingly. We posit:

-

H3Advertising elasticities are higher for movies than for Advertising elasticities are higher for pre-launch advertising than for post-launch advertising and advertising in both periods.

Contextual characteristics

Entertainment product type

We distinguish movies and video games as distinct entertainment products and choose not to include other entertainment products, such as books or music, because the share of studies that address advertising in these categories is below 5%. Furthermore, movies and video games are among the largest and fastest growing experience product sectors (Entertainment Software Association, 2020; Motion Picture Association, 2019).

A typical console video game costs more than a movie and is consumed over a longer period of time (Hennig-Thurau & Houston, 2019). Thus, the purchase decision involves more uncertainty. To reduce this uncertainty, additional quality signals are available for video games, but their presence also reduces the relevance of advertising for video games compared with movies. For example, consumers can use the price of a video game as a quality cue, unlike the uninformative, uniform price of a movie (Marchand, 2016). Moreover, video game consumption decisions likely depend on additional factors, such as hardware availability, technical innovation, or direct and indirect network effects (Healey & Moe, 2016; Liu et al., 2015), which reduce the impact of advertising. It thus follows:

-

H4 Advertising elasticities are higher for movies than for video games.

Social media

We expect advertising elasticities to decrease over time, as a consequence of ad clutter, which makes it harder to create awareness. The rise of social media also has enabled greater (electronic) WOM, as an alternative information source for consumer decision-making, such that it has reduced the impact of advertising as a quality signal (Hennig-Thurau et al., 2010, 2015). Because this sudden rise of social media cannot be captured fully by a linear time trend, we measure the impact of time by a binary variable that measures whether the mean year of data collection was before 2006, the year that Twitter launched (Britannica, 2022) and that Facebook opened to the general public, beyond educational institutions (Phillips, 2007). We posit:

-

H5 Advertising elasticities are higher if the data were collected before 2006.

Recession

Two competing mechanisms might arise during recessions. On the one hand, consumers facing budgetary constraints tend to shift their spending toward lasting material goods and reduce their spending on experiences, such as cinema visits or a video game they might play only once (Tully et al., 2015). Thus, budgetary constraints might reduce the impacts of created awareness. On the other hand, entertainment products provide the possibility to escape reality, at relatively low costs, which might be particularly desirable in recessionary times (Hennig-Thurau & Houston, 2019; Henning & Vorderer, 2001). Therefore, consumers might be more receptive to advertising for entertainment goods. A priori, it is unclear which effect will prevail.

Geographic region

Consumers’ uncertainty avoidance and evaluations of quality signals differ across cultures (Akdeniz & Talay, 2013). Cultures that exhibit a high level of uncertainty avoidance tend to regard advertising as a less credible quality signal than critics’ evaluations or WOM (Akdeniz & Talay, 2013; Roth, 1995). In contrast, cultures that are highly individualistic consider advertising a useful source of information about new products (Hofstede et al., 2010). According to measurements by Hofstede Insights (2020), EuropeansFootnote 4 exhibit higher uncertainty avoidance (score of 67 compared with 47 in the United States and Canada), whereas the United States and Canada score higher on individualism (score of 86 compared with 64 in Europe). Consequently, advertising’s role as a quality signal should be more important in the United States and Canada compared with Europe. However, greater ad clutter in the United States could lead to lower awareness than in Europe (Sethuraman et al., 2011). For suppliers, most movies are first launched in the United States and later in Europe, so those in Europe can make more informed decisions and depend less on advertising budgets as a quality signal. The net effect remains an empirical question.

Omitted variables

Omitting a variable that is correlated with both the dependent variable (supply or demand) and the independent variable (advertising) biases advertising elasticity, because the model attributes the effect of the missing variable to advertising. The direction of the bias is the product of the signs of the correlations (Greene, 2018).

Lagged advertising

Lagged advertising likely correlates positively with current sales but negatively with current advertising, because the majority of advertising spending occurs before launch and then rapidly decreases (Hennig-Thurau & Houston, 2019). Thus, we expect a negative bias if this variable is omitted.

Control variables

Entertainment studies usually incorporate a rich set of control variables that correlate with demand and supply (Clement et al., 2014). Advertising budgets reflect the expected success of an entertainment product and should correlate with several of these control variables as well, due to this endogenous nature (Elberse & Anand, 2007). For example, sequels usually receive higher advertising budgets (Kim & Bruce, 2018) and correlate positively with both supply and demand, due to their prior success and established fan base (Clement et al., 2014). Therefore, any omission of this variable would bias the advertising elasticity measure positively. Web Appendix B contains an overview of our expectations for each omitted variable bias.

Data and model characteristics

Sample selection

Among our data, 36% of the observations refer to samples that cover the complete market or rely on random selection. The remaining observations come from samples that focus on wide-release products with very high production budgets (43%) or samples determined by other selection criteria (e.g., only sequels, only animated movies). Such selections might bias advertising elasticities. A wide-release strategy is common for movies or video games that appear more likely to be hits and often correlates with high advertising budgets (Hennig-Thurau & Houston, 2019). The effect of advertising should be especially strong for these samples, because the created awareness centers on products that appeal to a broad audience. In contrast, limited release strategies are more prevalent for entertainment products that appeal to niche audiences. Even if consumers gain awareness of the product, it might not meet their taste. Samples that cover the complete market or a random selection of entertainment products include both wide- and limited-release strategies, so the elasticities may be lower for these studies compared with studies that focus on wide-release products. We do not form a separate category for limited-release products, due to the low number of observations, and instead include them in an “other criteria” category. Because this category features a variety of selection criteria (e.g., specific genres that vary in their appeal), we do not offer explicit predictions for it.

Advertising medium

Consumers process information differently, depending on the medium through which it is transmitted (Batra & Keller, 2016). Accordingly, advertising elasticities should differ across media, because the potential to create awareness and persuasiveness differ among media. Some entertainment studies in our sample use the total advertising budget and aggregate media; others focus on the effects of a specific medium, such as television or YouTube. Unfortunately, current research does not offer enough studies focusing on each single medium so we cannot investigate differences between individual outlets as a substantive driver and instead include this variable as a research design characteristic. We expect advertising elasticities to be lower for studies that focus on a single medium compared with multiple media, due to an omitted variable effect. If a study focuses on a single medium, the impact of the budget allocated to other media gets omitted. Assuming fixed overall advertising investments, this budget likely correlates negatively with the budget of the included medium and positively with the success of the entertainment product. Thus, its omission should bias advertising elasticity negatively, especially when advertising channels reinforce one another (i.e., interaction effects across channels; Naik & Raman, 2003).

Advertising measurement

Most studies measure the monetary value of the advertising budget, but some use alternative measures, such as pages per magazine weighted by circulation (e.g., Burmester et al., 2015). Due to the relatively rare occurrence of each of these alternative measures, we combine them into an “others” category and use it as a control variable.

Data structure

Panel data capture the dynamic effect of advertising over time, whereas cross-sectional data capture level effects at a specific point of time. Entertainment goods have a distinct lifecycle, characterized by high sales during the first week, followed by an exponentially declining sales pattern (Hofmann-Stölting et al., 2017). Thus, elasticities based on panel data should be smaller than those based on cross-sectional data.

Functional form

We have no general expectations about how advertising elasticities will differ according to the functional form, because the adequacy of a model form depends on the characteristics of the analyzed data (Tellis, 1988).

Estimation method

In line with the findings of prior meta-analyses (e.g., Albers et al., 2010; Bijmolt et al., 2005; Sethuraman et al., 2011), we do not expect significant differences in advertising elasticities for different estimation methods.

Endogeneity

Because managers usually assign higher advertising budgets to entertainment products that they expect to be successful, the endogeneity of advertising is a widely discussed topic in entertainment research (Hennig-Thurau & Houston, 2019). Following Villas-Boas and Winer (1999), we expect lower advertising elasticities for studies that do not account for endogeneity compared with those that do.

Heterogeneity

We have no prior expectations pertaining to heterogeneity. The effects depend on the heterogeneity pattern, in terms of whether accounting for heterogeneity leads to lower or higher elasticities (Bijmolt et al., 2005).

Publication characteristics

Manuscript status

If a publication bias exists, such that larger effect sizes and significant effects are more likely to get published (Rust et al., 1990), advertising elasticities should be higher for published work compared with unpublished work.

Focus of study

We further expect that effect sizes and elasticities are greater in studies that focus on advertising compared with those that include advertising as a control variable, because their primary goal and contribution is to identify advertising’s effect.

Data collection and methodology

Selection and coding of studies

To identify relevant studies, we conducted a rigorous literature search that followed three steps (Web Appendix C). First, we focused on building an initial database. We used our own, preexisting literature collections as a starting point and added studies included in a recent entertainment meta-analysis that investigates the effect of star brand equity and product reviews by consumers and critics on box office success (Carrillat et al., 2018). Moreover, we considered studies mentioned in the book Entertainment Science (Hennig-Thurau & Houston, 2019), which provides a comprehensive overview of entertainment research. We also conducted an issue-by-issue search of the most recognized journals in marketing, according to the Erasmus Research Institute of Management (ERIM) ranking,Footnote 5 and of journals dedicated to media or advertising.Footnote 6 Then we searched scientific databases such as Google Scholar. Second, we examined this initial database more closely by specifically investigating further publications by the identified entertainment researchers and by conducting backward and forward searches of the citations in all studies. Third, we sought to identify unpublished work. Therefore, we inspected conference proceedings in the previous five yearsFootnote 7 and contacted 44 entertainment researchers, asking for working papers and also for missing data. We received responses from 30 researchers and finished our literature search at the end of 2021.

In each of the three steps, we used a consistent set of keywords (e.g., entertainment, video game, book, music, movie, motion picture, box office, screens, cinema, advertising, promotion, pre-launch). To be included in our database, studies had to be situated in the entertainment industry, and the dependent variable had to be measured as sales units or revenue (demand) or as screens, platforms, or shelf-space (supply).Footnote 8 Due to the generally standardized prices for entertainment goods, we consider sales units and revenue to be comparable measures for demand. We excluded theoretical research and experimental studies, as well as studies in which advertising was not interval or ratio scaled (Edeling & Fischer, 2016), in which the dependent variable was “not real” (e.g., simulated markets), and for which the information needed to calculate the elasticity was not possible to obtain.

One author then coded the study characteristics using a comprehensive coding guide (Cooper, 2016). To enhance validity and reduce subjective biases, we adopted the approach suggested by Stanley et al. (2013), such that one author coded all studies, and then a second author coded a random subsample of them. This subsample accounted for 47% of the studies and 51% of the observations in our final database. Our coding agreement reached 96.7%; any inconsistencies were resolved through discussion with a third judge. Several researchers also helpfully provided necessary clarification or additional information about their studies.

Database

The final database includes 290 advertising elasticities, provided by 59 studies published between 1994 and 2021, using data sets gathered from 1960 to 2017 (Web Appendix D). The average number of elasticities reported per study is 5, with a minimum of 1 and a maximum of 28. We find that 87% of the observations come from studies published in peer-reviewed journals, of which 59% are from a leading journal.Footnote 9 Our literature search reveals that researchers have rarely investigated advertising effects for music, books, and theater plays. Because studies on these products are too scarce (less than 1% of the overall sample), we focus on video games (11%) and movies (89%).

Model estimation

We model advertising elasticity as a function of the selected independent variables, using hierarchical linear modeling (HLM) with random intercepts to account for within-study error correlations (Bijmolt & Pieters, 2001; Grewal et al., 2018). The intraclass correlation for a model that only includes an intercept, based on a within-study variance of 0.201 and a between-study variance of 0.138, amounts to 0.138/(0.138 + 0.201) = 0.407. This value shows that a high percentage of the overall variance in elasticities is due to differences between studies, which justifies the use of HLM (Raudenbush & Bryk, 2002). The Q-test (Q = 26,887.07; df = 288; p < 0.001) and I2 statistic (98.93%) underline that advertising elasticities are heterogeneously distributed which warrants the study of moderator variables (Huedo-Medina et al., 2006).

Characteristics can be observed at either the measurement (e.g., success type) or study (e.g., manuscript status) level. At level-1, Eq. 1 describes the characteristics that can differ within one study. Then the level-2 Eq. 2 captures the effects of study-specific characteristics on the intercept in level 1. This HLM specification also accounts for unobserved study-specific heterogeneity. Each observation is weighted by a normed variance, which is the absolute value of the ratio of the estimated elasticity and its standard error (Edeling & Fischer, 2016).Footnote 10 One of the observations has a weighting factor of 0 and is therefore excluded from the model, which reduces our database to 289 observations. Because incorporating numerous interaction effects can contribute to collinearity and compromise the stability of our model, we focus on main effects but investigate and discuss the effects of selected interaction effects in the Interaction effects section. Thus, we derive the following models for identifying potential influential factors related to advertising elasticity:

where εij is the ith advertising elasticity from study j, β0j is the random intercept for study j, βm are coefficients at the first level, wm,ij are the study characteristics (m) that can differ within one study, γ00 is the intercept at the second level, γk are coefficients at the second level, zk,j are the study characteristics (k) that are fixed within one study, and eij and u0j are the error terms of the first and second levels, respectively.

Results

Descriptive analyses

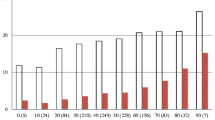

Figure 3 presents the distribution of 290 advertising elasticities, ranging from -0.37 to 4.08. Although 18% of the elasticities fall between 0 and 0.05, 20% of them exceed 0.5, highlighting the wide variance of effects in extant research. Approximately 3% of the elasticities are negative. Our “raw” mean advertising elasticity (unadjusted for any methodology-induced biases) is 0.33 for entertainment products. This value is substantially higher than previously estimated “raw” means across industries. We formally test the difference using a t-test against the mean elasticities of 0.12 by Sethuraman et al. (2011) and 0.09 by Henningsen et al. (2011) and find significant results for both (p < 0.001). The median elasticity for the entertainment industry is 0.15 (Sethuraman et al.: 0.05; Henningsen et al.: 0.04), and the standard deviation is 0.51 (Henningsen et al.: 0.16). Considering the exponentially declining lifecycle of entertainment products, we compare our results with short-term elasticities. Following the suggestion by Grewal et al. (2018), we apply the file drawer N procedure (Tellis, 1988). The number of zero observations needed to obtain an insignificant mean elasticity would be 12,951.

Distribution of advertising elasticities. Notes: Fig. 3 shows the distribution of “raw” elasticities gathered from original studies

Nine elasticities lie outside the interval of the mean elasticity, plus or minus three standard deviations (Bijmolt et al., 2005; Edeling & Himme, 2018). The mean advertising elasticity without these outliers is 0.26 for entertainment industries—still substantially higher (both p < 0.001) than the mean across industries indicated by the prior meta-analyses (Henningsen et al., 2011; Sethuraman et al., 2011).

We further investigate the distribution of the averaged elasticities per study and find an elasticity of 0.46 (median = 0.28), which is even higher than the mean for individual observations, because the outliers are weighted more strongly with this approach. If we remove the outliers before calculating the mean per study, we find consistent results (mean elasticity = 0.33; median = 0.23; Web Appendixes E and F).

The mean statistical power of our combined set of observations is 0.68 (Muncer et al., 2003). If we calculate the mean statistical power based on the mean advertising elasticity per study, it even increases to 0.75. Both values are above the threshold of 0.5, which is recommended for meta-analyses in business research (Muncer et al., 2002).

Model-free evidence

We find 23 significant mean-difference tests (p < 0.05; Web Appendix G). They support our expectation that elasticities depend on advertising mechanism characteristics. For example, elasticities are lower for supply than for demand, if success is measured in the launch period versus in total and if post-launch instead of pre-launch advertising is considered. Contextual variables such as the entertainment product type or geographic region also appear to influence elasticities. The results further indicate that elasticities are biased if important variables are omitted (e.g., competition, distributor). These findings provide an indication that advertising elasticities vary systematically and that the variations can be explained by the chosen variables. Next, we present weighted HLM results, because mean-difference analyses cannot account for correlations among variables, the precision of the elasticity estimate, or nested elasticities within studies (Edeling & Himme, 2018).

Model-based analyses

Overview

Table 2, column 4, presents the restricted maximum likelihood estimation results of the HLM. The model explains 72% of the variance in advertising elasticity. We assessed the extent of multicollinearity through variance inflation factors (VIF). In the final model, all VIFs are below 6.71, so multicollinearity does not appear to be a major concern. The coefficients of eight independent variables are statistically significant at least at p < 0.05 (two-sided test). We compared the fit of our model with a model that only includes an intercept using the Akaike information criterion (AIC) and deviance (-2 log-likelihood ratio; You et al., 2015). Both statistics are lower for the main model (AIC = 206.82, deviance = 202.78) compared to the intercept-only model (AIC = 219.63, deviance = 215.63), which indicates superior model fit.

Advertising mechanism characteristics

We find a significant impact of the new variables that reflect the advertising and distribution mechanisms of the entertainment industry and that are unique to our meta-analysis. The results strongly support our expectations of a lower effect of advertising on supply than on demand (ß = -0.365, p < 0.01). Furthermore, as expected, advertising elasticities are higher if success is measured in later periods (beyond one week after launch; ß = 0.190, p < 0.01) or in total (ß = 0.207, p < 0.01), rather than in the launch period. In accordance with our expectations, we find a first indication that advertising elasticities tend to be lower if studies include both pre- and post-launch advertising (ß = -0.171, p = 0.059) rather than just pre-launch advertising. Surprisingly, the effect of post-launch advertising does not differ significantly from that of pre-launch advertising (p = 0.582).

Contextual characteristics

Unlike in other industries, our results indicate advertising elasticities to be rather robust regarding contextual characteristics. We find no support that advertising elasticities are significantly lower for video games compared with movies (p = 0.217). Also, elasticities in the entertainment industry are not significantly influenced by recessions (p = 0.593), such that the effects of budgetary constraints and escapism seem to cancel each other out during challenging times. Regarding the geographical context, we do not find a significant difference between advertising elasticities in the United States and Canada compared with Europe (p = 0.400) and other countries or international samples (p = 0.405). However, as expected, advertising elasticities tend to be lower after the rise of social media in 2006 (ß = -0.177, p = 0.070).

Omitted variables

In line with our expectations, the omission of screens biases advertising elasticities positively (ß = 0.309, p < 0.01). Surprisingly, the omission of competition results in a positive bias instead of the expected negative bias (ß = 0.282, p < 0.05). The results do not support the expected effects of the omission of other control variables or lagged advertising.

Data and model characteristics

Advertising elasticities do not differ significantly between samples that cover the complete market or random samples versus samples limited by specific criteria (e.g., sequels; p = 0.122) or versus those focusing on wide-release entertainment goods (p = 0.373). However, advertising elasticities are higher in studies using an aggregate of overall media, rather than a single medium (ß = 0.635, p < 0.01). Moreover, elasticities estimated on the basis of advertising measurements other than monetary budgets are significantly higher (ß = 0.713, p < 0.01). Advertising elasticities do not differ significantly according to whether they are based on cross-sectional or panel data (p = 0.576). However, we find a significant negative effect of a linear functional form compared with the double log (ß = -0.515, p < 0.05). No significant impact of the chosen estimation method emerges on advertising elasticities. Omitting endogeneity (p = 0.100) or heterogeneity (p = 0.218) does not have a significant influence either.

Publication characteristics

We find no significant difference between advertising elasticities reported in unpublished versus published research (p = 0.811). Furthermore, there is no significant difference between studies in which advertising is included as a control variable and those with advertising as the focal variable (p = 0.875).

Bias-corrected elasticities

Our model-based analysis indicates that elasticities are significantly positively biased if supply (screens or platforms) or competition are omitted in the original study, and negatively if a linear instead of a double-log model (which accounts for more realistic decreasing marginal returns to advertising) is used. Therefore, a bias-corrected elasticity serves as a more appropriate estimate for managers and benchmark for researchers than the “raw” mean. After “correcting” each of the 290 elasticities in our database for these biases, using the parameters of our main model, we obtain a mean elasticity of 0.20. The distribution of bias-corrected mean-elasticities is provided in Web Appendix H. This bias-corrected mean is considerably lower than the “raw” mean elasticity of 0.33. However, by correcting for the omission of supply, the bias-corrected mean elasticity only reflects the direct effects of advertising on supply (0.19) and demand (0.20), whereas the “raw” mean also includes studies that do not control for supply and for which the elasticity therefore reflects the total effect of advertising on demand.

Interaction effects

In addition to our main model, we investigate interaction effects between our substantive drivers and also consider interactions for two omitted variables (critics and competition) for which we expect the results to differ with regard to success type and one omitted variable that should differ regarding success period (customer ratings). Similar to Sethuraman et al. (2011), we focus on interactions for which we have some prior knowledge based on theory or that are of managerial interest; Web Appendix I presents the respective rationales. Incorporating all possible interactions would contribute to collinearity and compromise the stability of our model. Unfortunately, the number of observations for most interactions is very low (< 5%; see column 3 in Web Appendix I). Therefore, the results only provide a very faint first indication and should be understood as ideas for further research.

While we did not find that the omission of customer ratings generally biases advertising elasticities (p = 0.200), we do find a significant interaction between success period and the omission of customer ratings (later periods × customer ratings omitted; ß = 0.357, p < 0.01). This finding is based on a sufficient number of observations (n = 38, 13.1%) and in line with the notion that customer ratings can mainly be given after the launch period and their omission should therefore become more relevant in later periods (Marchand et al., 2017).

Further time-related analyses

Unlike prior advertising meta-analyses across industries, we do not find support for a linear decline of advertising effectiveness over time (see Web Appendix J). However, we find that the impact of advertising tends to be lower after the rise of social media platforms in 2006 compared to before. Based on this structural break, we conduct separate analyses focusing on studies with a mean year of the estimation period prior 2006 (n = 122) versus in and after 2006 (n = 167). Due to the limited sample sizes, we focus on reduced models that only include the substantive drivers and omitted variables. We remove variables that do not fulfill our criterion of being represented by at least 5% of observations and that are not included in at least two studies for the new smaller samples (success type, entertainment product type, lagged advertising, and awards). Due to these criteria, we also combined the levels “Europe” and “Others” for the geographic region. Star power is excluded due to multicollinearity issues. The significant effects from our main model can be mainly found for the sample prior to 2006, which may support our assumption that the awareness function of advertising was aggravated by the rise of social media in and after 2006. We elaborate on our rationale for the specific differences in Web Appendix K. However, these analyses need to be interpreted with caution due to the lower number of the degrees of freedom in the split samples.

Furthermore, we find no linear impact of recessions in the entertainment industry. To investigate this further, we conduct analyses using two alternative, binary operationalizations of recessions (Web Appendix J). First, recession is coded 1 if the number of months the economy is in recession as a proportion of total months in the estimation period is greater than zero, and 0 otherwise. Second, recession is coded 1 if the proportion of months in recession is greater than 50%. Only in the second case, if the proportion of months in recession surpasses 50%, we find a marginally significant effect (ß = -0.265, p < 0.10).

Robustness checks

To test the robustness of our meta-analytic model, we perform multiple analyses (Table 3). First, we focus on observations (n = 243) with statistical power greater than 0.5 (Muncer et al., 2003). The results are very robust. Only the social media variable (in and after versus before 2006) turns from being marginally significant to insignificant (p = 0.126) and advertising medium (aggregate versus single medium) slightly falls below 5% significance (p = 0.065). Instead, sample selection turns marginally significant, providing a first indication that samples limited by specific criteria show lower elasticities compared to those covering the complete market (ß = -0.301, p < 0.10), in line with our expectations.

Second, we exclude nine elasticities that lie outside the interval of the mean elasticity, plus or minus three standard deviations (Bijmolt et al., 2005; Edeling & Himme, 2018). The results for our substantive drivers are mainly unchanged, except that three further variables turn significant. In line with our expectations, elasticities of post-launch advertising are significantly lower compared with pre-launch advertising (ß = -0.157, p < 0.05), samples limited by specific criteria show lower elasticities compared with those covering the complete market (ß = -0.416, p < 0.01), and elasticities are lower in and after 2006 than before this year (ß = -0.146, p < 0.05). We also find that geographic region (Europe versus US) turns marginally significant (ß = -0.100, p < 0.10). For the research design characteristics, the omission of critics (ß = 0.125, p < 0.01) and star power (ß = -0.192, p < 0.10) turn (marginally) significant, whereas competition (p = 0.509) and advertising measurement (ß = 0.420, p < 0.10) become insignificant and only marginally significant, respectively.

Third, we estimate a model without the video game observations and limit our database to movies (n = 257). Two changes occur for the substantive drivers. Advertising period (both versus pre-launch; p = 0.658) turns insignificant, and the social media variable (in and after versus before 2006) falls just below 10% significance (p = 0.101). With regard to research design characteristics, not accounting for endogeneity turns marginally significant and negatively biases advertising elasticity (ß = -0.148, p < 0.10) and sample selection (limited by specific criteria versus complete market) turns marginally significant (ß = -0.331, p < 0.10).

Fourth, we limit our model to studies that use demand (n = 265) as the success type and exclude those that include supply as the dependent variable. Advertising period (both versus pre-launch; ß = -0.189, p < 0.05) and social media (in and after versus before 2006; ß = -0.215, p < 0.05) go from being marginally significant to being significant at 5%. For research design characteristics, functional form turns insignificant (p = 0.129), while sample selection (other criteria versus complete market; ß = -0.369, p < 0.05) and the omission of distributor turn significant (ß = -0.433, p < 0.05). Other than these shifts, the model stays robust.

Fifth, we exclude the variable data structure (cross-sectional vs. panel), which could contribute to multicollinearity due to its correlation with various other variables, such as the success period, the advertising period, or the inclusion of lagged advertising. The results for the substantive variables do not change relative to the main model. Only the effect of not accounting for endogeneity turns marginally significant and biases advertising elasticity negatively (ß = -0.106, p < 0.10).

Sixth, we test a sample-level clustering and find that all results remain consistent with the exception of distributor which turns marginally significant (ß = -0.202, p < 0.10). Other than that, advertising period (both versus pre-launch; ß = -0.177, p < 0.05) and social media (in and after versus before 2006; ß = -0.227, p < 0.05) go from being marginally significant to being significant at 5%. We further conducted all robustness checks on the sample level and find very robust results (Web Appendix L).

Seventh, we calculate a reduced model that only includes the substantive drivers and the omitted variables to account for the limited size of our database. Only two changes occur. For the advertising period, advertising in both periods versus pre-launch increases from marginal significance to significance at 1% (ß = -0.253, p < 0.01) and the omission of lagged advertising turns marginally significant (ß = 0.339, p < 0.10).

Overall, our main model appears sufficiently robust, especially with regard to our substantive drivers. Because our analyses are limited by the size of our database, unfortunately, we cannot conduct additional robustness checks that focus only on supply or on video games. Furthermore, the results of the subsample analyses need to be interpreted with caution, due to the lower number of the degrees of freedom in these analyses.

Discussion

Practical implications

An ongoing debate deals with whether exceptionally high advertising budgets in the entertainment industry are justified. Assuming a decreasing marginal effect of advertising, current allocation practices might not be optimal for managers. With this meta-analysis, we provide an estimate that managers can use as an additional decision criterion to plan their budgets more systematically. If managers increase the advertising budget by 1%, the success of the entertainment good is likely to increase by 0.33%, around three times more than the average for other industries (Henningsen et al., 2011; Sethuraman et al., 2011). Even though advertisements are primarily designed for consumers, we also find a substantive effect on supply. If managers increase the advertising budget by 1%, supply likely will increase by 0.21%, whereas demand should increase directly by 0.27%.Footnote 11 Given a screen elasticity of 1.04 (Clement et al., 2014), this increase in supply then should almost equally increase demand.

We further highlight strategically relevant, influential drivers of advertising effectiveness (advertising mechanism and contextual characteristics). Managers can use our main model (Table 2) to predict the average advertising elasticity for their individual circumstances. Table 4 provides an overview of exemplary cases. For example, managers can expect demand to increase by 0.46% in the launch period if they increase their pre-launch advertising budget by 1%. We further find that the impact of advertising is lower after the rise of social media platforms in 2006 compared with before. Managers should consider this important structural break if they derive important parameters for their estimations and forecasts from past data.

Furthermore, the launch week is of enormous importance in the entertainment industry. Yet, our results indicate that the effectiveness of advertising campaigns should not be judged exclusively by their impact during the first week, because the impact can increase in later periods. This finding supports the notion that advertising has more of an acquisition effect (i.e., generating new customers) in later periods, not necessarily an acceleration effect (i.e., shifting demand to earlier periods) for the launch period (Delre et al., 2016).

It has often been speculated in practice that the entertainment industry is recession-proof, and we indeed find no linear negative impact on the effectiveness of advertising. Instead, we find a marginal effect of recessions only if the proportion of months in recession surpasses 50%. This suggests that, to a certain degree, the entertainment industry is indeed recession-proof, yet it is affected when recessions become more enduring. The positive effect of escapism seems to counteract the negative effect of budgetary constraints during challenging times. Managers should not reduce advertising during recessions, especially because previous research shows that such a procyclical strategy is likely to backfire (e.g., Van Heerde et al., 2013). Moreover, unlike in other industries, advertising seems equally effective in Europe and the United States, despite their cultural differences.

Research implications

Our meta-analysis reveals the most influential research design characteristics, along with their direction and effect size. Researchers can use these insights to plan their own studies and to interpret existing ones more accurately.

We find that studies focusing on a single advertising medium (e.g., only TV or only print) versus aggregated media spending tend to report lower advertising elasticities. Further, in specifying their models, researchers should realize that omitting screens or competition will bias advertising elasticities positively. Thus, we strongly suggest they include these variables if the goal is to reduce potential biases in the advertising estimate. Interestingly, almost all of the most recent studies in our database (published within the last five years) included screens in their model, with only one exception, but only a third included competition. The omission of other notable control variables in the entertainment industry did not significantly bias the advertising elasticity in our findings, but we still suggest researchers should aim to build the most comprehensive models, controlling for various firm-, competitor-, and consumer-specific influences on demand and supply (which helps reducing endogeneity concerns due to unobserved influences).

The omission of endogeneity falls slightly below the 10% significance level, which implies that even though endogeneity is an often-discussed issue in entertainment research, it should not need to be addressed per se but only if the data require it. Similarly, the choice of functional forms and estimation methods should reflect the specific research problem. We acknowledge that no bias appears to result from using published versus unpublished research. For interested researchers, we provide access to disaggregated data that they can use as a starting point for their own estimations and to conduct further analyses of individual topics of interest.

Theoretical implications

Meta-analyses further provide generalizations of theorized and tested relations and their respective effect sizes. First, our results support the importance of supply and demand dynamics of marketing instruments in the case of advertising. While this issue has been highlighted prominently by Reibstein and Farris (1995) only a few researchers addressed these dynamics theoretically or empirically. Our results support that advertising has a direct impact on demand but also an indirect effect through supply.

Second, we find that advertising elasticities in the entertainment industry are approximately three times higher compared to other industries. They are also more stable over time, across geographic regions, and during recessions. Theoretically, this could be explained by the unique characteristics of entertainment products and their distribution (e.g., the hedonic experience characteristics of the products and the short and exponentially declining lifecycles enhance uncertainty of both customers and suppliers and thus increase the relevance of advertising as a quality signal). Moreover, these findings support the theoretical assumption that entertainment advertisements themselves might include crucial elements (e.g., storytelling, sampling of the product) that increase the effectiveness. Entertainment advertisements differ by including relatively high degrees of emotion and enjoyment. These characteristics may lower customers’ reactance to advertising compared to other industries. We also find that elasticities are greater for later periods compared to the launch period. This supports the theoretical assumption that advertising has a wear-in effect in the entertainment industry, whereas wear-out effects appear more prominent in other industries. Furthermore, the possibility for consumers to try the final entertainment product through advertisements might be a relevant aspect to enhance advertising elasticities for other experience products for which the quality (based on objective criteria) is also difficult to convey.

In addition, meta-analyses help explain potential non-findings and can provide new impulses for theory building. We find that the emergence of social media negatively influences advertising effectiveness. Although this is in line with our hypothesis and can be explained as a consequence of ad clutter and the rise of social media as alternative information sources, the effect is only marginally significant. A reason for the marginal significance might be that entertainment advertisements, such as trailers, are theoretically especially prone to being shared and social media platforms enhance the possibilities for content sharing. Thus, entertainment advertisements might have an additional function (creating engagement) that became more relevant after the rise of social media in addition to reducing uncertainty and creating awareness. This positive engagement effect could counteract the negative effect we hypothesized and should be investigated in more depth.

Surprisingly, we find a positive bias for the omission of competition even though prior research suggests a negative bias (see Web Appendix B). A possible explanation might be that supply is limited in times of high competition and thus, positive demand effects might occur for movies that have not sold out yet or video games that are still available in stores (Radas & Shugan, 1998). Future research could investigate potential positive effects of competition on demand more closely.

Limitations and further research

Meta-analyses depend on extant research, which limits our investigation of success outcomes, influential drivers, and underlying mechanisms, as well as the generalizability beyond movies and video games. Yet, these limitations also highlight potential for future research.

First, we can only investigate the effect of advertising on supply and demand, measured as sales units, revenues, and the number of screens. However, more recent studies also indicate an effect of advertising on important engagement outcomes, such as buzz (Onishi & Manchanda, 2012; Xiong & Bharadwaj, 2014). More research on these outcomes is needed to draw generalizable results. Furthermore, current research does not offer enough data to investigate supply as a subsample. More research along these lines would enable a separate examination of supply and its antecedents. Moreover, our database highlights that supply outcomes of advertising have only been investigated for movies. For other entertainment goods, suppliers, such as retailers, might also interpret advertising budgets as a signal for the expected success and assign shelf space accordingly. However, supply is also determined by the platforms on which a product is available (e.g., consoles for video games, streaming services for music), and this strategic decision might be influenced by other factors, which could be a fruitful area for research.

Second, our selection of influential drivers of advertising elasticity is limited by the independent variables investigated in the original studies. We could not compare advertising elasticities for specific, individual media (e.g., television versus social media). Further, many researchers have investigated the effects of the amount and the distribution of advertising budgets on the success of entertainment products, but differences in the advertisements themselves (e.g., specific advertising strategies) have received little attention (Karray & Debernitz, 2017; Liu et al., 2018; Rao et al., 2017). Our database further highlights that two control variables, star power and production budget, have been investigated only for movies, not video games, even though they are relevant in practice, which could be an interesting route for further research.

Third, we built the rationale for the impact of our substantive drivers on advertising effectiveness based on two underlying mechanisms: advertising’s function to create awareness and to reduce uncertainty. The studies in our database use secondary data and do not measure these mediators, so it was not possible to derive empirical generalizations for neither mental processes nor individual perceptions of entertainment advertisements.

Finally, due to the low number of studies focusing on video games, music, and books, our sample mainly consists of movies, which limits the generalizability. Entertainment products differ from each other to some extent, for example, regarding their reliance on visual elements, which is higher for movies and video games. That being said, visual elements are also relevant for music and books in the form of music videos or video trailers for books (Arons, 2013). Despite such distinctions, we believe that our findings on advertising elasticities are driven by unique advertising characteristics and distribution mechanisms shared by those entertainment products (Hofmann-Stölting et al., 2017). However, further research including different entertainment products is needed to confirm our assumption that the results of this study are indeed transferrable. Even though our meta-analysis is situated in the entertainment industry, we suggest testing whether our results might even apply beyond to “must-have” products, such as iPhones or fashion items. These products induce similar consumer uncertainty, have high pre-launch advertising budgets, and feature quickly declining and short lifecycles. Goldenberg et al. (2007) argue that this diffusion pattern, in which marketers observe a peak in demand immediately after product launch, results from a pre-launch “shadow diffusion,” triggered by advertising and buzz. In this case, consumers make the adoption decision even before the innovation is available, but they must wait until the product is introduced to the market (Burmester et al., 2015; Muller et al., 2009). This pattern is also prominent for pre-announced innovations such as smartphones or electric vehicles.

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request and online at: https://osf.io/hmnz9/?view_only=be97a8b21f834590979c7aaac6e36de9.

Notes

It was not possible to include other entertainment products such as music, books, or theater plays, because they have been investigated very rarely, due to difficulties associated with obtaining advertising budgets for these products. However, movies and video games account for a major part of the entertainment industry (Hennig-Thurau & Houston, 2019), and we expect the results to be transferrable.

Supply refers to the entire distribution process of the entertainment product and reflects the availability of the product to the consumer. For movies, supply can be understood as the number of allocated screens; for video games, music, and books, supply reflects the number of platforms on which the product is offered (e.g., consoles such as Xbox, streaming services such as Spotify) or shelf space in retail stores.

We excluded the following variables because they are not applicable to the entertainment industry or our database: product lifecycle (growth vs. mature), dependent measure (absolute vs. relative), temporal interval (weekly and yearly vs. quarterly), lag dependent variable, lag price, price and promotion.

We took the average score of the United Kingdom, Germany, and Greece—the countries that represent the most European samples in our database (68%).

STAR-Marketing-Journals in the ERIM ranking are International Journal of Research in Marketing, Journal of Consumer Psychology, Journal of Consumer Research, Journal of Marketing, Journal of Marketing Research, Journal of the Academy of Marketing Science, and Marketing Science.

Journals focusing on media or advertising are Journal of Cultural Economics, Journal of Media Economics, Journal of Advertising, Journal of Advertising Research, Marketing Letters, and Journal of Interactive Marketing.

Conference proceedings came from EMAC, AMA, Marketing Science, and the Mallen Conference.

STAR-Marketing-Journals in the ERIM ranking.