Co-authored by Matt Gibbs @cipherbio_gibbs, Ben Johnson SVB National Head of Early Stage Life Sciences, Barbara Alcaraz Silva SVB VP, and Kaitlin Berube SVB VP.

Accelerators and incubators are a vital element of the life science ecosystem as they support scientific ventures through programs designed to help them develop their initial products, identify lucrative customer segments, and get access to critical resources, such as capital and employees. They also offer early-stage innovative companies a wealth of networking opportunities, consisting of both peers, mentors, industry leaders and investors.

As they play a crucial role in the landscape — in particular at the early stage of the spectrum — CipherBio tracks data about the activity of major accelerators and incubators active in the life science ecosystem to produce meaningful insights to the benefit of all industry members. After the first article covering life science accelerators and incubators published in March 2020, we worked with 8 of the top 11 accelerators to provide our users with the most up to date funding details for Q2 2020.

The Most Active Life Science Accelerators and Incubators

JLABS

657

STARTUP

HEALTH

336

Y

COMBINATOR

284

MEDTECH

INNOVATOR

238

MATTER

191

QB3

154

STARTX

151

LAB

CENTRAL

89

INDIEBIO

65

ROSENMAN

INSTITUTE

60

ILLUMINA

ACCELERATOR

41

Table 1: Top 11 Life Science Accelerators; Source CipherBio June 2020

The incubator with the highest number of life science companies (657) under its wing is Johnson & Johnson Innovation – JLABS, a global network of open innovation ecosystems across the healthcare spectrum including pharmaceutical, medical device, health tech and consumer health sectors established by Johnson & Johnson Innovation. While both accelerators and incubators offer entrepreneurs support in their early ventures, there are differences between the two types of these vital members of the innovative ecosystem. Unlike accelerators, which run specific time-limited programs providing selected companies with seed funds in exchange for an equity stake to work with a team of mentors who help them develop their business, incubators are generally less investment-focused. Instead, incubators usually don’t operate on a set schedule and are focused on providing a supportive co-working environment for innovative companies facilitating their networking with mentors, investors and other entrepreneurs, which is precisely how the JLABS model operates.

“We aim to provide small companies with big company benefits in a cost-efficient environment.” |

JLABS aims to connect companies with key industry players and investors to enhance entrepreneurial capacities, helping them translate cutting-edge science into the potential groundbreaking healthcare solutions of tomorrow through a unique model that enables life science companies to unleash their innovative potential while retaining their intellectual property. JLABS’ companies are in a position to leverage the incubator’s immense gravitas in the life science space with Johnson & Johnson’s extensive network, which caters to the needs of companies across all investment stages. The network includes Johnson & Johnson Innovation Centers that provide housing for deal teams and experts for early-stage development, Johnson & Johnson Innovation – JJDC, Inc., the corporate venture arm, and Johnson & Johnson Innovation – BD, the business development group that concentrates on later-stage development. Data from the CipherBio database* shows that this prominent life science incubator collaborated with 657 companies since 2012, out of which 451 are from the pharma vertical, while 133 belong to medical devices, 73 to consumer health, and 78 are cross-sector. This world renowned incubator collaborated with a number of successful life science companies, some of which went public in deals that marked industry’s most significant events such as BridgeBio Pharma, a biotech company that aims to develops groundbreaking medicines for genetic diseases; Black Diamond Therapeutics, a precision medicine company seeking to pioneer solutions for patients with genetically defined cancers; Alector LLC, a biotech company developing novel therapeutics for neurodegenerative diseases based on state-of-the-art antibody technology, neuroimmunology and human genetics; and Bridge Biotherapeutics, Inc, a Korea-based clinical stage global biotech company focusing on areas of high unmet medical needs, such as ulcerative colitis, fibrotic diseases, and cancer, with its subsidiary at JLABS @ TMC in Houston, Texas and JLABS @ Shanghai.

* Some companies may be excluded due to reporting requirements (stealth mode, acquisitions, etc.)

With 336 companies, the second-ranked accelerator is StartUp Health, a New York-based health accelerator established in 2011 to help innovative health entrepreneurs across the world achieve health moonshots and transform health. Starting from its very beginnings, the accelerator has been committed to implementing an impressive 30-years strategy. After the first phase of the plan dedicated to the building of the Health Transformers community, this year marks the beginning of the second phase of the strategy, dedicated to the exponential acceleration of health innovation, to achieve the health and wellbeing-related UN Sustainable Development Goals.

“StartUp Health is a new model for investing in health. Over the past decade we’ve built a global platform to invest in and unite thousands of Health Transformers — the world’s entrepreneurs dedicated to health moonshots — so together we can impact billions of people’s lives.” |

The decade starting from 2030 will be devoted to achieving 12 health moonshots to the benefit of everyone in the world. The data from the CipherBio database show that the accelerator has a special focus on companies from the Digital Health/AI space, with 309 out of a total of 336 companies coming from this vertical. StartUp Health also has a history of hosting 16 Medical Devices, 8 Biotech and 2 Diagnostics companies.

With 284 life science companies, Y Combinator occupies the third place among the top life science accelerators and incubators in the CipherBio database. As the first US accelerator founded in 2005, Y Combinator represents a community of 4000 founders and more than 2000 startups funded since the launch. Although known mainly for its portfolio of tech companies, this generalist seed-stage accelerator recognized that a revolution in the life science industry is underway, similar to that of the software industry in the 90s when costs and cycle time decreased significantly, empowering startup founders to launch tech companies. Similarly, the costs of doing life science research are declining. A fully developed infrastructure that enables Biotech to work at a lower cost is emerging. It has never been easier to rent a fully equipped lab space or to hire a low-cost CROs that provide scientific research for a fee. Recognizing that it’s now possible to start a Biotech company the way people start a tech company, Y Combinator increased its presence in the life science space with 284 member companies from this industry, rapidly becoming one of the most prominent seed-stage biotech investors globally.

“Funding more biotech companies is one of Y Combinator’s top priorities.” |

This highly regarded accelerator operates under the premise that the future of Biotech is for scientists to start their own companies, much earlier in their careers and to keep control of those companies. CipherBio database demonstrates that this prominent accelerator’s preferences are almost equally split between Biotech, with 117 companies from this vertical, and Digital Health/AI with 115 member companies. Significantly lower company count comes from Medical Devices (40) and Diagnostics (12). Some of the most notable Y Combinator alumni include Ginkgo Bioworks, Zenflow, Verge Genomics, uBiome and Notable Labs.

With 238 companies, MedTech Innovator is the third-placed accelerator as per the company count. This nonprofit accelerator specializes in Medical Devices, with 180 companies coming from this vertical, while 33 of them are from Digital Health/AI, 18 from Biotech and 6 from Diagnostics. It uniquely has operated a virtual accelerator program for the past 5 years. The accelerator prides itself on 54 medical products successfully launched by its graduates and 1.7B of follow-on funding raised.

“MedTech Innovator is privileged to work in partnership with leading strategics, federal agencies and stakeholders to identify the world’s most promising medical technology startups and provide the proper guidance and resources to ensure that transformative technologies reach patients and improve lives.” |

MATTER is a global innovation hub, headquartered in Chicago, that brings together entrepreneurs, industry leaders, scientists and clinicians from across the world to collaborate on developing next-generation healthcare technologies. Since it was founded in 2015 with a non-profit, no-equity model, the MATTER collaborative has included hundreds of cutting-edge startups working together with dozens of hospitals and health systems, universities and industry-leading companies to build the future of healthcare. Since 2015, MATTER startups have raised more than $1.26B and benefitted more than 117M patients.

“At MATTER, we believe that collaboration between entrepreneurs and industry leaders is the fastest, most effective way to accelerate innovation, advance care and improve lives.” |

With 154 companies, QB3, an early-stage life science hub founded by the University of California, is the mid-placed accelerator. QB3 is committed to cultivating the life science ecosystem in the State of California as well as supporting the University of California and Bay Area bio-entrepreneurs to launch innovative companies and partner with industry. The accelerator is mainly involved with Biotech (78 companies) and Medical Devices (54), while Diagnostics (17) and Digital Health/AI (4) is also present, although to a lesser extent.

“We enjoy working with early stage startups and thinking creatively on how to best position them for success.” |

The seven-placed life science accelerator is StartX, a non-profit community associated with Stanford University, which collaborated with 151 companies across Digital Health/AI (55), Biotech (42), Medical Devices (39) and Diagnostics (11).

With 89 companies, LabCentral, an accelerator based in Cambridge, MA offering shared laboratory space for high-potential life science innovative companies, occupies the eight place. Providing affordable, move-in-ready laboratories to talented scientific entrepreneurs, LabCentral empowers them to turn their groundbreaking science into a viable business venture. This accelerator is almost exclusively focused on Biotech, with 86 out of 89 member companies belonging to this vertical and 2 of them to Diagnostics and 1 to Medical Devices.

The CipherBio database shows that IndieBio has 65 member companies since 2019, out of which 48 are from the Biotech space, while 9 are from Digital Health/AI vertical, 5 from Medical Devices and 3 from Diagnostics.

“Our success in getting startups funded has led us to expand. In March, we opened IndieBio New York on the campus of Rockefeller University, so we are doubling our throughput of biotech companies. We are also now offering up to $2 million for early stage therapeutics companies.” |

UCSF Rosenman Institute is an institute within UC San Francisco launched as an initiative of QB3 to connect entrepreneurs to a wide range of vital resources, such as mentors, partners, clinicians and investors. The CipherBio database shows that this accelerator has collaborated with 60 companies since 2019, almost exclusively from Medical Devices vertical (59), while there was one company from Biotech vertical.

“We connect health technology entrepreneurs to the right resources at the right time to advance their technologies that will improve patients’ lives.” |

Illumina Accelerator, the world’s first accelerator focused solely on the genomics industry based in San Francisco CA, counts 41 portfolio companies. It has supported 22 Biotech, 10 Digital Health/AI, 7 Diagnostics and 2 Medical Devices companies since 2019.

Register for a free CipherBio account to find exclusive life science industry insights.

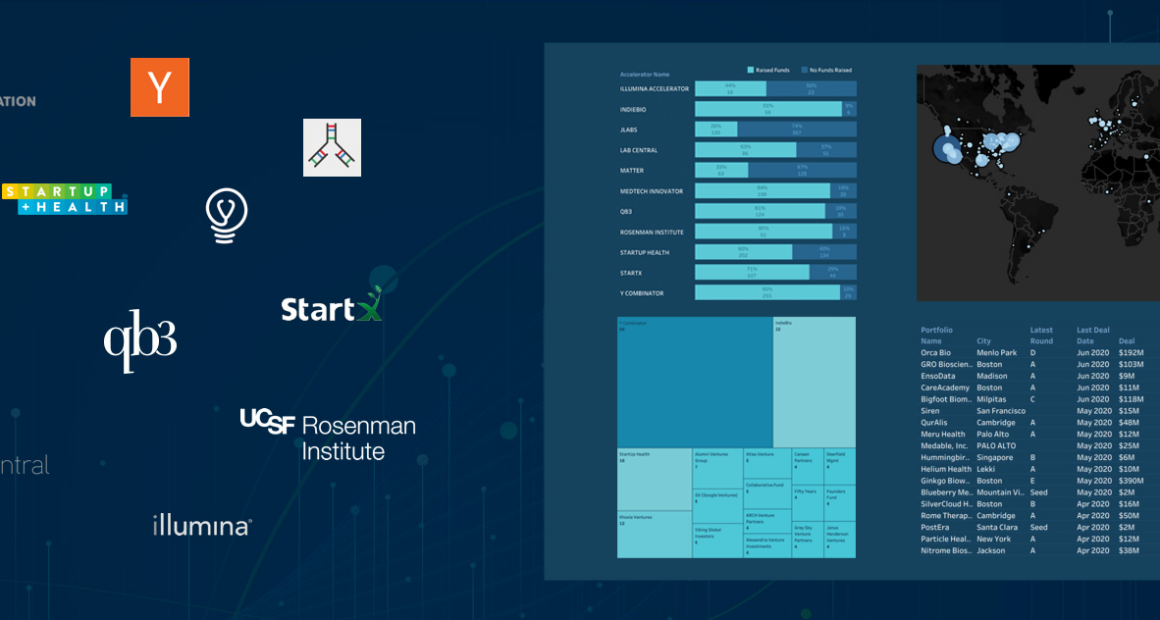

How Many Accelerators’ Portfolio Companies Raised Funds

Accelerators offer a range of support services as well as funding opportunities for member companies. The data from the CipherBio database shows that the proportion of member companies that raised funds vary greatly within the 30%-90% range (Figure 2).

The highest proportion of member companies successful in raising funds goes to IndieBio with a 91% success rate (59 companies). The second-ranked accelerator is Y Combinator with a 90% rate relating to 255 companies that raised funds since 2019.

The third place is taken by MedTech Innovator and UCSF Rosenman Institute exhibiting an 84% success rate closely followed by QB3, which is not only one of the most sizable accelerators but a productive one at that, with 81% of its companies successful in fundraising equivalent to 122 companies. The extended list illustrating the proportion of companies linked to an accelerator that were successful in raising funds is presented in Figure 2.

Taken at nominal level, Y Combinator supported the highest number of companies successful at raising capital (255), followed by Startup Health (202) and MedTech Innovator (199). *Please note these figures change daily.

Figure 2: How Many Accelerator Member Companies Raised Funds; Source CipherBio June 2020.

Figure 2: How Many Accelerator Member Companies Raised Funds; Source CipherBio June 2020.

Top Accelerator Portfolio Companies by Deal Size

The table representing the top accelerator companies by deal size in Q2 largely resembles that of Q1 as the pandemic brought investment activity to a halt and the aftermath was still felt in Q2 (Figure 4). The table is topped by BlueRock Therapeutics, a JLABS alumni that engineers cell therapy to develop regenerative medicines for intractable diseases, acquired by Bayer in a $1B deal in 2019. The runner up is Tilos Therapeutics, a Lab Central graduate offering antibodies for the treatment of cancer, fibrosis, and autoimmune diseases, acquired by Merck in 2019 in a $773M takeout. The third place is taken by Zymergen’s $400M Series C, the largest US upstream Agtech deal in the US. It is followed by Ginkgo Bioworks’ $320M Series E. The company, a graduate of Y Combinator, colloquially known as the organism company, is a synthetic biology company engineering custom organisms by learning from nature. Devoted Health, a new healthcare company focused on seniors and offering Medicare Advantage plans, raised $300M Series B funding in a deal led by established Silicon Valley VC firm Andreessen Horowitz. The Waltham, MA-based company is the graduate of StartUp Health. The list of other notable deals from the CipherBio database is presented in Figure 3. For an interactive list of all deals involving top accelerators’ companies in Q2 2020 and before, visit the latest Accelerator/Incubator Insights on the CipherBio platform..

Figure 3: Top Accelerator Companies by Deal Size; Source CipherBio, June 2020.

Figure 3: Top Accelerator Companies by Deal Size; Source CipherBio, June 2020.

Most Active Investors in Accelerator Companies

Figure 4: Most Active Investors in Accelerator Companies; Source CipherBio, June 2020.

Figure 4: Most Active Investors in Accelerator Companies; Source CipherBio, June 2020.

By far, the largest investor in life science accelerator companies is Y Combinator, with 69 investments, demonstrating the oldest accelerator’s commitment to supporting startups in the life science industry and its strategic focus on establishing a prominent presence in this field. It is followed by SOSV’s life science-focused accelerator IndieBio, the world’s largest seed accelerator in this space, which is also the third-placed investor in accelerator companies as measured by the number of deals closed since 2019 (22). It is followed by StartUp Health with 16 transactions and Khosla Ventures, a Menlo Park CA-based VC firm founded in 2004 by Vinod Khosla, co-founder of Sun Microsystems and once General Partner of KPCB, which sealed 12 deals over the same period. They are followed by Alumni Ventures Group, an investment company designed to meet the needs of the individual accredited investors that quickly became one of the most active VC firms in the world, and participated in 7 transactions involving accelerator companies. GV and Viking Global Investors closed 6 deals, followed by Atlas Venture and Collaborative Fund, which participated in 5 deals. The complete list of Top 20 investors that invest in companies involved with at least one accelerator/incubator is presented in Figure 4. For an interactive table allowing users to search all deals per each of the top accelerators, including data representing the deal size, investment stage, location and date, visit the page with the latest Accelerator/Incubator Insights at the CipherBio platform.

Geographical Breakdown of Companies Admitted to Top Life Science Accelerators

As depicted by Figure 5, life science companies admitted to one of the top accelerators/incubators from the CipherBio database predominantly come from the US. Usual innovative hubs again play the most prominent role such as the West Coast where San Francisco (267 companies) and San Diego (84) dominate; the East coast with hotbeds such New York (99) and Boston (42), and Chicago, which also have a notable place with high company count (95). The second most active location generating life science companies which go on to be accepted to an accelerator is Europe, with the UK (29), Ireland (17), Germany (11) and France (9) having the highest participation. China follows as an Asian leader with 20 portfolio companies, followed by India (15), Singapore (11), South Korea (4) and Japan (3). For additional insights about top locations, the searchable dashboard at the CipherBio platform allows users to unlock data representing each depicted location.

Figure 5: Geographical Breakdown of Companies Admitted to Accelerators; Source CipherBio, June 2020.

Figure 5: Geographical Breakdown of Companies Admitted to Accelerators; Source CipherBio, June 2020.

Conclusions

Entrepreneurial ventures can rarely succeed in isolation but rather need intertwined networks of partners, peers and investors and other organizations forming a vibrant business ecosystem. When scientific entrepreneurs lack access to an established business ecosystem, accelerators and incubators provide a vital support mechanism for accessing these essential resources. As these organizations supporting entrepreneurship are evolving, we collect the data to track their behavior and generate insights that can help innovative companies in their entrepreneurial ventures as well as other members of the life science ecosystem. For a deep dive into the life science landscape, join the CipherBio data platform to get free access to the invaluable data that will help you decipher the latest trends to better navigate today’s life science landscape.

Join us in our effort to capture the entire life science ecosystem in our database.

We strongly believe that the availability of a high-quality database about the life sciences ecosystem increases sector efficiency and benefits every company raising capital. Thus, if you are an investor or a startup in any of the relevant industries, we would like to extend an invitation to you to join the platform and or subscribe to the CipherBio insight newsletter.

Fill out your digital profile, or update it with your company’s latest news, so that you can be a part of the data set that represents the life science ecosystem.